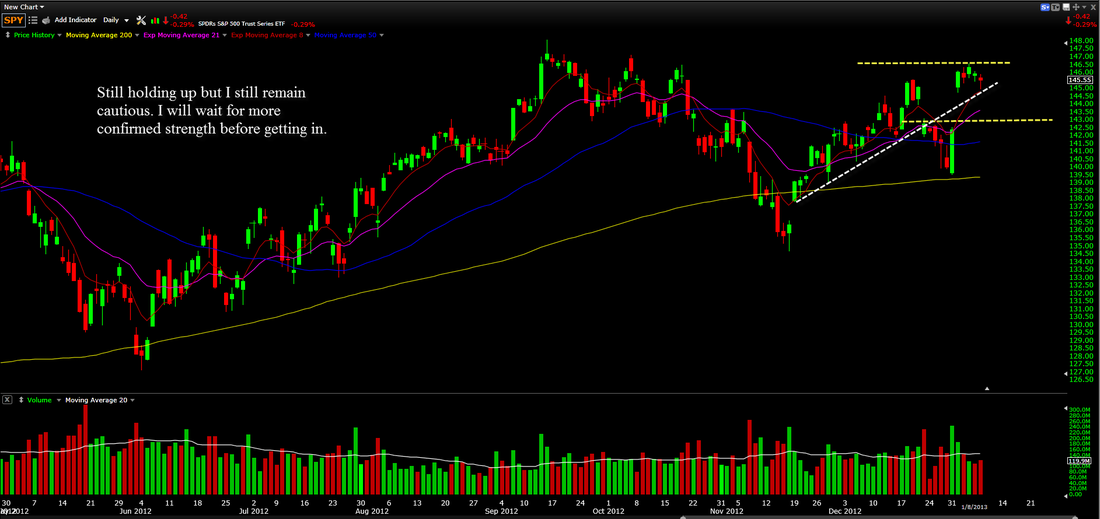

We drooped a little lower today which was expected as we still seem to be consolidating the massive move. All is good, or is it? I do remain cautiously bullish but there are a couple things that need to happen before I jump in on the long side with great confidence. Here are the things/options;

1. Consolidate more, and let the 21 EMA catch all the way up

2. Have a engulfing bar soon on volume that engulfing this range

3. Sell off more and give me a reversal signal with volume (Ex. Nov. 16th)

If one of these things does not happen, I will go ahead and tell you, I will NOT be on the on the long side.

Apple is still rotten and I do not like it. What else is there to say? Haha, Here is why -

1. hit support 3 times so far at 500, and eventually support gives after repeated tests

2. the rallies/short squeezes are SOLD, this is obviously a bearish sign.

3. Not a leader in the market.

Google is still looking fine, I am looking to enter this one on a pullback but will wait for a proper signal.

Amazon is now consolidating after it made all-time highs yesterday, I think all is fine here. With the proper set up (see below), I will buy this.

1. a consolidation period and then an engulfing bar

2. sell off with reversal signal.

Banks are still holding up fine though they are still extended and are NOT buys yet, use caution and wait for a more clear set up.

If you would like to contact me for questions/comments please Visit the Contact Page.

1. Consolidate more, and let the 21 EMA catch all the way up

2. Have a engulfing bar soon on volume that engulfing this range

3. Sell off more and give me a reversal signal with volume (Ex. Nov. 16th)

If one of these things does not happen, I will go ahead and tell you, I will NOT be on the on the long side.

Apple is still rotten and I do not like it. What else is there to say? Haha, Here is why -

1. hit support 3 times so far at 500, and eventually support gives after repeated tests

2. the rallies/short squeezes are SOLD, this is obviously a bearish sign.

3. Not a leader in the market.

Google is still looking fine, I am looking to enter this one on a pullback but will wait for a proper signal.

Amazon is now consolidating after it made all-time highs yesterday, I think all is fine here. With the proper set up (see below), I will buy this.

1. a consolidation period and then an engulfing bar

2. sell off with reversal signal.

Banks are still holding up fine though they are still extended and are NOT buys yet, use caution and wait for a more clear set up.

If you would like to contact me for questions/comments please Visit the Contact Page.