I know I said yesterday that we still looked fine, but remain cautious. That still remains true. I expect a pullback soon and here are FIVE reasons why -

5 days now of consolidation with lots of doji closes, while this is bullish (in some sense) I sit more in the bearish camp -

1. Vix reversal today

2. SOLID resistance above

3. A little extended on the upside (still)

4. The banks (leaders) took a dive today, more importantly, $BAC took a dive.

5. Wicked down a little, though that is not that significant.

Those are my five reasons for being short a little now. IF we do pullback some I would look to buy long again but remember, a market "ebbs and flows" so be careful not to get caught in the wrong direction. The risk:reward is NOT in favor of the bulls right here in my opinon we are at some SOLID resistance and came a long way. Earnings also may be a "sell the news" type of a event, given how far we have gone.

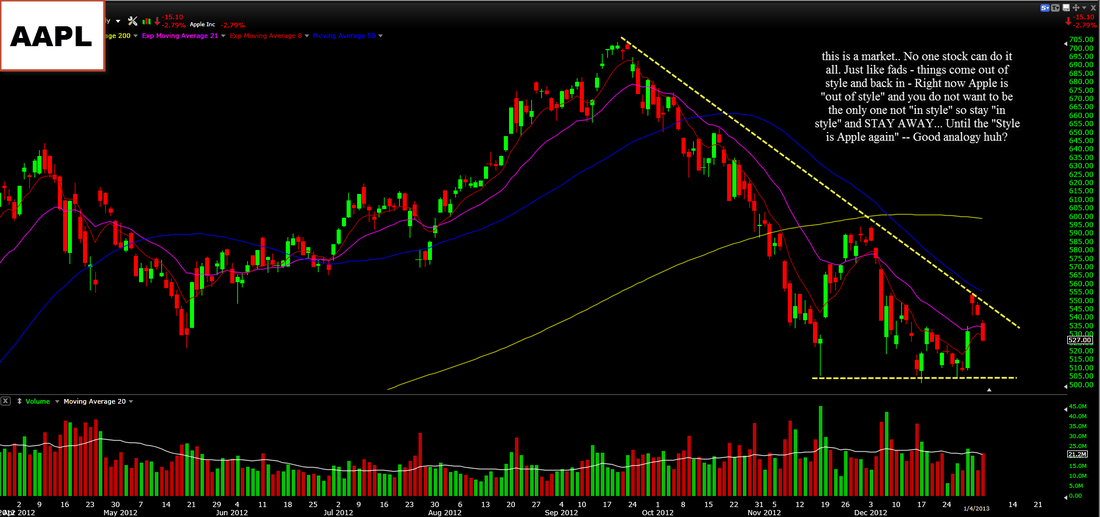

Apple is a non event at this point. Love my phone, HATE the stock. It is going lower, 500 is still support - though based on this action, it looks like it will break it.

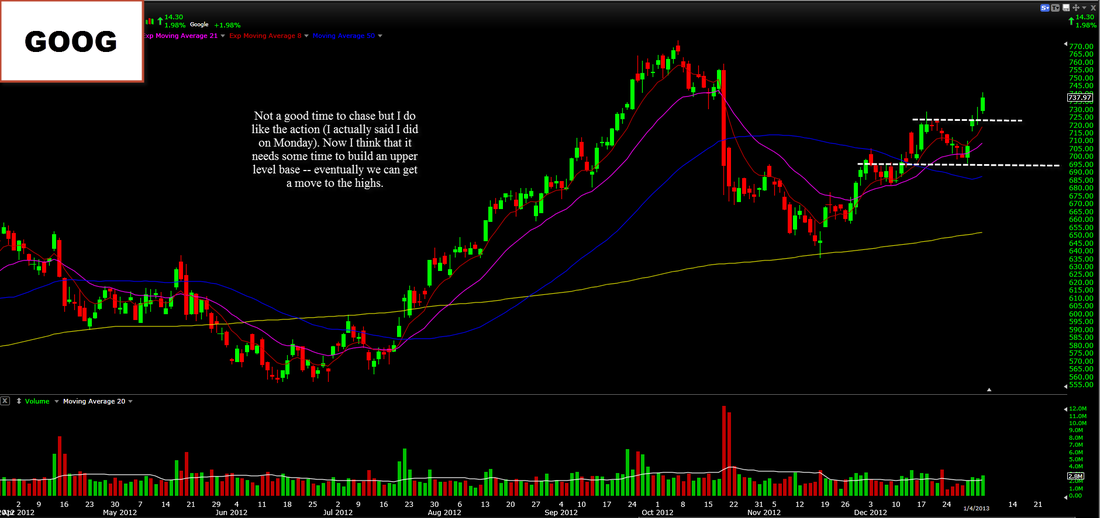

Google is basing nicely. Looks like it wants higher, good volume pattern.

Amazon pullback a little, I will wait for a more confirmed signal. Do not buy blindly. Still looks fine though, at ALL time highs.

Banks, our leaders do worry me a little bit. $BAC (our main leader) sold off pretty harsh today and I think it can go lower. I am firm believer in the fact that LEADERS, LEAD - and therefore, the market very well could sell off a little more.

Trade accordingly. If you would like to contact me for questions/comments please visit the contact page.

Basically there is nothing good to say about this trade. I did not follow any rules, and that is what I did wrong, I know that.

I shorted the massive rally on the second day intraday and then moved my stop up (was short) because it was not going my way and I "knew" it would "correct" or pullback eventually (like we are seeing now) so I banked on that and did not really have an appropriate stop loss. Anyways, that is the number one thing I did not do right, here is the other -

I did not wait for my sell short signal, a topping out type of candle, if I had done this I would have never been in the trade and would not be typing this now.

Here is what I now know -

1. WAIT for my signals!!!!

2. Do not jump in front of a bulldozer (the 2 day rally)

3. RESPECT the stop losses

Overall, an UGLY trade, one that I am NOT proud of. Live and learn, I will do better next time.

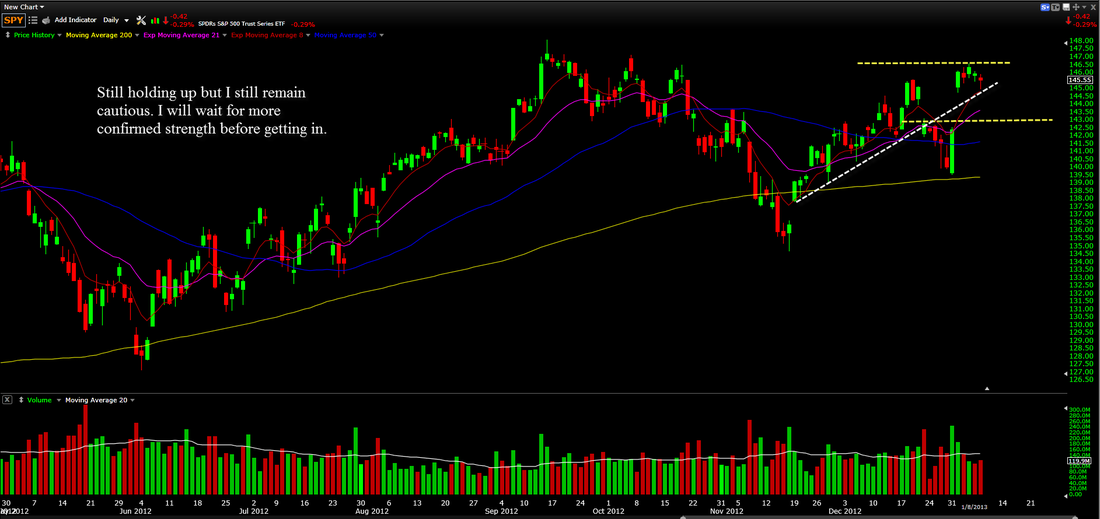

We drooped a little lower today which was expected as we still seem to be consolidating the massive move. All is good, or is it? I do remain cautiously bullish but there are a couple things that need to happen before I jump in on the long side with great confidence. Here are the things/options;

1. Consolidate more, and let the 21 EMA catch all the way up

2. Have a engulfing bar soon on volume that engulfing this range

3. Sell off more and give me a reversal signal with volume (Ex. Nov. 16th)

If one of these things does not happen, I will go ahead and tell you, I will NOT be on the on the long side.

Apple is still rotten and I do not like it. What else is there to say? Haha, Here is why -

1. hit support 3 times so far at 500, and eventually support gives after repeated tests

2. the rallies/short squeezes are SOLD, this is obviously a bearish sign.

3. Not a leader in the market.

Google is still looking fine, I am looking to enter this one on a pullback but will wait for a proper signal.

Amazon is now consolidating after it made all-time highs yesterday, I think all is fine here. With the proper set up (see below), I will buy this.

1. a consolidation period and then an engulfing bar

2. sell off with reversal signal.

Banks are still holding up fine though they are still extended and are NOT buys yet, use caution and wait for a more clear set up.

If you would like to contact me for questions/comments please Visit the Contact Page.

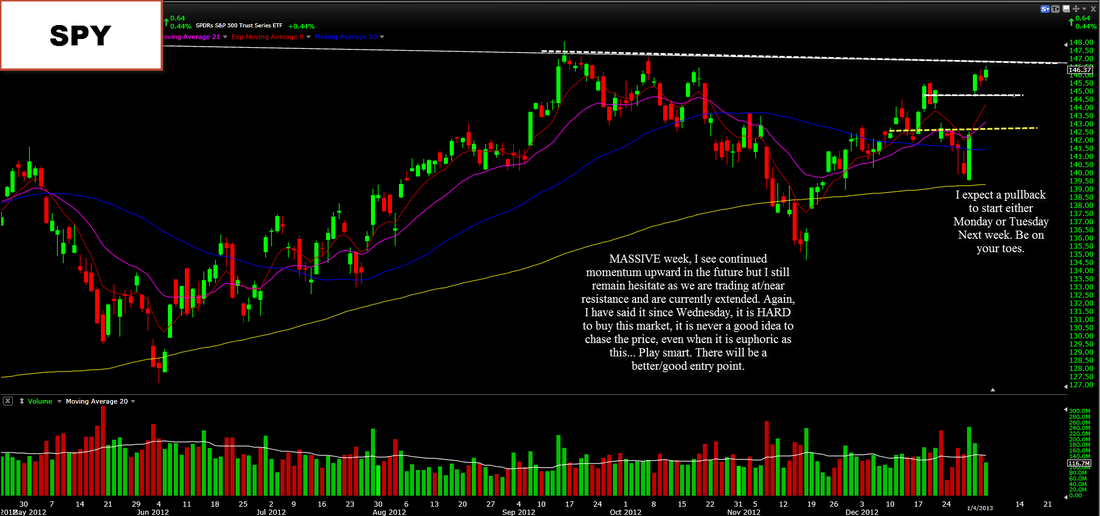

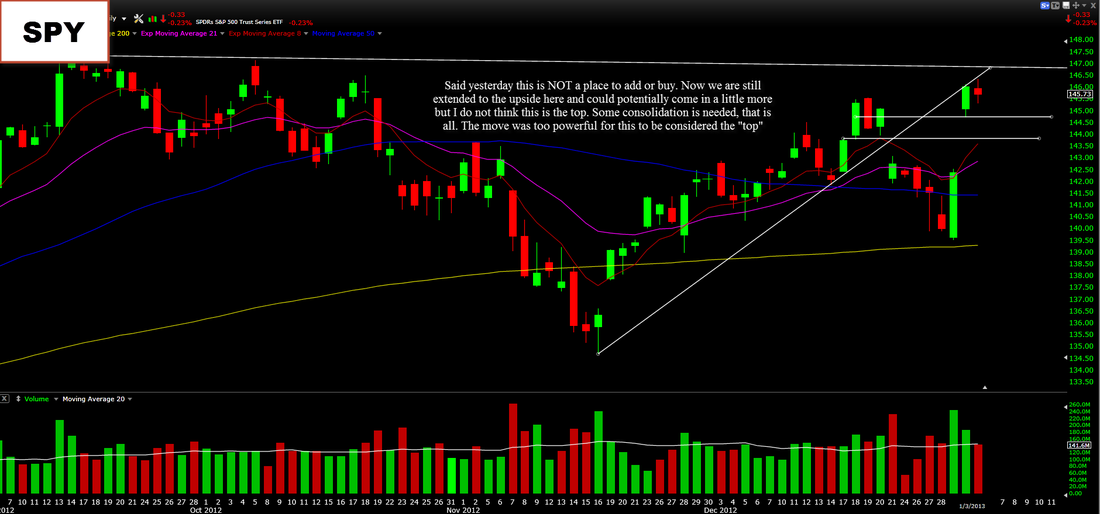

Click to enlarge - Slow, not much happening today in the index (SPY). We are just consolidating at the highs after a huge move last week. Just because it is not still going higher that does not mean it is not still bullish. This IS bullish. Someone was tweeting me earlier today saying that I "flip flop" my thoughts on the market. I would like to spend a minute to clear up some things and give you guys my personal opinion on where the market sentiment is so yall will not be confused anymore.

Micro time frame (1-2 days) - Could pull in a little bit more, therefore I tend to sit on the bearish side.

Intermediate - (1-3 weeks) - I am in the bullish camp, we just had a powerful move and consolidating at highs.

Long term - (3 - 6 months) - I am neutral, I have no bias either way.

Really long term - (1-3 years) - Very bullish. I think we can great the all time highs in SPX.

Moving forward...

Apple (as I tweeted this morning) is a rotten Apple. I do not like other than a day trade long or short term short. Support is still 500.

Amazon! I think it was Friday that I said Amazon looked good and I think it wants higher.. Well there ya go, it went. I would look to buy on a dip back to the break level, do not chase the price action here.

Google is still holding in there. I like it long still though it looks like it might need some more time. I am stalking this one for a good R:R set up.

Homebuilders I have been saying have been perking up all across the board with many of them breaking out of channels this week. I still like them and they want to go higher. I sold LEN today, I still think it will go higher but there is massive resistance on the weekly chart that I did not want to be apart of.

banks still look like they are strong though I will say, it is difficult to chase them here. Maybe on an extended consolidation but right now.. It is a no play for more. Not a short, but not a long.

If you would like to contact me for any questions/comments please visit the contact page.

Alright, yes it was profitable and I chose the right pattern and everything but there is ALWAYS something to learn from. Personally, for me it was lagging the market and not really showing that much relative strength and that is why I got out when I did... But here is how I could have done better;

1. I was already up, I could have just as easily have set my stop loss where the break even price was and been just fine. But no, I had to set it above that just to gain barely anything. Therefore, next time I need to set my stop loss a little less. This happened to me more than once and I have really killed myself with not letting my winnings win..

I am too quick to take profits. Trust myself that I chose the things and go with it, or just "break even".

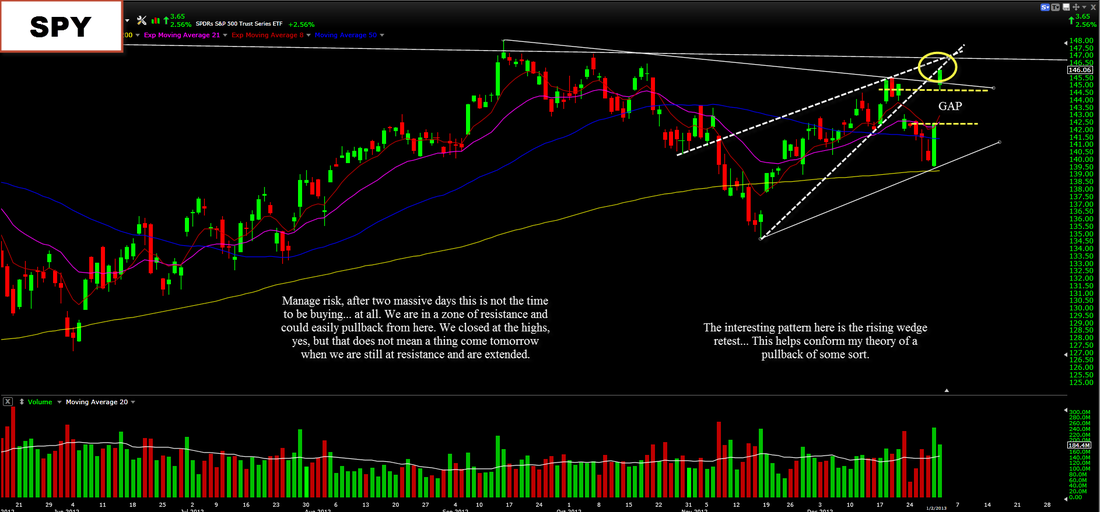

Click to enlarge the images - Another green day, this is wild in my eyes, and did not expect this (not that that matters, I trade price). I have been saying all day that we still are extended to the upside and that is difficult to buy this kind of euphoric market without being concerned with the probability of some short term selling/pullback to digest the move. I believe this still remains true. It is not a good idea to be buying this market right now, the risk to reward is not really in your favor. I would much rather be a buyer on a pullback to support. You do not want to be the one stuck at the top. Euphoric markets, where everyone is "happy" is usually a point to be concerned. When all you see on Twitter, StockTwits, CNBC, etc is "Another gap up coming" or "BUY BUY BUY" it usually close to an inflection point. I feel like we are very close to that point here. I expect to start to see the signs of a pullback if not a pullback itself either Monday or Tuesday next week. Now, there is always the chance we do not pullback very much at all and just continue to trade somewhat flat with a down day in there every so often. This theory would have the same result; the extendedness will be gone, and the market will likely be buyable again.

Apple has proven time and time again it is not where the money is, and not where yours should be (unless your short). Here is my little analogy -

"this is a market.. No one stock can do it all. Just like fads - things come out of style and back in - Right now Apple is "out of style" and you do not want to be the only one not "in style" so stay "in style" and STAY AWAY... Until the "Style is Apple again"

I do hope that made sense and if it did, then that is exactly what Apple is dealing with right now, it is out of fashion.

----------------

Google I did say on Monday that I liked the action in Google and it looked like it wanted to go higher, it did go higher this week and performed well. I currently think that it is not a conviction buy right now because it is "wee" bit extended now and at some resistance zones. Let's wait to bid some support.

---------------

Amazon is probably one of my favorite set ups. Amazon is very close the all time highs, it is consolidating well, and not too extended from the MAs. I personally think amazon sees higher. The only point of concern I have with it is that the volume pattern is not that amazing. You do not see the volume increasing like it should be, but none the less, it still looks good and I like the fact it has defined support and defined resistance.

---------------

Bank of America has been very good over the past month and is has not shown any signs of slowing down (for the most part). I would however say, it is not a buy at these levels unless with very little size. I do not like how far it is extended, and I do not like that there is not more/increased volume coming in. I am more likely to be a buyer down closer to support. I choose not to be the "chaser".

---------------

Lennar homes/homebuilders are holding the breakout gap pretty well and look like they do want to go higher. I am in long on $LEN right now. Currently I think the hombuilder ETF ($XHB) is a little tired and extended but not $LEN or $PHM, those both look fine and not too extended at all, that is why I chose them. I like the fact that the homebuilders broke out of the channels/bases with defined support/resistance.

---------------

Please visit the contact page if you have any questions/comments -

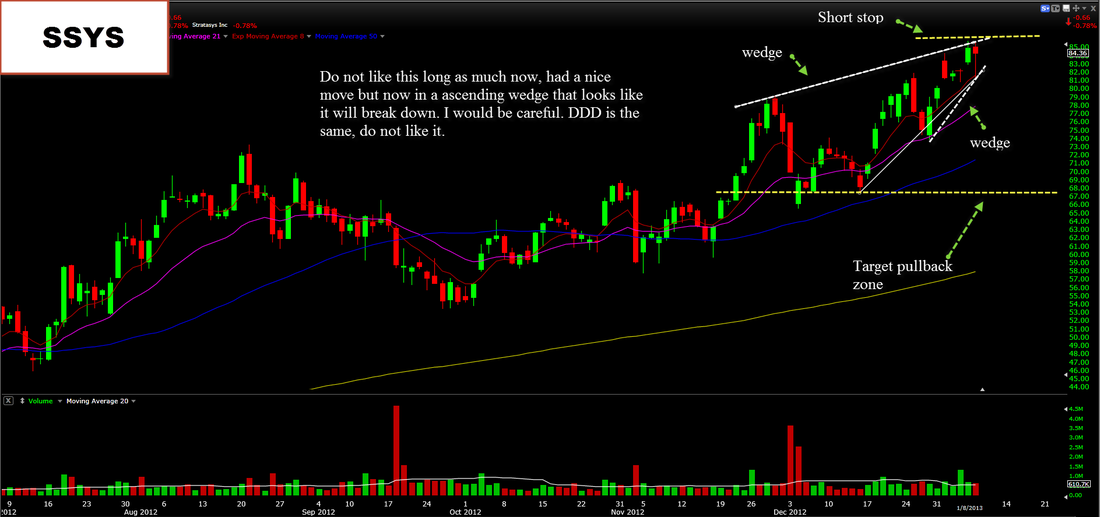

Below are some charts I have looked at with my notes on them, please click them to enlarge.

I commented yesterday that today was not a day to be buying, or adding. This proved to be true today as we did pullback a little and formed a very short term reversal signal. I do not think this is a point of concern and I do think this market looks like it wants to go higher but as of right now, it still looks a little extended. A pullback to the 144 area would be fine, and still considered healthy and likely to go higher. Even a little bit of action into the gap would be fine.

Apple is still weak and quite frankly does not look ready to take off. As long as it is is above the 540 area though I think it still has SOME momentum there. I do not think this is a buy right now thought, there are better acting names to be in. Even for investors, I am not thinking Apple is a good play right, it is not showing any relative strength and NOT leading the market.

Google showed some strength today which is nice and I think Google looks like it wants to go higher. It is holding the gap well, any very short term people need to have a stop IN the gap, but just barely in it.

Same goes for Amazon, looks good for the most part. Holding the gap though I do not like how the volume is playing out, I would have much rather have seen expanding volume on way up rather than decreasing.

If you have questions/comments please visit the "Contact" page at the top of screen.

It is time for some football! Fiesta Bowl on tonight!

Gapped up big again today and traded higher which is a bullish sign as a whole and we will likely build higher. In the short term however, we are extended to the upside and looks like we want to pullback some from here. You do not want to be the one that is chasing these prices, you will get hurt, your money is not made now. It is much smarter to be buying on a pullback than buying highs. Therefore, saying this - I would feel most comfortable being short tomorrow, then long, and then flat (though that really doesn't count).

Apple did not close green today unlike the market and it showing continued signs of weakness, NOT leading the market. Again, this is not the time to buy Apple, let's wait for a constructive pullback to buy.

Google was a lackluster stock today, did almost nothing, it did gap up with the market in the morning and then just hung out for a little bit. I would look to long this stock now, or maybe at the re test of the 712 area. Again, it is hard to chase but looks like it wants higher eventually.

Amazon had a nice day like all the other market stocks (mostly) but it did not have the strongest day it's had. It did not have the volume to confirm it's move and it closed with a hammer (a possible reversal sign).

If you would like to contact me for any questions/comments please see the contact page.

Also, I uploaded the 2013 predictions TODAY. Visit that page by clicking on the link at the top of the page.

|