I do not know what today will lead to, the futures and the market are down huge pre market hours and I do not know what to make of it. There are a few theories but none of them could be true, here are some of the things I am thinking about -

1. The fiscal cliff is all baked in now and this is a buy opportunity

2. The fiscal cliff is huge deal in someone's eyes are we gap down and sell off more

3. We gap down and then stall and from just a doji

Any three of these theories could turn out to be true but I do not know which one. I will let the chart tell me. I will say though, a lot of longs were hurt overnight (me included). We were in an uptrend so the likely hood of this dip being bought is slightly higher. I will focus on the banks and the hombuilders today. Good luck to all.

Ben

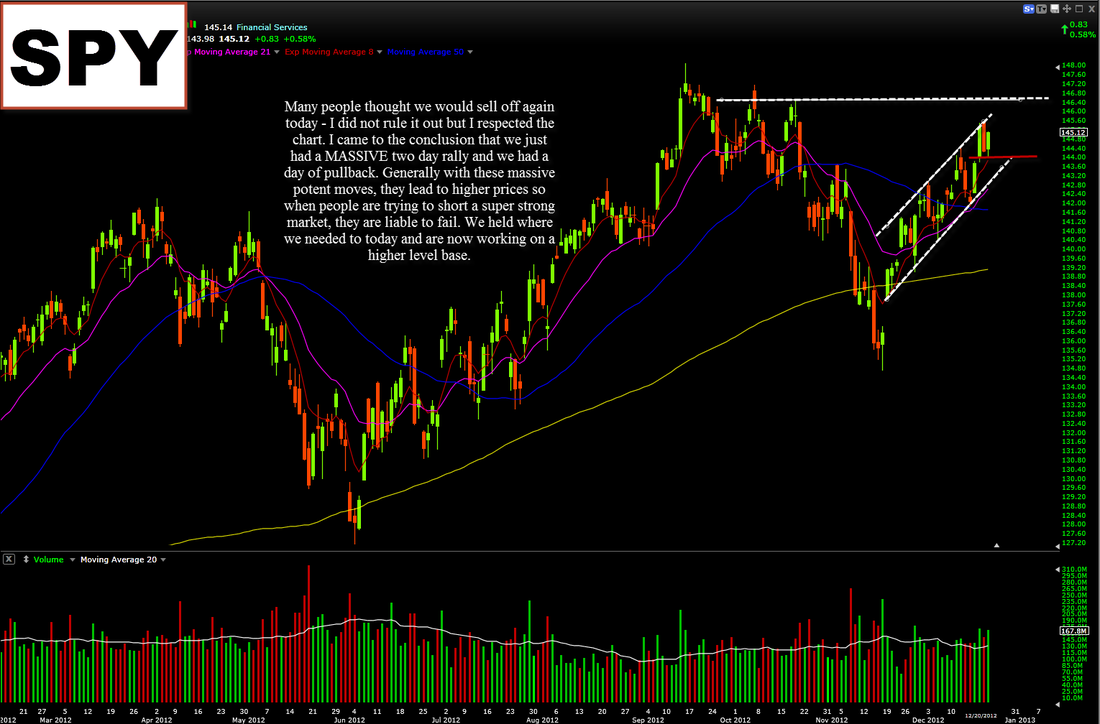

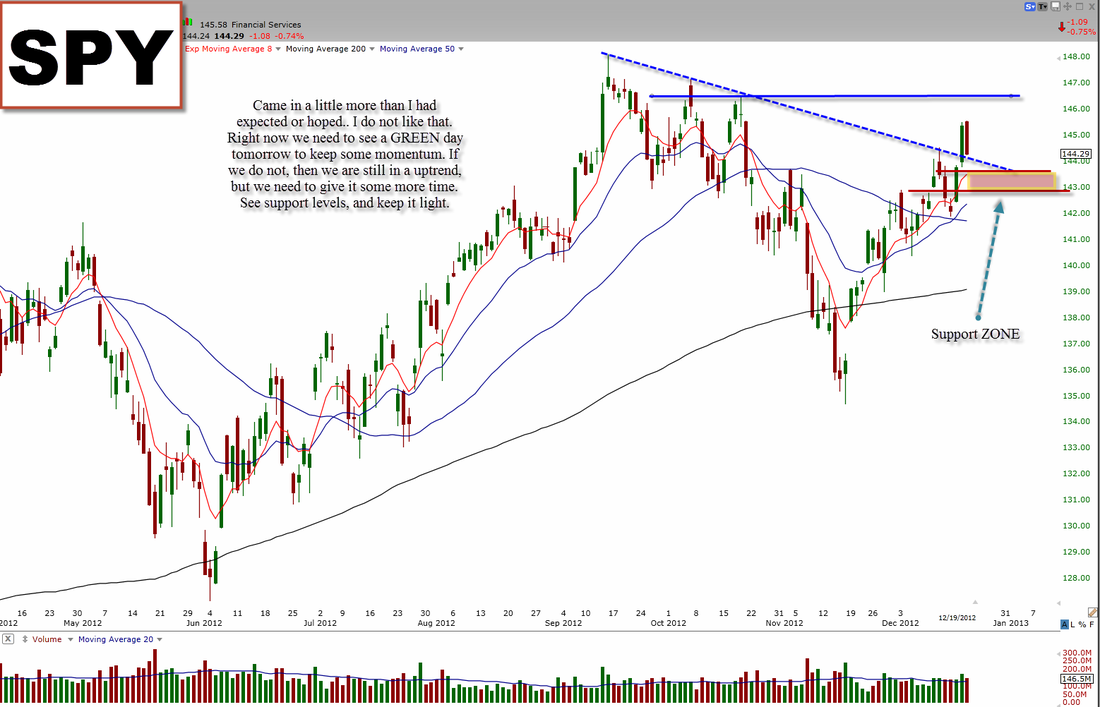

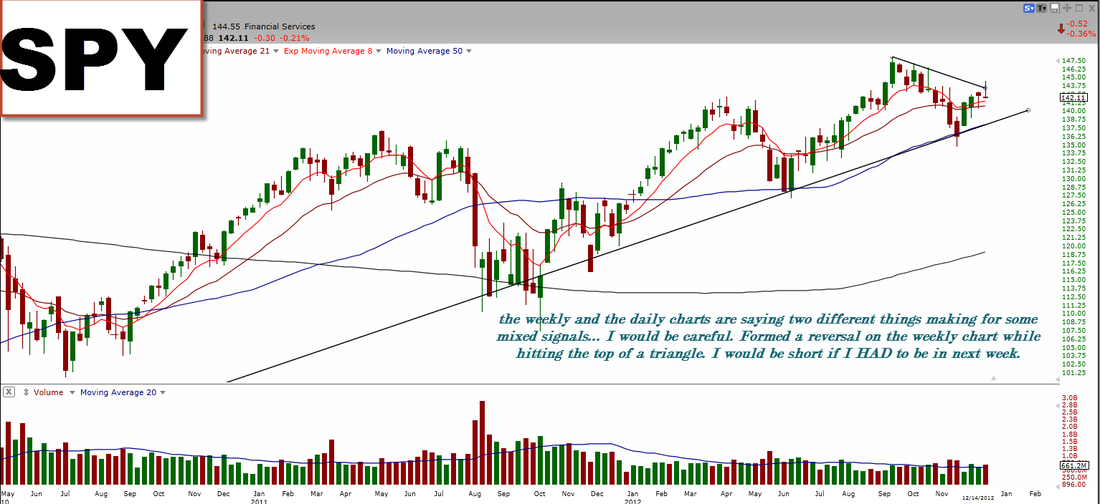

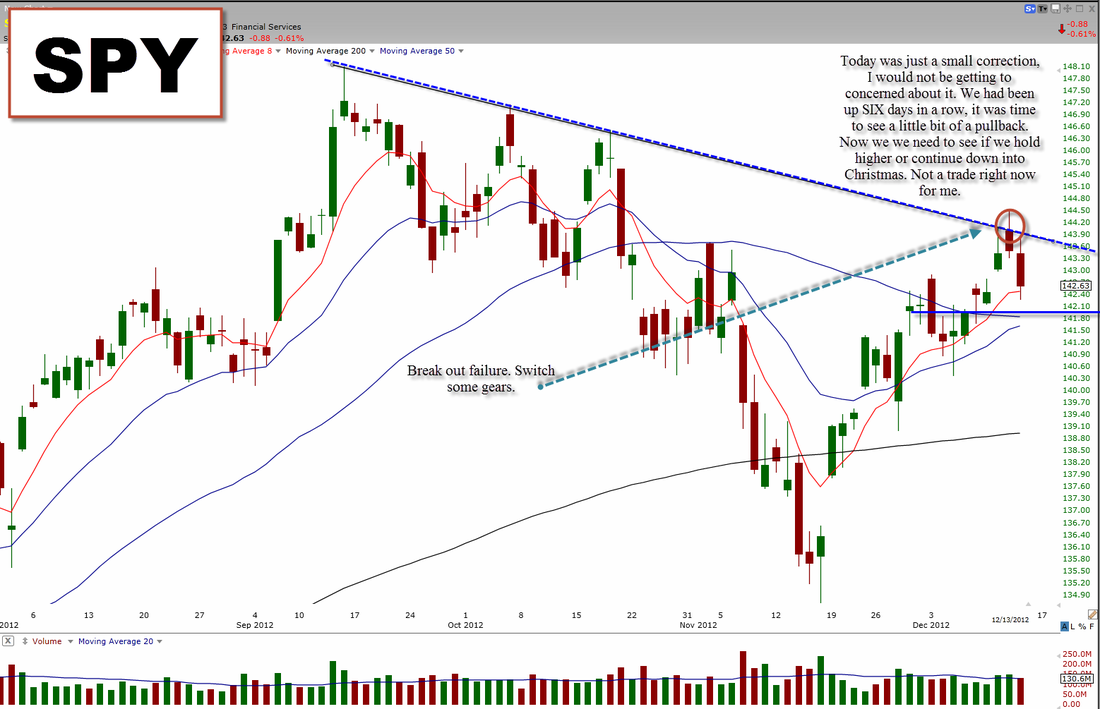

Click to enlarge -- Welcome back! It is finally Christmas break for me, I am excited to have a few days off of school to purely focus on bringing you some charts. This morning I posted a chart on the level we need to hold to keep momentum in the market. the chart I posted around 5:50 AM this morning is below --- Well, we basically came back an barely nicked that area. This tells me there is still momentum in this market. Shorts were trying to short a potent move and calling a move back down to the 143 area - I determined that because of how potent the move was the past two days, we should not come back that much, this evidently was true. Going forward it looks like we are forming a higher level base to potentially break higher out of this upward channel. We are still slightly extended though today helped alot with that. You could trade against today's lows as your stop for a swing long, thought I will not buy the $SPYs right now (just not yet) because of the fact we still seem a tad extended (this does NOT mean we go down though).

------------------------

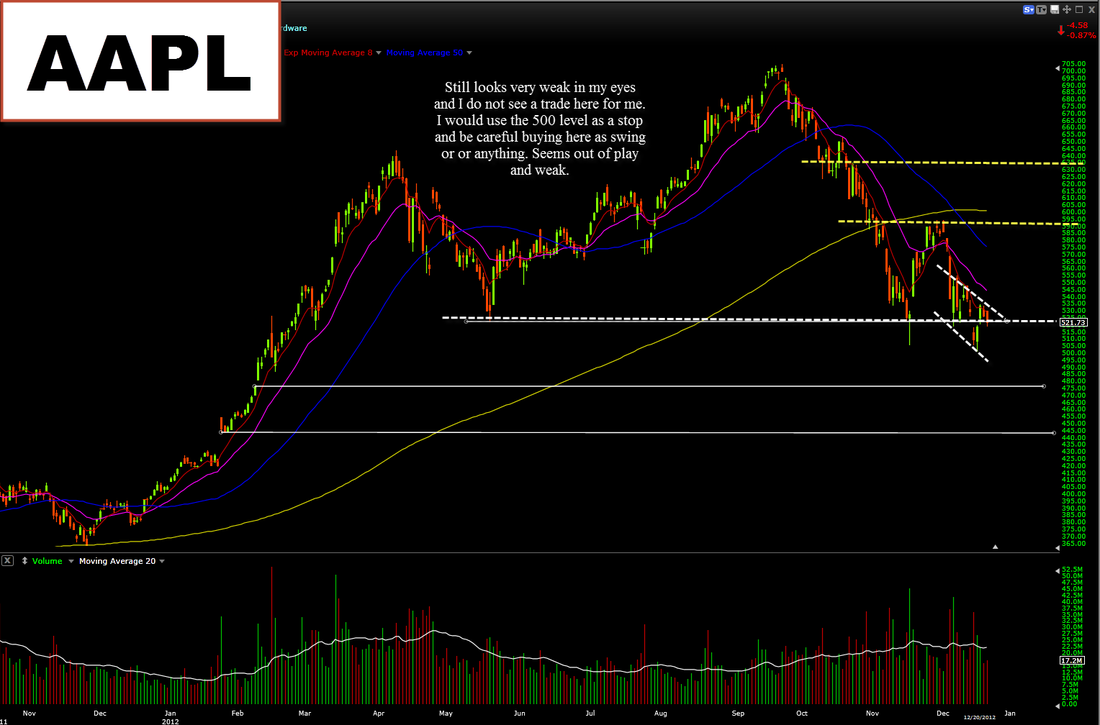

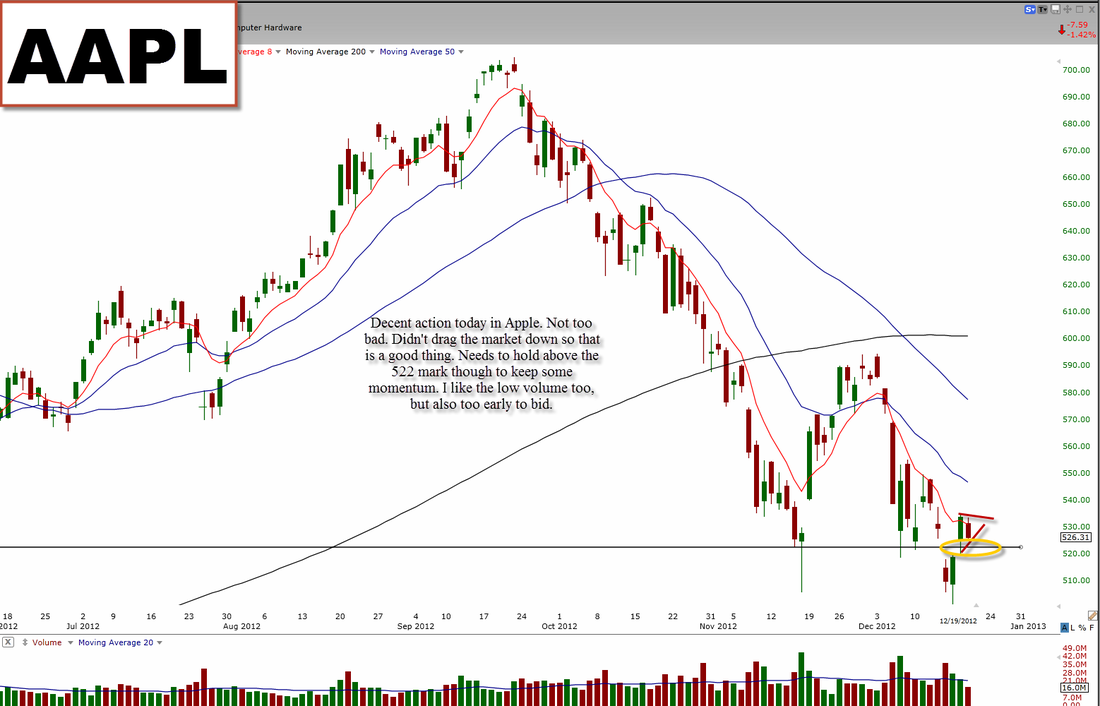

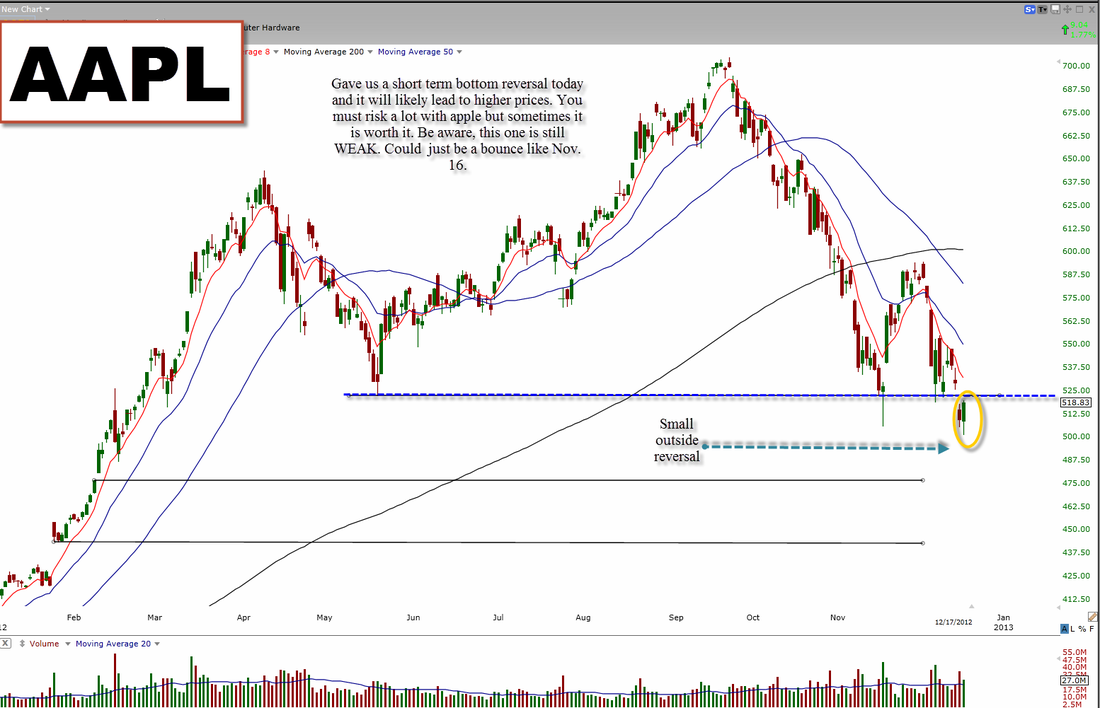

Apple has been out of play for a long time now and continues to be so, I would not be putting more money into Apple (I would have been taking it out after the first sell signal around 685). Going forward I still think there is a high probability of it breaking the 500 mark. A close below 500 could send this one down much further. There seems to be somewhat of a fight going on to keep it above this mark but the chart tells me the bulls are currently losing the battle. It's a trade, and most likely not even a swing trade.

Google has been acting very well lately and I have mentioned it a lot saying it is the strongest or "best in breed" stocks that you can own right now. Definitely the best in the high beta land (behind Amazon of course). Going forward, I still think it looks good. The MAs are catching up and the theory of the bull flag is still in play. The one thing I do not like too much about is the close today -- the market closed green (open vs close) while Google close red. Therefore, I will be buying before a breakout, I will wait for a more clear signal.

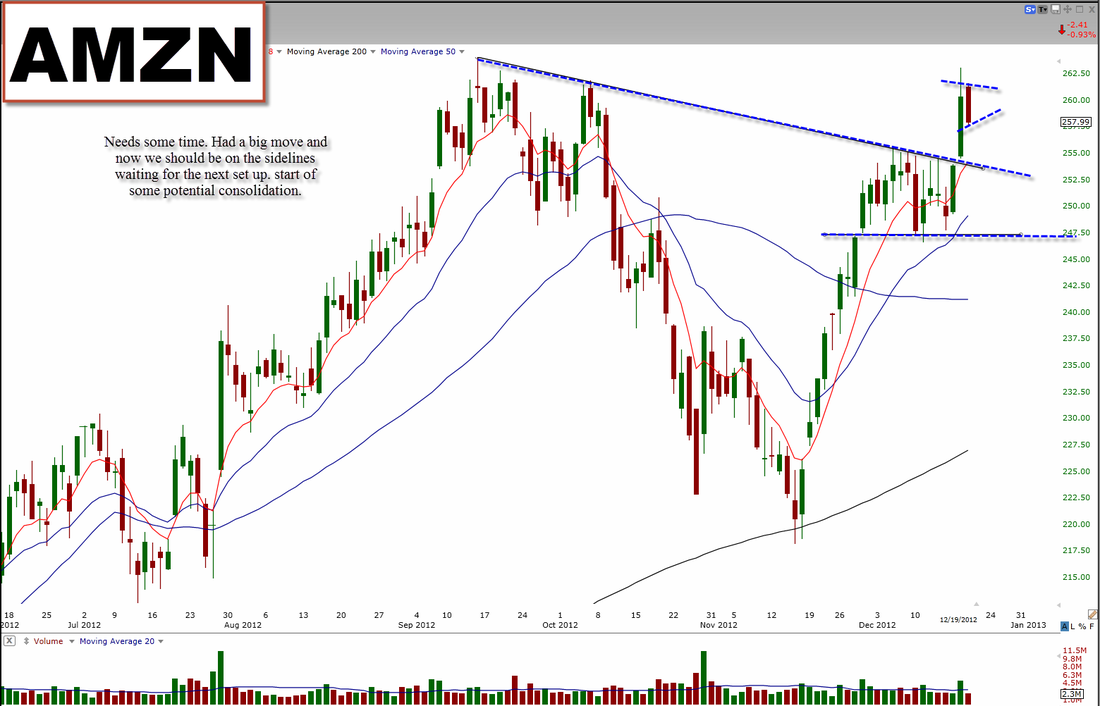

Amazon is the best high beta name right now and it looks very good for new highs. Trade against the days lows and then just hold onto to it. I would not day trade a stock like this, it is more a swing trade candidate.

Facebook has been a little slower recently, I am not a buyer right now as it is not showing me much of a set up, in time in may very well again but right now it is no trade for me.

IBM is similar to Facebook as it is just a no trade right now for me, not a clean set up and not really trending with authority.

DD looks good for higher prices, showed for strength today has room above, the day's low as your stop.

Visa and Mastercard have both made countless all time highs this year and I would stick with them if I were you. Although, every new high and every rally is one more closer to their last. They are going to get tired and pullback a little more than you may like. (Similar to HD and LOW right now). Trade accordingly.

Please visit the contact page for details on how to email/message me for comments and questions.

Here are some of the main charts with my notes, enjoy! Now some chart y'all requested --

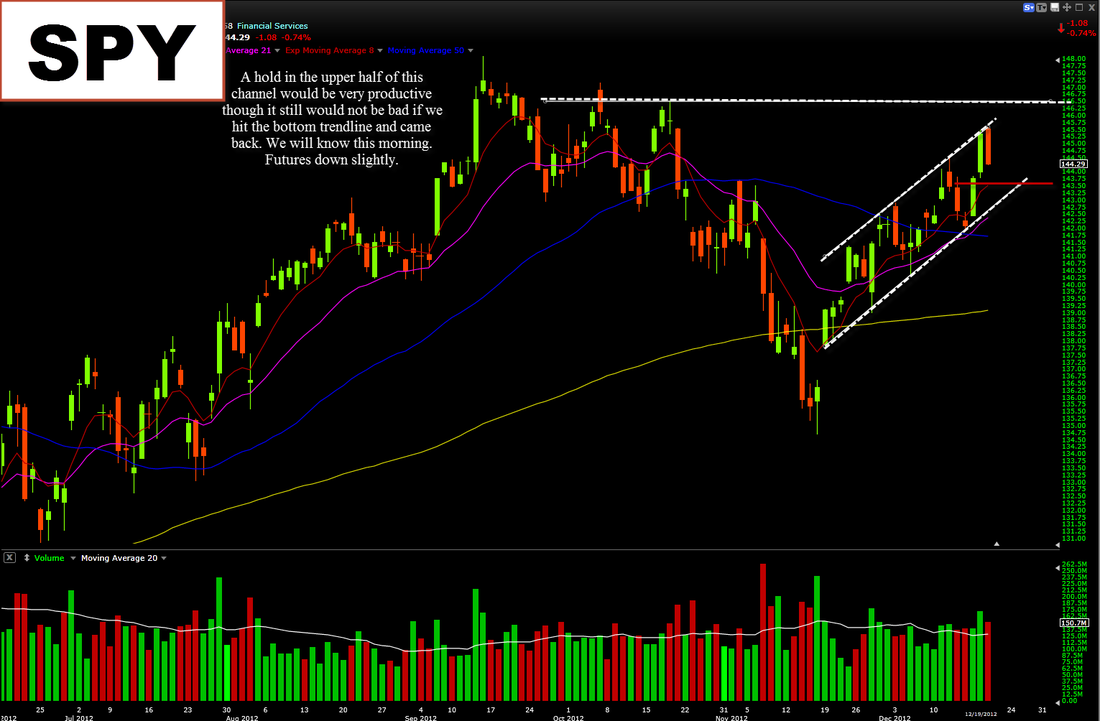

Another day done, congratulations if you made money today. I did not expect this kinda of downward action. I was more thinking we would see a smaller bar with some consolidation but that is obviously not what we got. There was a short entry in there though I am sure most people did not take it because it was not that potent and we were/are in such a strong market that it didn't see like it would pay out. The entry I am talking about is when the market when from green to red, the stop would be at the high of the day then. Again, I do not think this was the best set up because no one knew we would come in as much as we did but it is just a strategy to use in the future. Going forward, it looks like we could go a little lower but support and trendline support is not far off so I would not be comfortable being short for more than three days. We were extended after the massive two day move up so it was likely we would come in a little bit. This is the reason why you do not chase the price. You will get burned. Wait for the next set ups now, it will come. I am looking for a reversal candle or something to trade long against. Until this happens, I will not be buying anything else long.

Now onto some specific names that y'all all care about --

Apple is not looking all that bad from a short term point of view right now. I would look for it hold the 522 area (this would be the area to trade against). It did not sell off all that much with the market is trying to form a higher low. Right now we need to see it go sideways and then take out the 555 area.

Google is holding in there really well and looks like it wants to go higher. Hardly sold off at all today which is a really good sign. I think it looks like a really good bull flag and maybe after another day or two or the the $SPYs reach a bottom - we could then see another leg up.

Amazon needs time again. Formed a SHORT term sell signal today and now it needs to consolidate again before taking out the highs.

The banks ($XLF, $C, $BAC, $JPM, $GS, etc) all need some more time. They all had massive moves recently and it would be nice to see some consolidation or a pullback to bid into. Right now they formed a short term sell signal but that is alright. They will be buyable again.

The homebuilders are trying to stay in play. They sold off early but came back later in the day. I would be looking to buy them soon. I am giving them another day or two.

Facebook still looks like it is forming a bull flag (similar to Amazon) and maybe in another couple day we see another leg higher in FB.

If you would like to contact me for questions/comments please visit the contact page for details.

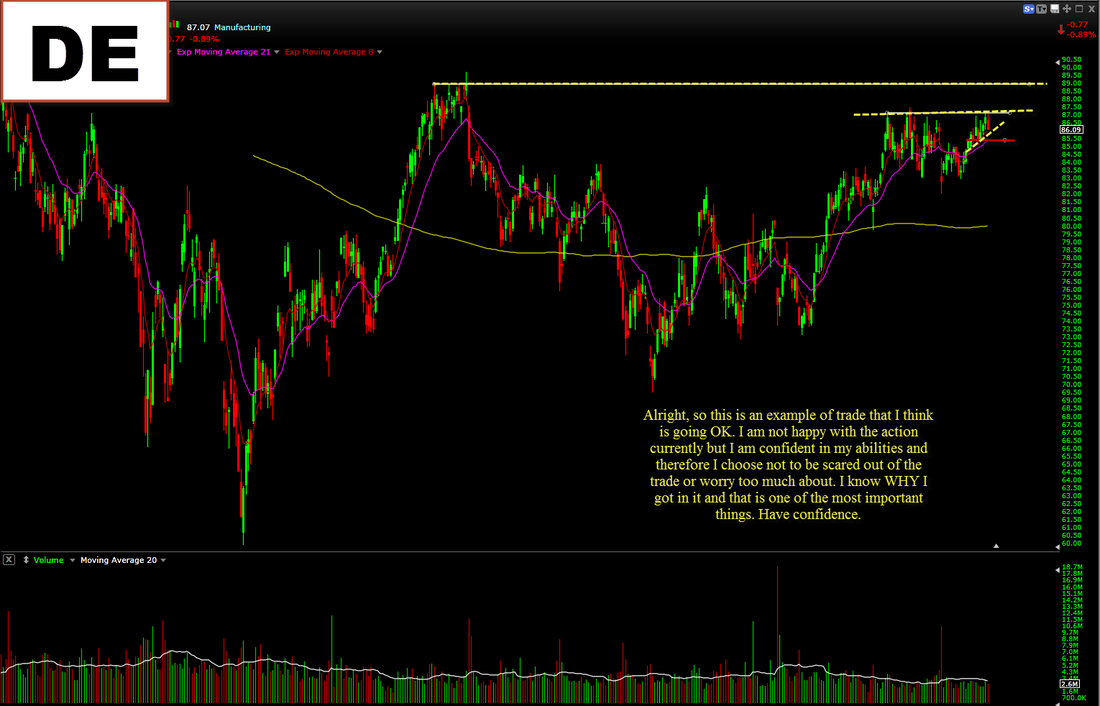

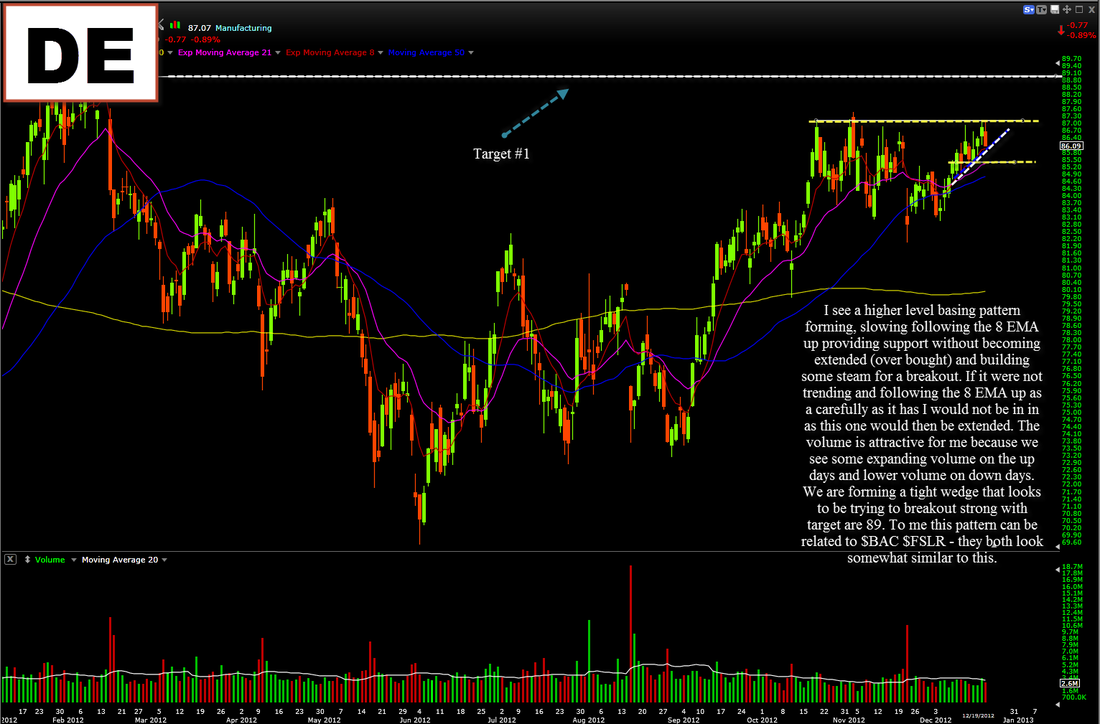

Below are my charts with notes/analysis -- WHITE or BLACK? Thanks. Reason behind the $DE trade -

Click to enlarge -- Welcome back to the daily analysis. We saw another move today showing MORE power and proving we want higher. I said yesterday that I finally felt comfortable being all long and having great confidence. I said this because I started to see everything line up again. Techs coming back (Apple specifically , the banks having a POWERFUL day, and finally, the forgotten leader, the homebuilers. As of right now we may be a bit extended and I would be looking for some consolidation tomorrow or in the coming days that holds higher. I would NOT be looking buy right now (as this would be chasing) and at the same time, this is also not a place to short. Play it smart, and it looks like right now, cash may be a good position.

Apple I mentioned yesterday formed a reversal signal and could have reached a short term bottom. It looks as if that is true. Right now it needs to get over the 555 mark to get anywhere. Again, i would not chase this price. Measure commitment on a pullback.

Google is hanging in there. I like the action and if it can hold around this are we could see another move higher and could potentially test the highs before their earnings report. Wait a couple more days though to see if you can get some more sideways action.

Amazon broke out today, I mentioned it in my Daily Analysis yesterday saying it looked like a perfect bull flag. Right now, I would not chase but I would exepect it to test the highs and surpass them very soon.

The banks ($C $BAC $JPM $GS $MS) all had AMAZING days and weeks. As of right now, I would not be buying but on a pullback, oh yes. BUY the banks. Keep a close high on them now as they are leading us higher.

Below are some charts with notes I have compiled. Your welcome.

If you would like to contact me for questions/comments please visit the Contact page for details!

(Click to enlarge)

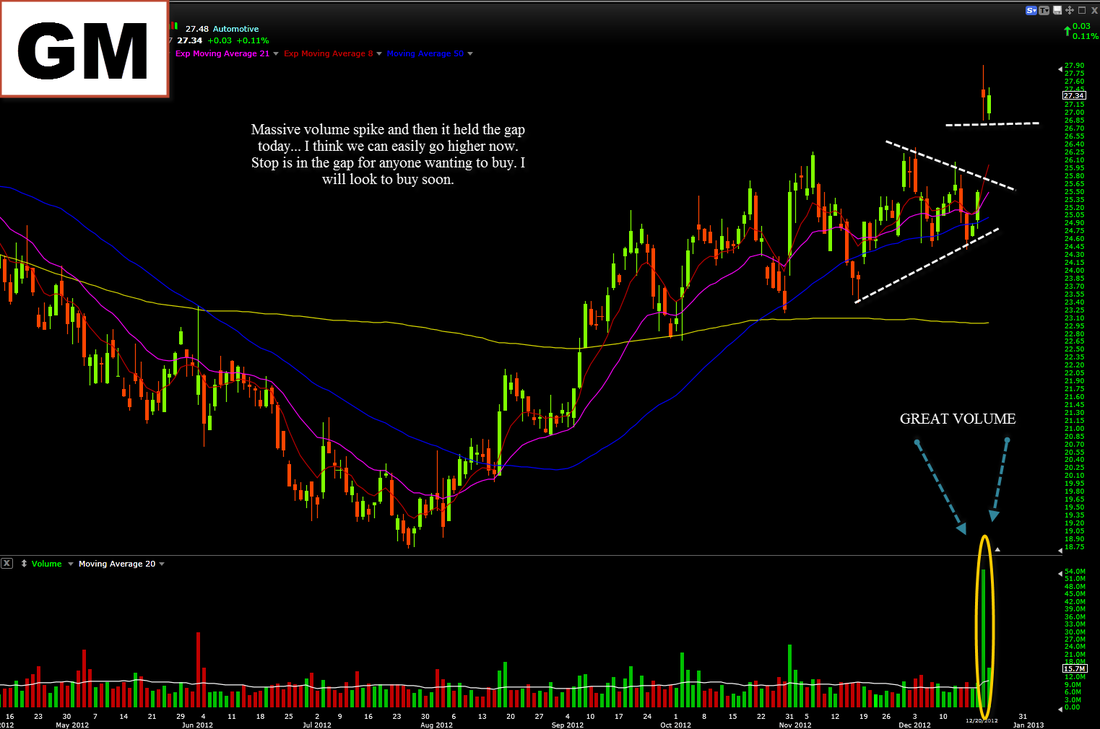

AWESOME DAY! I hope you were in the marker today, it was a powerful move that will likely lead us higher. We saw some nice volume the last hour and some great action in the banks as well as the homebuilders today. We have not seen that kind of action the homebuilders in a long time, this tells me they are still hangin around and will likely try and lead some more. We need more leadership and seeing an old leader have a powerful day will likely help us out. The banks too saw some continuation, I would not chase now but maybe on the next bull flag you can jump in. Overall, the market looks like it wants higher. We are seeing commitment to the move now with some potency.

Apple finally gave us a trade today and it still is a trade. The outside reversal. The trade here would be to set the stop at the low of the day and ride the move. There may not be a move in Apple or there could be a short squeeze rally (like Nov. 16th). I expect the later. You do have to risk a lot with Apple but that is just the way Apple trades. Good luck. I like reversals. ALOT.

Google is really strong and continues to be so. It has almost taken out half the massive red bar it had on the early earnings release (OOPS!), this tells me it is stronger and power move down does not have near as much power. I would continue to look to buy on pullbacks. Do not chase this price though.

Amazon is likely going to go higher. I like the bull flag action and it looks as if it is just about ready to move again. This has been one of the strongest names in the market and therefore it will likely continue to lead us higher. Watch the 255 area. Nice bullish engulfing today though.

Some other names --

$GE -- said it looked good over the weekend it continues to perform. I think we see higher prices in GE. Nice volume today with a break of trendline with room above.

$DUK - Holding higher and will likely continue. Not a leader, but a trade possibly. Target could be around the 66 area.

$LF -- I highlighted this one over the weekend and said it could be a short term reversal, that turns out to be true. Trim and trail this one, do NOT chase this one at all.

$DE -- Deere is holding higher and I think we see move up very soon in $DE, I will likely be in this one.

$H -- The hotels are acting well as a lager play. $HOT and a few others made there moves today so now we are looking for $H to play catch up.

$MA -- a low risk trade in IMO. I think we see it go higher. I like the action. You must be careful though, the higher it goes the less it has left in it.

That is it for now. Thanks for reading. Below are some more charts as I do not have a separate page for Charts any more. Enjoy! (Click to enlarge images)

Also, if you would like to ask me any questions or provide comments please visit the Contact page for instructions.

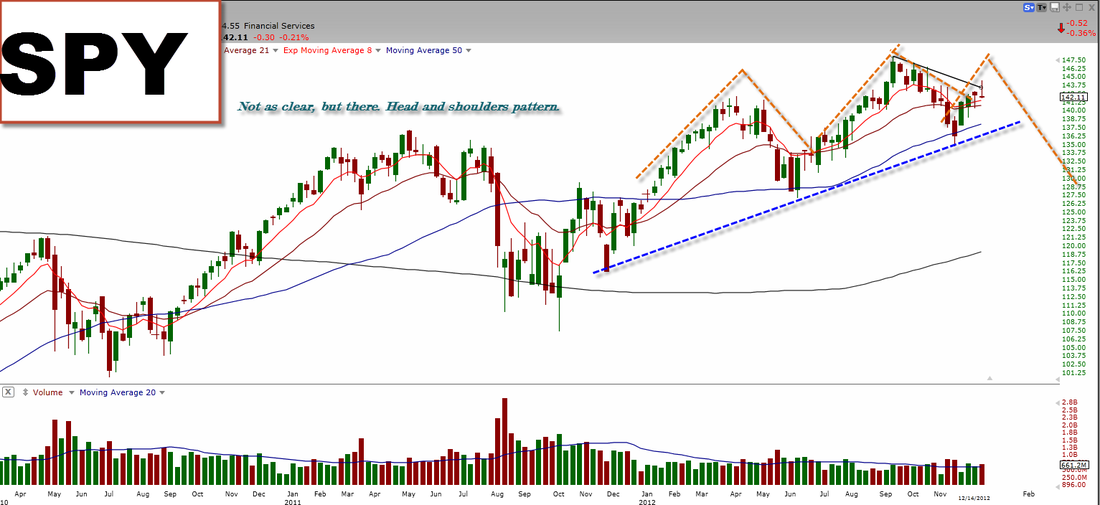

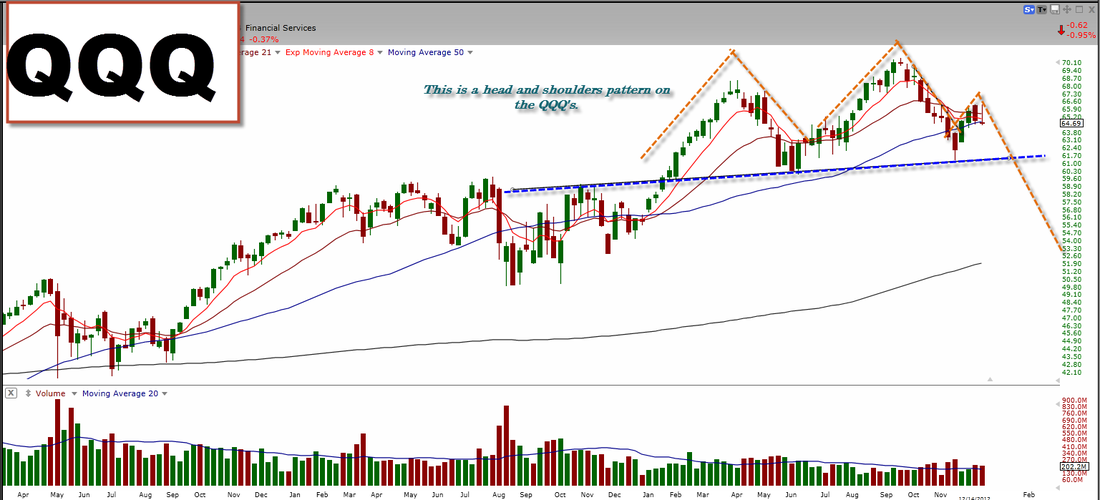

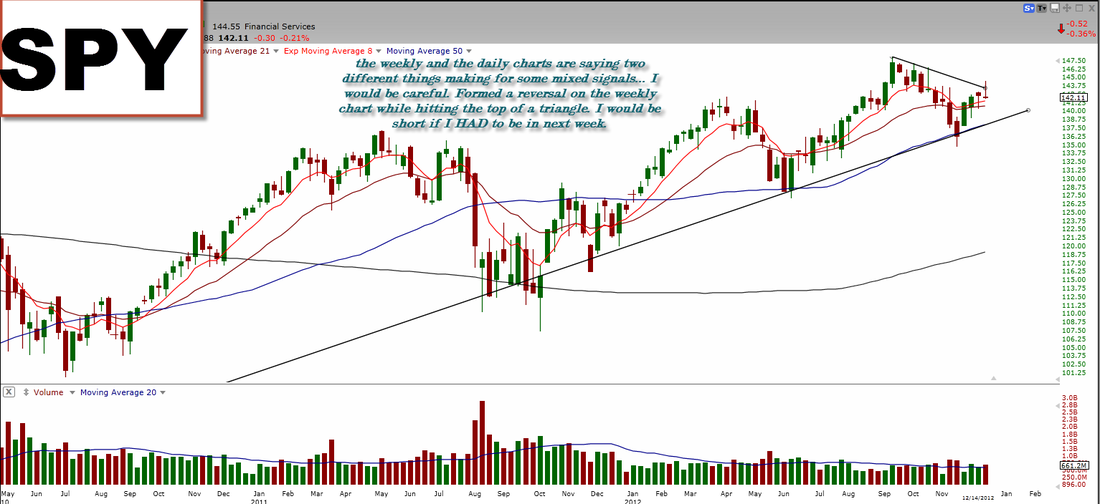

I have heard many people say now that Apple has stopped leading the market but as I sit here in the car and ponder this thought and look over some charts, I think we need to consider something else too. Think about this, Apple had been a leader in the market for so long and everyone was a die hard Apple lover - you were told all you needed to do was buy Apple and you would be rich (thus we have a sell off). Now that Apple has stopped performing well (at all), it appears from the daily chart that the Dow and SP500 have tried to "disconnect" with Apple though it has not been strong. As we have all seen on the way up the market is sluggish, kinda weak, and slow - this is all during the same time Apple is trading lower and lower. So yes, the indexes are trying hard but as with everyone/everything... you eventually run out of steam and give in. I am referencing the indexes to Apple at this point and the "elephant in the room" the head and shoulders pattern seen on all indexes but specifically Apple. Therefore, by saying all this if you view the market as a living creature (like it often is) then it would make sense that if there is still some connectedness between Apple and the indexes (which it appears there is) then once Apple confirms it's head and shoulders pattern (below 500) we could see the indexes really give up, specifically the NASDAQ, and work towards confirming theirs. IF it is the case that Apple is still LEADING the market then it would make sense that once Apple confirms the Head and Shoulders pattern we should be more likely to see the same confirmation pattern in the indexes.

Saying all this is just something to think about, no one will really know the answer until the possible head and shoulders pattern is invalidated. The purpose of this post is purely to consider all options. I feel like the market is in more of a stand still than anything else. Slowly moving higher, but weak, and not great volume... Individual stocks are moving and you need to keep an eye on those but also be aware of the "elephant in the room". Below are some charts of these looming head and shoulders patterns. (Click to enlarge images)

I got a question the other day, well it was more of a comment and I did not respond to it immediately. I wanted to think about it for a while then answer it in a blog post, so here it is. Below is the question this person asked me, throughout the whole thing he was referring to APPLE:

--------------------------

I never understand the logic/POV behind "all powers come to and end?"

What happened to real research instead of cherry picking a few misleading metrics.

What happened to knowing the products that Apple sells still have sustained growth for the next 5 years.

What happened to knowing that Apple already makes more profits then the almost all other media and consumer electronics combined and CONTINUE to grow those profits.

What happened to knowing that Apple has investment/cash that know one has ever seen in the history of the markets.

Yes, the stock is disconnected from the actually company at this time but its very, very foolish to assume that disconnect simply continues.

We all agree short term irrational stock price movement happens but at some point REAL FACTS take over.

This does not mean that price movement can not go much lower...again short term irrational markets happen.

My point is a simple one......there is not a valid metric that agrees with anyone thinking Apple's real world domination is coming to an end. Nadda, Nothing.....the $$$ profits, sales, retention rates are as strong as they have ever been.

Apple's 2013 profits alone could sustain Amazon profit growth for the next 10+ years ;)

----------------------------

We will go in order and I will number them according to the different "paragraphs" this person wrote in.

1. I believe all "powers" do come to an end, at least in the world we currently live in. For example, one president doesn't rule forever, a country has not and will not last forever, you do not live forever, and the list goes on. I view this as the same in the financial markets, nothing goes straight up (in this case $AAPL) , and nothing can go straight down. If you thought Apple was invincible and would always go up, I am sorry but you are mistaken - as we just saw, all "powers" come to an end or start something else.

2.Misleading metrics? This person was not clear enough with his question but I assume he means the technical indicators? Well, many people have had success with technical analysis, so obviously it is not misleading (if you know how to read it). This person also says "real research", I believe that this is real research, technicals may be different than the way you do it but that doesn't make it invalid.

3.HOW do you know that Apple will have sustained growth for the next five years? I didn't know anyone had a crystal ball but if you do, PLEASE contact me! I want to use it too! In other words, there is no way of knowing what the company will produce or be like in five years, it is all expectations and word of mouth, no one truly knows. Therefore, I follow the price action.

4.Again, I am not sure if they are "continuing" to grow this profits or not but either way, does this mean they cannot stop making a profit? There have been many companies that have gone down after in the past making profits.

5. So what? Apple has cash? Great. Again, just cause they have "cash" doesn't make them a great investment. If you only base your buying off that then you would have obviously lost A LOT of money in the past couple months because they have about the same amount of cash at 700 as they do now at 530...

6. How do you know it is "disconnected" have you thought of the chance that someone else may know something you do not and that is the reason for the "sell off". I do not think anyone has the authority or ability to call something "disconnected".

7. REAL FACTS? What are the real facts? The fundamentals are the real facts, that is obvious because if they were (according to the fundamentalists) we would be going higher and higher now, not lower and lower. Therefore the technicals must be the REAL FACTS, the technicals help interpret price action (which is the most important thing in a stock). Currently the "REAL FACTS" (technicals) are telling us a different story than the "IRRELEVANT FACTS" (fundamentals) and sense price action is what you are really putting your money in, you need to respect the technicals.

8. There it is, you saved yourself. "it can move much lower". My response to that is - at what point will be too low for you? Will you wait for $50 a share (way extreme at this point) before saying it is not a good investment anymore because finally their "cash" balance has fallen, or whatever else the fundamentalists look at?

9.Valid metric? There is again. Technicals are a valid way of viewing stocks, if it weren't do you think ANYONE would ever talk about them?

10. Finally, so what Amazon growth is smaller? What does that have anything to do with Apple? Amazon is heading higher, do you think it will just sell off to the extremes that some fundamentalists claim overnight or something? It has proven it is a strong stock and wants to go higher repeatably and I predict that once the fundamentalists realize that Amazon is a good "investment" according to them - the majority of the move will be over.

Wow, well sorry if that seemed a little offensive in some parts, I just am really proud of my technicals and do like it when people think it is not a "valid" way of trading/investing. Thanks for reading.

Click to enlarge image - Before I start, there are a few changes I have made to the blog as past visitors can easily see. First off, I deleted the "trading journal", "Charts" "search" and "Daily Analysis" pages. Secondly, I changed the theme. I did these two things because I wanted to make my blog look more professional and a lot cleaner. Do not worry, I will still post all the same content that could have been seen on those pages but now they will be strictly on this page. This is for the benefit of me and you. Now onto what you really care about --

-----------------------------------------------------------------------------------------------------------------

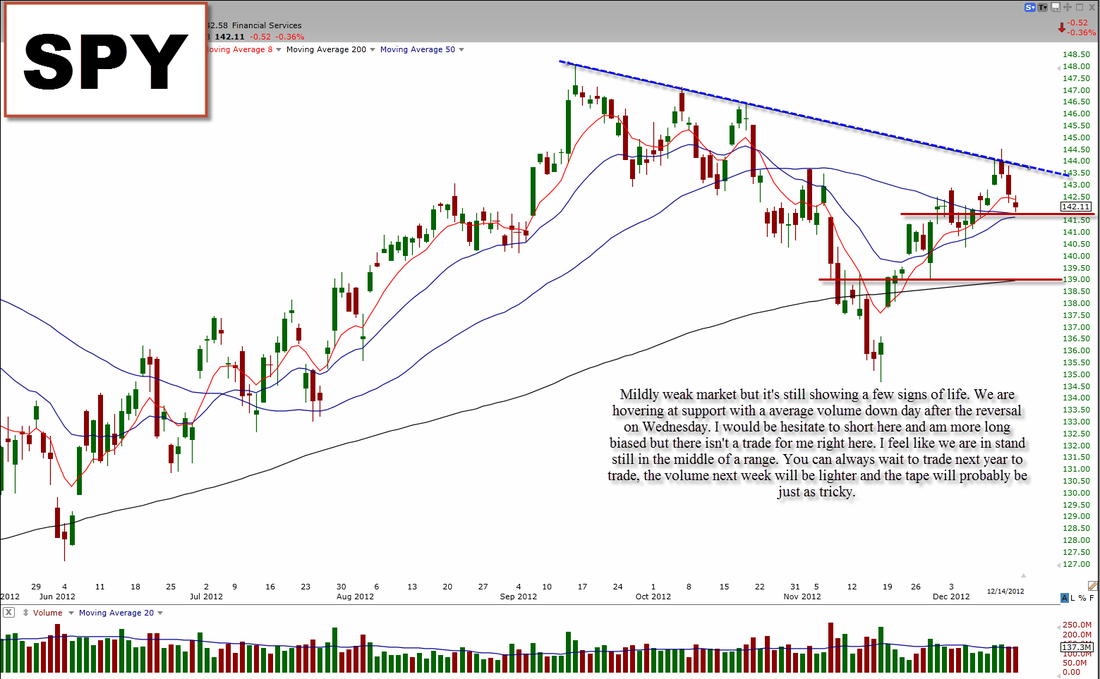

The marker sold off a little bit again today making it the third down day we have seen after the reversal candle we saw on Wednesday. I still believe this is a healthy market though it is tricky. We have seen a lot of choppy mixed information action but for the most part, we have been going up and uptrendling. During uptrends, pullbacks are necessary, and they are buyable. As of right now, I consider this a pullback but I will not bid into it because of the high er volume days that past tow days and some of the underlying sectors/stocks I am following are showing me something different. I will buy when we see a reversal or probably once the new year comes.

Apple fell below the wedge I have been talking about today on very high volume. I am a firm believer in staying away from the weak, and if you adhered to that rule, there would have been nothing to worry about with Apple. Apple has proven it is weak, and has been weak ever since the market has continued higher and Apple was stopped dead in it's tracks and fell. For anyone that still owns it, 500 has got to be the line in the sand for you. There will be trades long in Apple but as right now, it is in a downtrend and very weak.

Google gave you a reason to be cautious yesterday and today we just a a very small bounce (open vs. close) on very light volume. I would still be hesitate with Google, it is not a buy for me. Needs to hold the 695 level to show some strength.

Amazon is not really in a tradebale area for me. It looks like it wants to go a little lower but there is support around here and the volume is not confirming the bearness of it. I do not see a trade right now in it. I would like to see it hold 246.

The banks have really held tough this weak and today. I think we can see higher prices in them, and these are the ones you would like to buy on good low volume pullbacks. Some banks I am watching are; $C, $JPM, $BAC $MS - I believe these are some, if not the strongest ones out there. They may not be quite ready though. $MS broke out today but really didn't confirm it with any volume therefore I would remain on the sidelines until more confirmation with these names.

$NUE and $X both woke up today, I was watching them both to see if they could coil up some more next to resistance before buying into them but that didn't happen - they went today. $X is stronger than $NUE and may be buyable on a light volume pullback. Keep it on the watchlist.

That is it for now. Make sure to check back here throughout the weekend for more charts/posts. Have a good weekend!

If you would like contact for questions/comments, please visit the contact page.

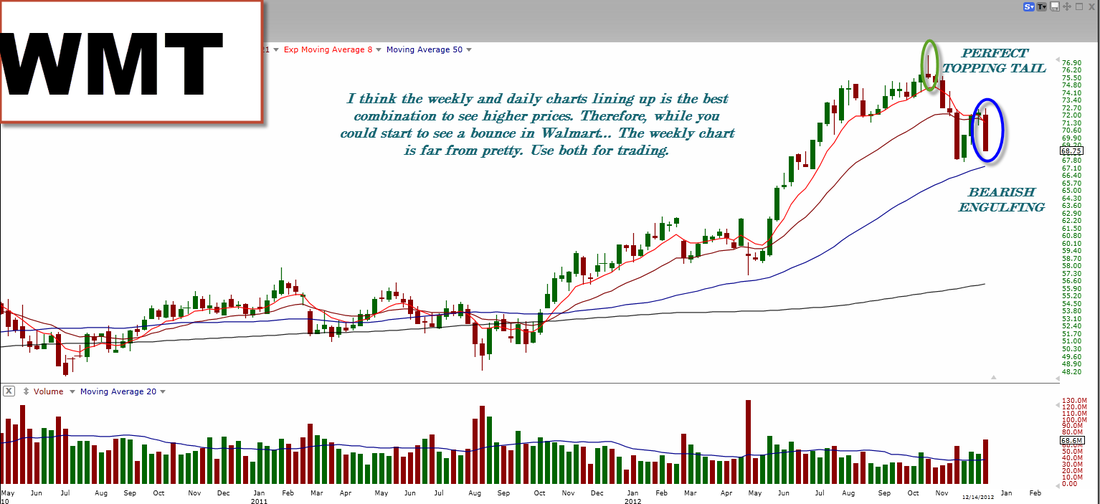

The charts will be on the Daily Analysis posts from now on - Now, some weekly chart because it is then end of the week ---

Click to enlarge images -- First off let me tell you, it IS possible to time the markets. See a set up, execute, and you have timed the markets. I got short two days ago and sold today, a little premature but either way -- still money. I believe today was just consolidation or a small pullback day. I think pullbacks will be buyable but I would like to see a another day or two of consolidation and tight price action. I would bid into this market long right now but I do not like how the volume ended today, if it were well below average, I would have probably bought some of the banks long because those are the strongest sector right now. I will wait for a clean, and better set up. This is just me though, trade your own way if that is what your gameplan calls you to do. Apple is still weak, nothing has changed. I will say however that the longer it stays below the 555 mark, the more likely the chance it will trade through the support at 500 and trade deep into the 400s... Just a warning. I would not want to own Apple long unless it is for a day trade only! Google is not near as good looking as it did yesterday. It formed a reversal candle today on OK volume and could see a little further downside. The pop in the pre market (that I still do not know what it was from) and the opening was a point to sell some. Amazon is still strong, but has formed topping tails in a row, I would not long this stock or short this stock right now. It can go either way. It is a little extended but then again, it is a strong name right now. I do not like a whole lot of mixed messages. I will stay away. Netfilx is still trading higher and is TRYING to fill the gap though the volume is not that strong. I do not like how it broke out a little prematurely (IMO) yesterday, I would have liked to have seen it coil up some more near the 90 level first. Facebook I highlighted yesterday in the DAILY ANALYSIS and I said I think it will move again very soon, it did today. I was not in it, I wanted to see if go one more day sideways before bidding but oh well, that's the market. Now for some names y'all requested -- GTAT - I do not see a buyable trade here, yes it is holding higher a MAYBE forming a bull flag but the sell of and minor engulfing bar does not give me a reason to buy it right here. Also it has been beaten down A LOT meaning it is a very weak stock and a lager play. BAC - yes, it could be considered a buy here but I, my self, am not going to. I think we need to form a tighter range to trade with, right now it is just rounding off and kinda choppy. I do think it is still strong though, and should be watched. RIMM - It is probably a short squeeze rally and should not be chased, you have missed the move if you are not in it now. There will be another. BSBR - very similar to GTAT I mentioned earlier. Not really a trade here. Here are my reasons: The volume is not shaping up like I would like, it is WEAK and beaten down name, there was a reversal/topping tail today, and sitting as some resistance. I will not say it will not go up, I am just saying -- there are probably better set ups with stronger patterns. LVS - LVS has been range bound for a while now, I like trending stocks more the channel range bound. I will say though, it does look strong. Wish there was bit more volume coming in but not bad. I wouldn't chase though after so many green days. HAL - HAL has been downtrending for quite a while it looks to be making a lower high right now. I do not see it as a buy right now as slashed through some key MA's. Make sure to visit the chart page to see some of your favorite set ups/names with analysis -- CLICK HERE to go to Charts Page And that is it! Thanks for reading! My contact info is below for questions/comments -- Twitter - https://twitter.com/BenCBanksStockTwits - http://stocktwits.com/BenCBanksEmail - [email protected]

Alright well today we worked off SOME of the "extendedness" I saw in the market yesterday. In the process we formed a topping tail with some good volume in the indexes. This is a point where you lighten up on some longs and potentially short for quick trade. My short term pullback target is around the 8 EMA (this would help work a lot off the "extendedness"). I am currently short the DIA with the DXD and targeting around 48 though I will likely sell before there. We are in an uptrend right now and currently there is nothing stopping us from continuing, all I am saying is we are currently a little extended - nothing goes straight up. Apple is STILL weak. If this weren't for Apple, I would not cover it all in my blog posts but because it is, I feel like I need to. I still think Apple is a day trade only stock, still very weak but there are HINTS of bulls in the stock right now, but then again - I am not a buyer yet. Nor am I a daytrader. Google is still showing some strength and I still like the name a lot but personally, right now I do not want to buy it. The market is a little extended and it closed with a doji today. This does not mean it will no go up and test resistance but it is just a trade for me. Amazon is the strongest stock in "high beta land" right now. Nothing seems to pull this one down. I will still say though, it isn't a long for me right here either. The moving averages really need to do some catching up and it can still easily roll over a little bit. Facebook is looking really nice for higher prices. I think we can see another up move in this one VERY soon. Ideally I would like to see one more up day that stays below 28.26 with some increased volume, this would confirm my thoughts. I think it does head higher though. Riding the 8 EMA like a champ. YHOO is extended, that is easy to tell. I would not initiate any longs just yet, let it pullback some first. Contact info for comments/questons -- Twitter - https://twitter.com/BenCBanksStockTwits - http://stocktwits.com/BenCBanksEmail - [email protected]

|