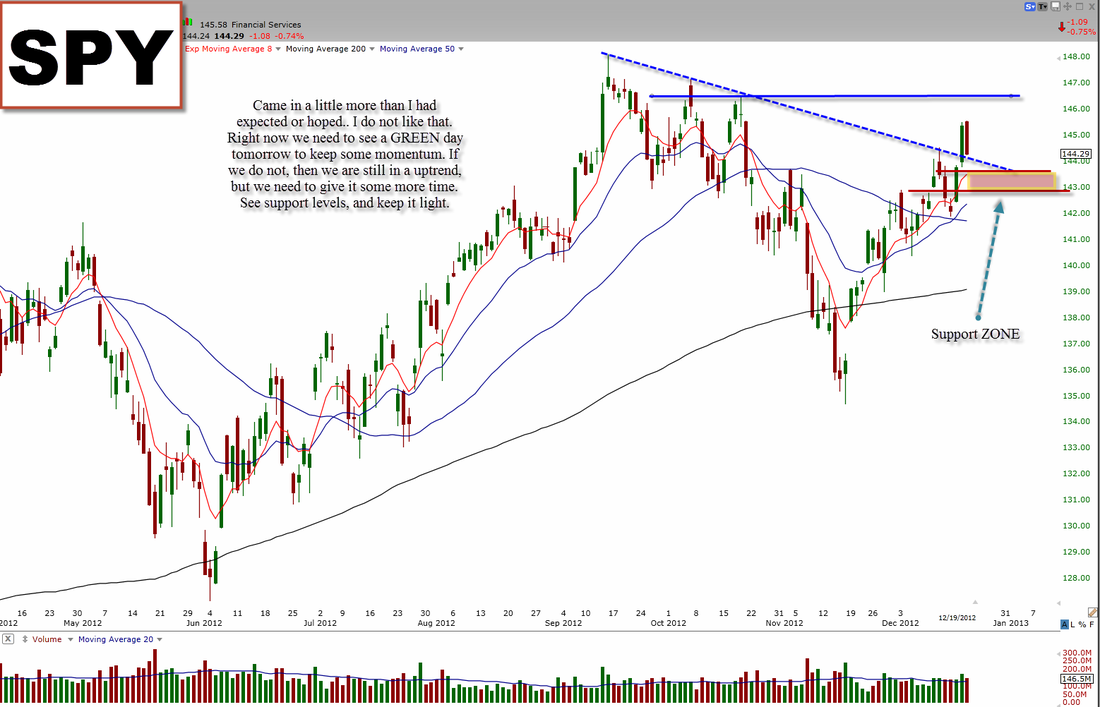

Another day done, congratulations if you made money today. I did not expect this kinda of downward action. I was more thinking we would see a smaller bar with some consolidation but that is obviously not what we got. There was a short entry in there though I am sure most people did not take it because it was not that potent and we were/are in such a strong market that it didn't see like it would pay out. The entry I am talking about is when the market when from green to red, the stop would be at the high of the day then. Again, I do not think this was the best set up because no one knew we would come in as much as we did but it is just a strategy to use in the future. Going forward, it looks like we could go a little lower but support and trendline support is not far off so I would not be comfortable being short for more than three days. We were extended after the massive two day move up so it was likely we would come in a little bit. This is the reason why you do not chase the price. You will get burned. Wait for the next set ups now, it will come. I am looking for a reversal candle or something to trade long against. Until this happens, I will not be buying anything else long.

Now onto some specific names that y'all all care about --

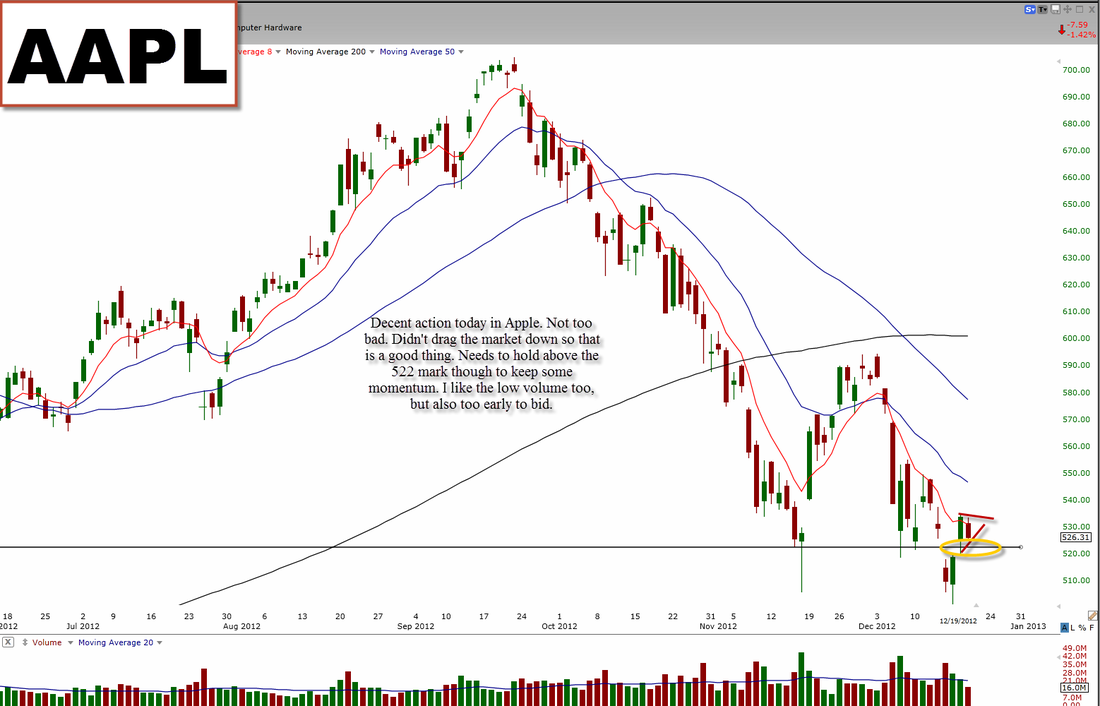

Apple is not looking all that bad from a short term point of view right now. I would look for it hold the 522 area (this would be the area to trade against). It did not sell off all that much with the market is trying to form a higher low. Right now we need to see it go sideways and then take out the 555 area.

Google is holding in there really well and looks like it wants to go higher. Hardly sold off at all today which is a really good sign. I think it looks like a really good bull flag and maybe after another day or two or the the $SPYs reach a bottom - we could then see another leg up.

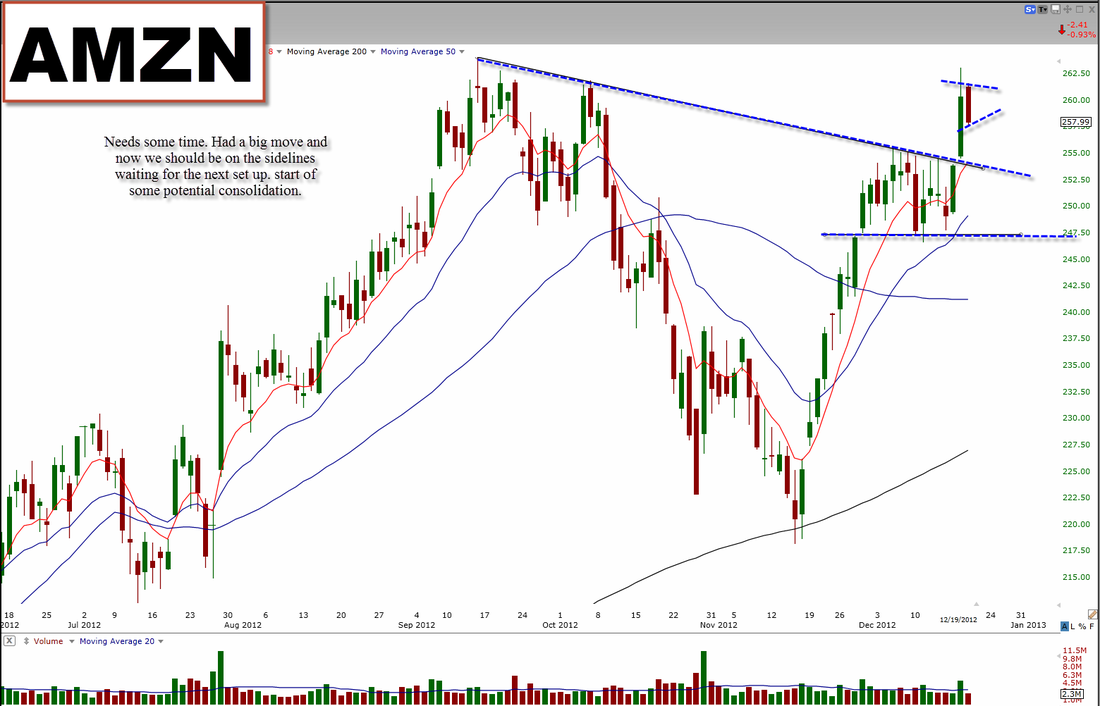

Amazon needs time again. Formed a SHORT term sell signal today and now it needs to consolidate again before taking out the highs.

The banks ($XLF, $C, $BAC, $JPM, $GS, etc) all need some more time. They all had massive moves recently and it would be nice to see some consolidation or a pullback to bid into. Right now they formed a short term sell signal but that is alright. They will be buyable again.

The homebuilders are trying to stay in play. They sold off early but came back later in the day. I would be looking to buy them soon. I am giving them another day or two.

Facebook still looks like it is forming a bull flag (similar to Amazon) and maybe in another couple day we see another leg higher in FB.

If you would like to contact me for questions/comments please visit the contact page for details.

Below are my charts with notes/analysis --

Now onto some specific names that y'all all care about --

Apple is not looking all that bad from a short term point of view right now. I would look for it hold the 522 area (this would be the area to trade against). It did not sell off all that much with the market is trying to form a higher low. Right now we need to see it go sideways and then take out the 555 area.

Google is holding in there really well and looks like it wants to go higher. Hardly sold off at all today which is a really good sign. I think it looks like a really good bull flag and maybe after another day or two or the the $SPYs reach a bottom - we could then see another leg up.

Amazon needs time again. Formed a SHORT term sell signal today and now it needs to consolidate again before taking out the highs.

The banks ($XLF, $C, $BAC, $JPM, $GS, etc) all need some more time. They all had massive moves recently and it would be nice to see some consolidation or a pullback to bid into. Right now they formed a short term sell signal but that is alright. They will be buyable again.

The homebuilders are trying to stay in play. They sold off early but came back later in the day. I would be looking to buy them soon. I am giving them another day or two.

Facebook still looks like it is forming a bull flag (similar to Amazon) and maybe in another couple day we see another leg higher in FB.

If you would like to contact me for questions/comments please visit the contact page for details.

Below are my charts with notes/analysis --

WHITE or BLACK? Thanks.

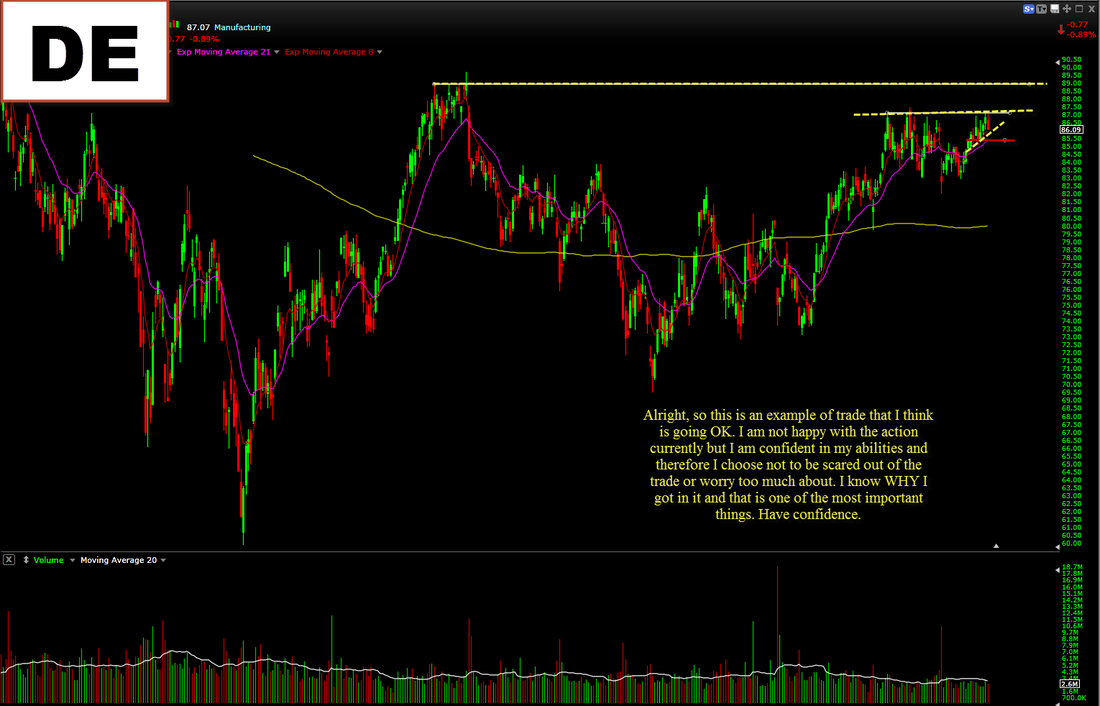

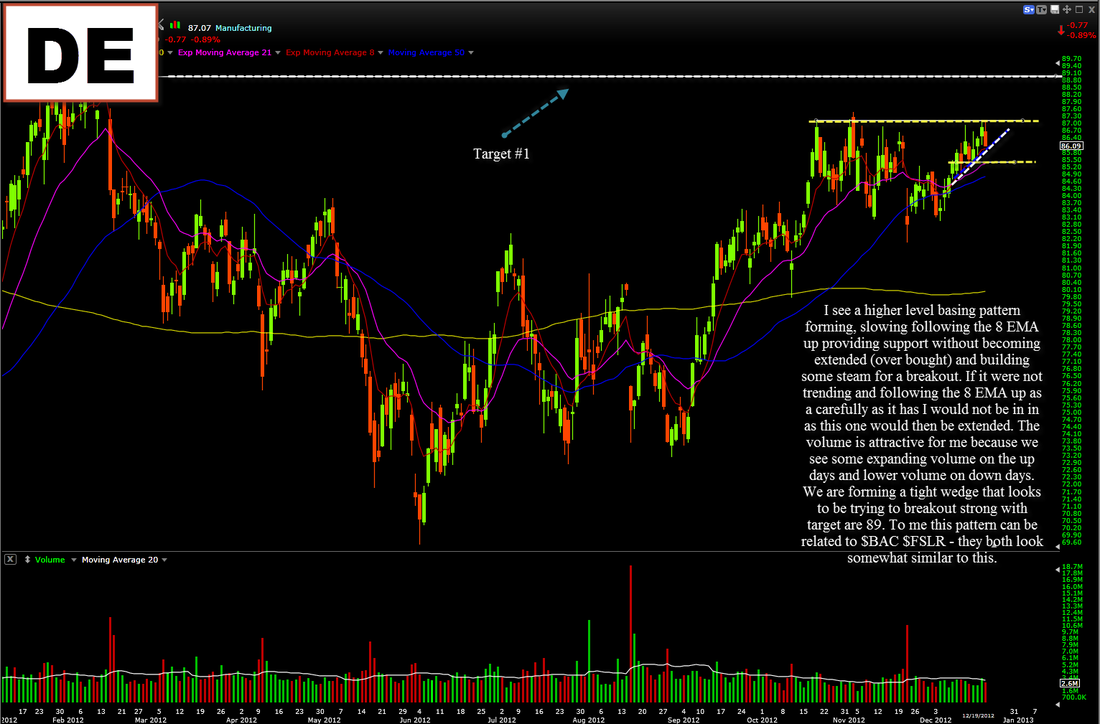

Reason behind the $DE trade -