--------------------------

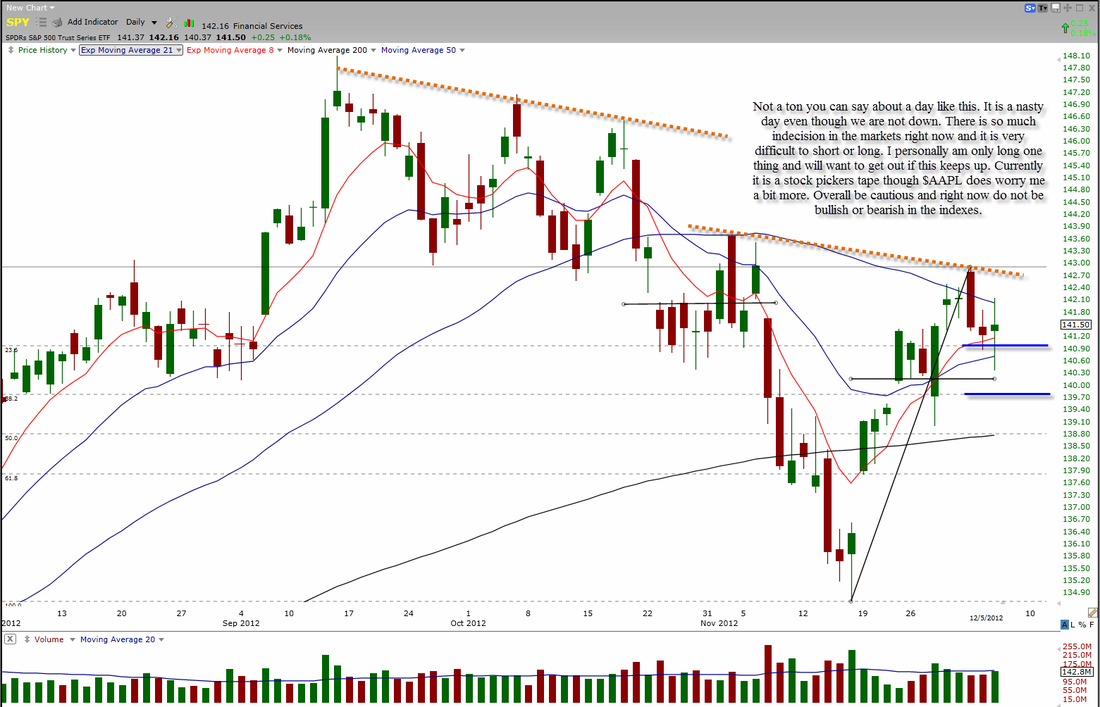

On to the Daily Analysis. Today we rallied and sold and rallied and sold. Today was a choppy day and did not provide much for swings, I do not plan on participating in this current market condition from a swing perspective, it is way to indecisive. We have formed two dojis in a row now and that tells me we really do not have much conviction to either side. I am glad we close green but then again, it does not mean much when you look at the scheme of things, we have two dojis and virtually UNCH compared to yesterday. We will most likely move on any significant news, good or bad and that will be a direction to trade with. I cannot say with great certainty at all which way we will go from here. With Apple selling off hard but the banks and the Dow doing well, I really do not have a clue (which is alright, you do not have to know everything, you can't).

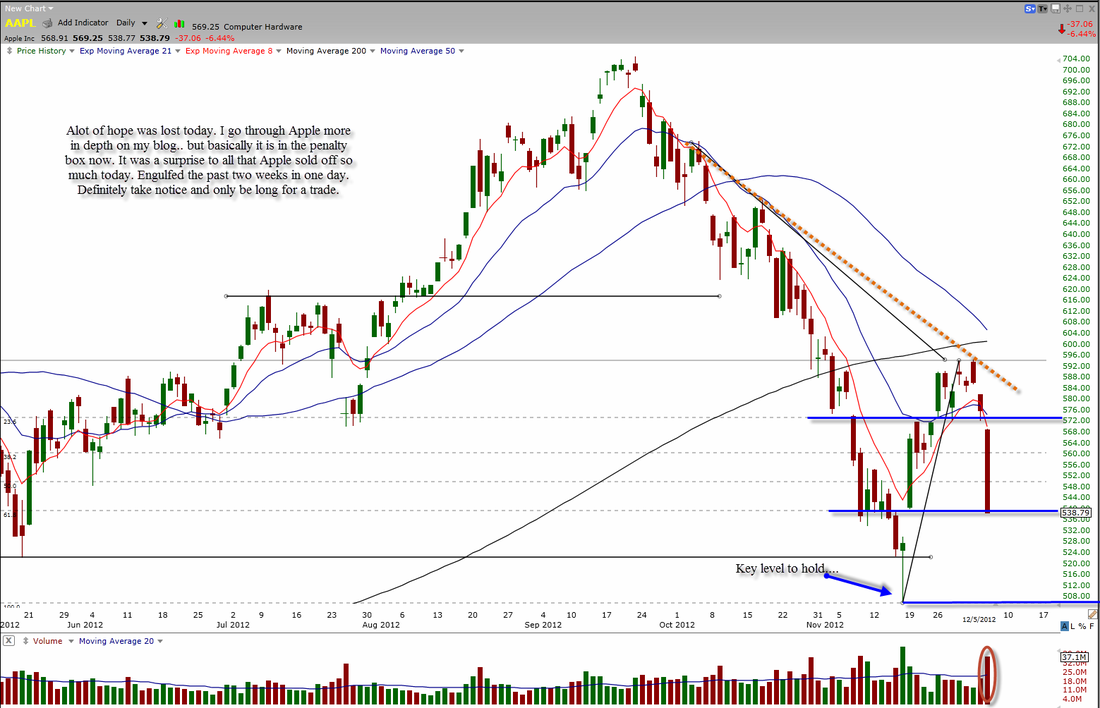

Now to Apple, everyone's favorite? Well I doubt so after today. What a disgusting day. We sold off a ton and engulfed the past two weeks. I do not think anyone was expecting this much of a downside. We were weak yesterday and all last week but holding in there. Now we are not at all. Of course we could get a bounce here and there (and maybe a slight one tomorrow) but overall, until proven otherwise - this one is in the penalty box and should not traded long for a swing or investment. Personally a fall below the 500 level with a close there will more than likely send some investors off the "cliff". Do not play Apple, unless for a trade.

Google sold off a little again today, we do not want to see too much more of this going on in Google. We need to see a green day soon to confirm a still bullish sentiment. We have been selling on lighter volume which is good sign but still, selling is selling. We need a green day soon.

Amazon is holding tough. It is really amazing how this one is doing. I do not want to buy up here on Amazon because of the rest of tech land selling but it is still holding in there.

I feel the same way about Facebook as I do Amazon. Needs to consolidate more and prove itself longer in this tape than it would have if Apple hadn't done what it did. I am not a buyer. Up day with lighter volume.

Netflix sold off a little more than I thought it should today and is not resting at support. In a strong strong tape it could be a bounce buy but this tape is far from that. So me personally, I am not a buyer. Needs to prove itself by consolidating.

IBM today showed us it is still weak, but that is not a huge surprise. It has been weak for quite some time now. It would need to hold 185 at this point. I would not trade this long. Another tech that is weak....

The good news about today is that the more Apple sells off, the less an effect it has on the market. Which is a good thing at this point. Less is more in Apple right now, literally. I hope everyone had a nice day and I will see you all tomorrow. As always here is my contact info and Twitter/StockTwits handle (where I often post charts). Also, remember to check out the charts page on here, wink wink, nudge nudge ;).

Twitter - https://twitter.com/BenCBanks

StockTwits - http://stocktwits.com/BenCBanks

Email - [email protected]