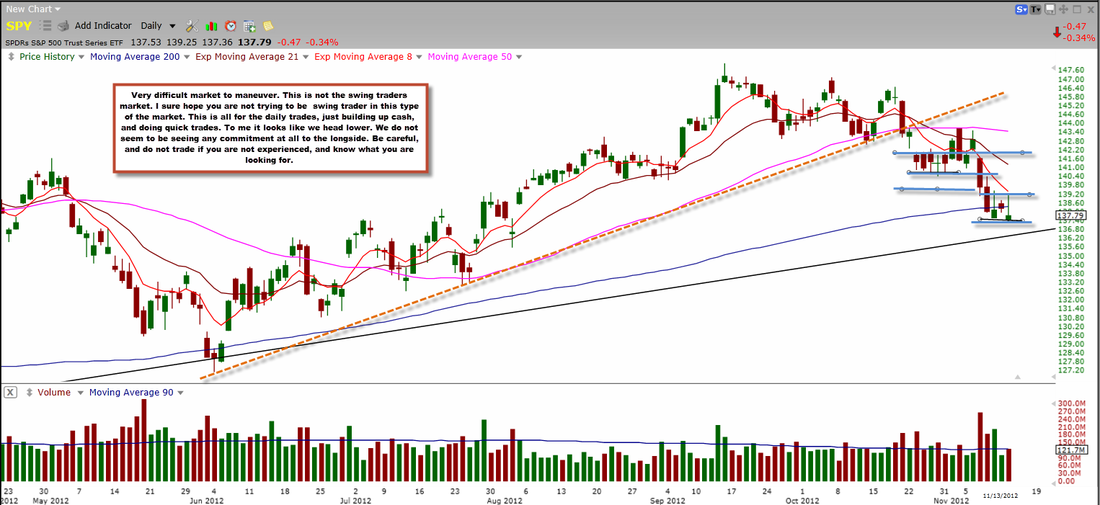

To say the least, today was ugly. We looked almost exactly like Friday. The shorts were squeezed, and longs punished. This is not a friendly environment at all. Swing traders should not be looking to initiate any positions This is not the time. The time will come. The only type of people who really should be trading right now are the day traders, or the people who really know what they are doing (the pros). As of right now I think we can head lower. There is no commitment to the longs right now at all. I still stand by my call of around 135 in the $SPY.

As for Apple, there really isn't anything else to say except that it is still weak, and anybody who is long this stock really should not be. It has proven to be weak, and I would recommend waiting til a more solid bottom to form before testing longs. 520 - 522 is a level to watch.

Google is also still weak like Apple is. It does look slightly better than Apple though, not near good enough to by into though. I think we can roll over and head towards the 638 level. This is not the time to test longs.Still weak.

The banks showed us more weakness today. I would be careful trying to pick a bottom. The 15.20 level ($XLF) is still the place I am watching. Do not buy this long without having a proper base, or a day trade.

The homebuilders did close below it's 50 SMA so that is not good, but it is also closed green for the day, showing relative strength. I do not think this is safe though. A leg lower in the homebuilders is likely.

Overall I think the market still needs to be given some time. This is not a pretty environment I am all cash, I will continue to be so until I see more clarity.

As for Apple, there really isn't anything else to say except that it is still weak, and anybody who is long this stock really should not be. It has proven to be weak, and I would recommend waiting til a more solid bottom to form before testing longs. 520 - 522 is a level to watch.

Google is also still weak like Apple is. It does look slightly better than Apple though, not near good enough to by into though. I think we can roll over and head towards the 638 level. This is not the time to test longs.Still weak.

The banks showed us more weakness today. I would be careful trying to pick a bottom. The 15.20 level ($XLF) is still the place I am watching. Do not buy this long without having a proper base, or a day trade.

The homebuilders did close below it's 50 SMA so that is not good, but it is also closed green for the day, showing relative strength. I do not think this is safe though. A leg lower in the homebuilders is likely.

Overall I think the market still needs to be given some time. This is not a pretty environment I am all cash, I will continue to be so until I see more clarity.