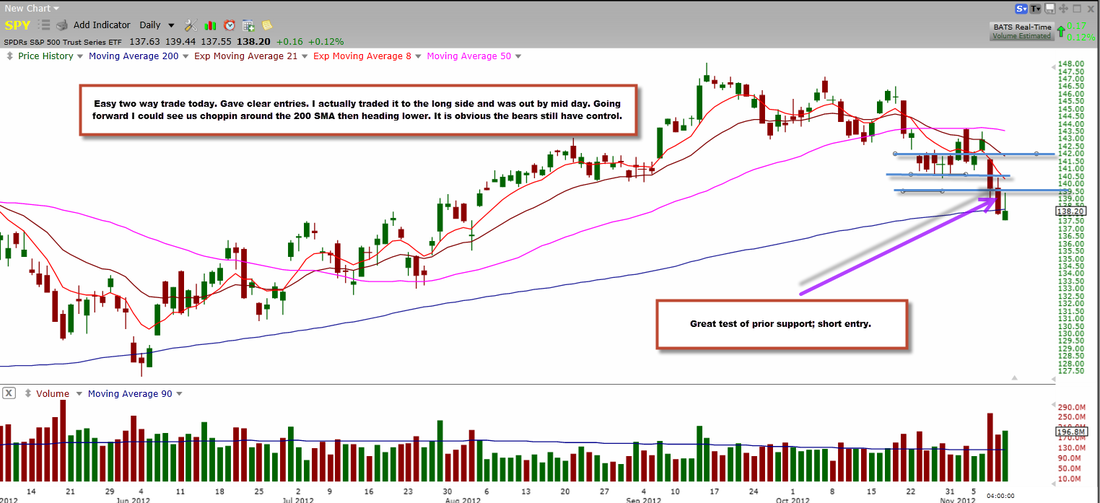

It was pretty obvious the bears are still in control after this weak bounce we received. It was expected and I traded it long and sold before noon. Going forward I would stay cash. This was an expected move. We are now in another unexpected area. If I had to say, I would guess we would dance around the 200 SMA for a while before deciding which way to go. The techs showed us some relative strength near the end of the day meaning we could see some chopiness here. I do not think this is a good area to go all in long. Still a weak market.

Apple! Apple had a very very slight outside day today on large volume but not trumping the previous day's. It also did not form a bullish candle. I would set a stop under today's lows and then wait and see. I do not think this is a buy now though. Too unpredictable still. I posted a chart earlier in the day (see below) that basically said it looks like we could be forming another short term base before ultimately reaching the target everyone is talking about -- $520 - $525.

Google! Same goes for Google as it did with Apple. It does look a bit better though. The support is much closer and today's volume is higher and all the other recent days. I would much rather be long Google than Apple, but neither is great. I will wait for more confirmation.

the banks continued to show us they are weak. Their candle is very similar to the markets. This is the time you need to start drawing in those next support lines. For example, $XLF support #1 - 15.20 Support #2 - 15.05. This helps you determine where you are willing to buy with the other approriate conditions.

Well that's it for today. I hope you were profitable. This is a shorter one just because it is Friday! Also, tweet me if you have got any questions! (@BenCBanks)

Apple! Apple had a very very slight outside day today on large volume but not trumping the previous day's. It also did not form a bullish candle. I would set a stop under today's lows and then wait and see. I do not think this is a buy now though. Too unpredictable still. I posted a chart earlier in the day (see below) that basically said it looks like we could be forming another short term base before ultimately reaching the target everyone is talking about -- $520 - $525.

Google! Same goes for Google as it did with Apple. It does look a bit better though. The support is much closer and today's volume is higher and all the other recent days. I would much rather be long Google than Apple, but neither is great. I will wait for more confirmation.

the banks continued to show us they are weak. Their candle is very similar to the markets. This is the time you need to start drawing in those next support lines. For example, $XLF support #1 - 15.20 Support #2 - 15.05. This helps you determine where you are willing to buy with the other approriate conditions.

Well that's it for today. I hope you were profitable. This is a shorter one just because it is Friday! Also, tweet me if you have got any questions! (@BenCBanks)