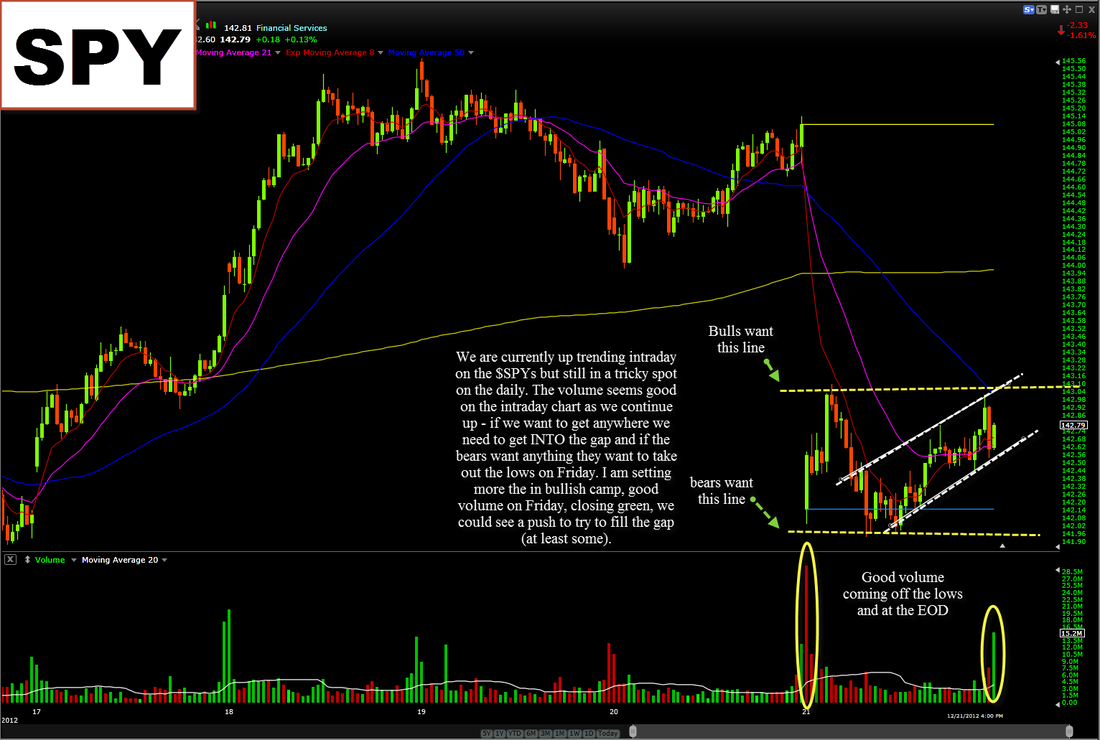

intraday price analysis, sitting more in the bullish camp.

First of all, Merry Christmas (or Happy Holidays)! I wish you all a good time on your days off and hope you use this time to take a different perspective on your trading and try to regroup some. Analyze a few of your trades and determine how you did on them and what you could have done better. And, of course, spend some time with your family.

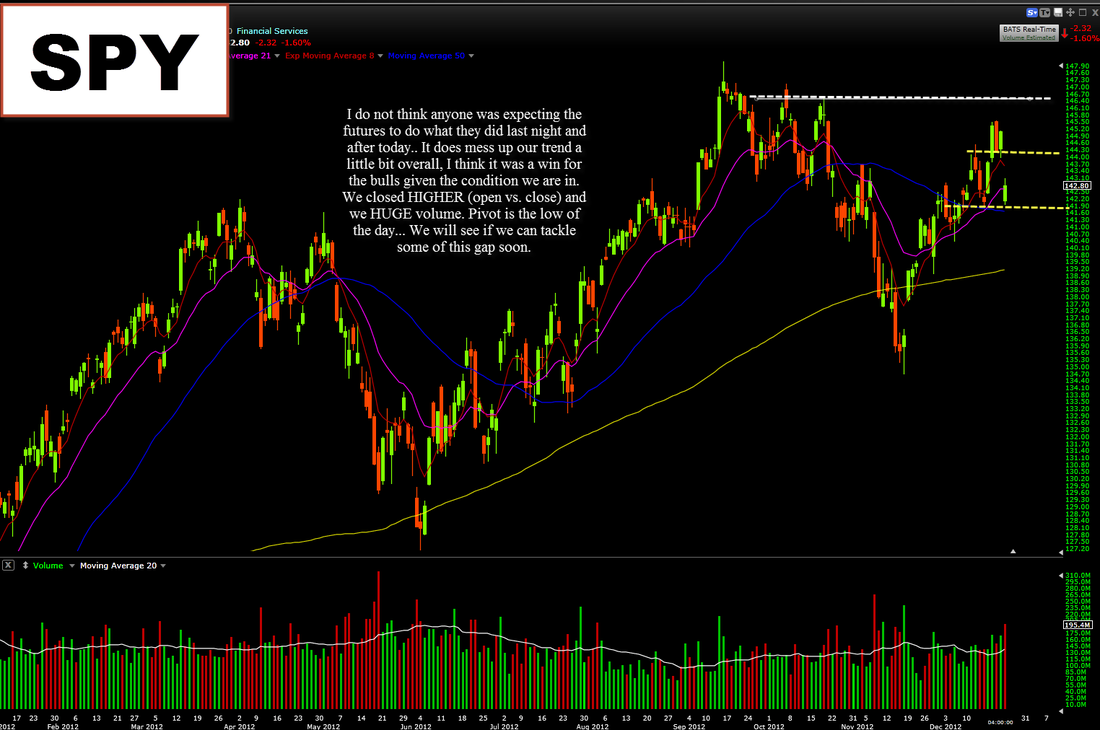

The market last night fell a ton over the failed "Plan B" bill and we open significantly lower than we had closed. This was a huge problem for most traders and I am sure it was very nerve racking too. Personally I did not have a clue what this was going to lead to and therefore I posted a blog this morning going over three different scenarios that could play out. After witnessing the close today I feel confident in saying that it was the first scenario that I listed was/is true. Another scenario I listed talked about the gap down sell off theory, this would have been detrimental for the bull in my opinion. I feel like this is just creating a buying opportunity for the bulls to get some reasonable prices after the prices being so extended. Time will tell though. Going into next week I think we can see a little upside to try to feel the gap with light volume (similar to Thanksgiving week) or we could just see continued sideways action. Though, as hard as this is to gut - there is still the concern and fear of the silly politicians opening their mouths this weekend and into next week that could sway the prices significantly like we saw today. I do believe that we are CLOSER to a deal and that they will likely come up with one but it will be more of a last minute thing (as always) but then again, what do I know? I am just a technician and the only thing I am basing that one is hearsay and theories - all could change come Monday.

The fact that we closed off the lows and trader higher (open vs. close) and we trader higher with massive volume tells me there are still buyer stepping in and buying the dip and thus us closing off the lows like we did - is a win for the bulls in my eyes.

--------

$AAPL - Onto Apple now. I do wonder when I will have to stop covering this stock every day, when will it not be the favorite anymore? When will the dynamics and the biology of this stock change so much that it is purely a trading vehicle in specific time periods (like $CSCO and $MSFT)? The answer to these questions.. I have no way of knowing. I will say it is still in a bearish pattern from a more macro/long term point of view. The bears have managed to push it all the way down to the 500ish level, from 700 with out much of a bounce. The trading and the price has become more and more choppy and less and less like a trend, this concerns me. I generally only focus on the stocks that are trending, one way or another and currently Apple is in a down trend but it so choppy and testy that i consider it more trendless. Currently there are a few signs of life from a more micro point of view (day to day) that I would like to highlight.

Saying these TINY positive things is not much though. It still has a lot to prove and these small things are not enough for me to want to buy it right now. Time will tell and I will be patient with Apple. Forget about the name Apple, trade the price.

$GOOG - I still think Google is pretty strong and should be watched but currently I do not think I see a trade in it. It has been a little choppy with a lot of doji closes. I would stay long if you are a long but I will wait for a more clear signal before I want to buy in.

$AMZN - Decent channel action today after gapping down to the 8 EMA. It is at some support but then again, it is similar to Google -- there is not a real clear buyable trade here. It did have some selling volume today and it closed red (unlike Apple) which is not a great sign if you are looking to buy. Therefore, I would say give it some time and wait for a more potent reversal day or a more actionable signal.

The banks held up really well today and should definitely still be watched. Most of them filled the entire gap down and then traded even higher. There could still be some sideways action in the future because of how extended they still are but for the most part, if you are in the banks.. you should feel very comfortable and be very happy. Keep with it and for people that want in on the banks, you could buy now verse the low of the day or wait for a couple more days of basing as a lot of them are still extended to the upside.

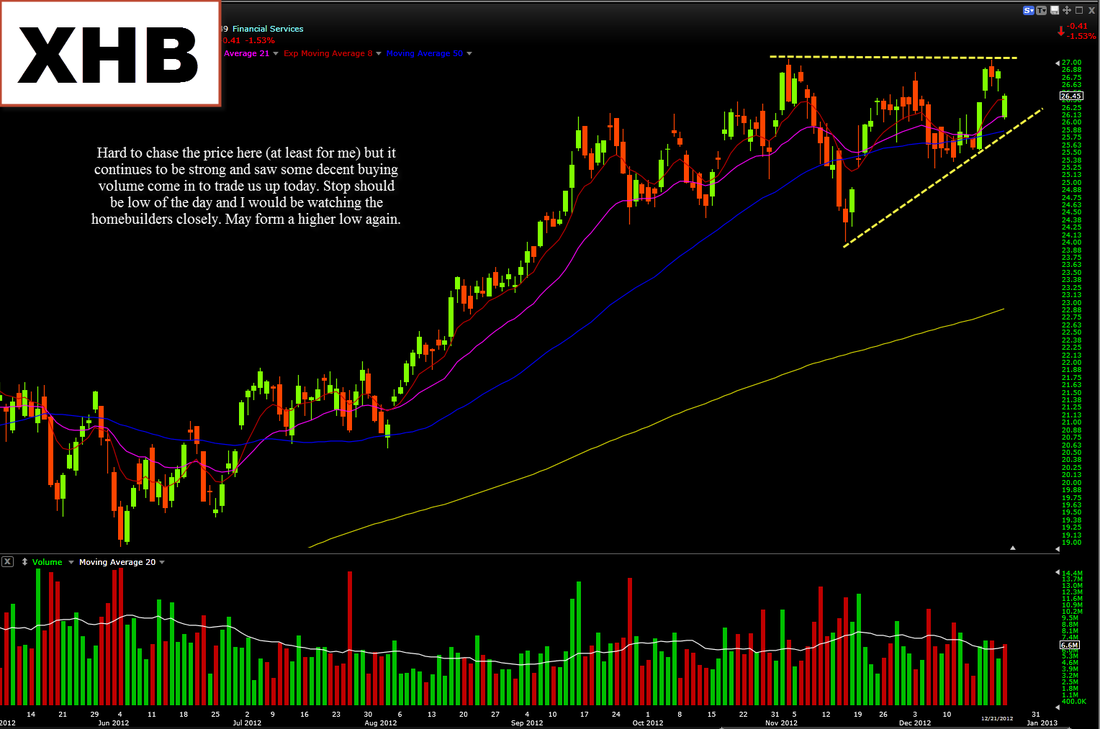

The hombuilders are still seeing some strength and buying and I like to see money going back into them. $KBH is the weakest out of the group and should be avoided. $PHM and $XHB look good though and the stop should be at the low of day (Friday) if you own it or want to own it. They saw some nice volume today and will likely continue higher. It is however difficult to chase price in $XHB, be careful.

Those are the main names and thinks you should be watching, I am currently long $DE and $MON. Both look pretty good breakout candidates and both showed relative strength today.

Have a nice holiday and be sure to check back here for charts/analysis over the weekend.

If you would like to contact me for questions/comment please visit the Contact page for details.

Click to enlarge the images --

The market last night fell a ton over the failed "Plan B" bill and we open significantly lower than we had closed. This was a huge problem for most traders and I am sure it was very nerve racking too. Personally I did not have a clue what this was going to lead to and therefore I posted a blog this morning going over three different scenarios that could play out. After witnessing the close today I feel confident in saying that it was the first scenario that I listed was/is true. Another scenario I listed talked about the gap down sell off theory, this would have been detrimental for the bull in my opinion. I feel like this is just creating a buying opportunity for the bulls to get some reasonable prices after the prices being so extended. Time will tell though. Going into next week I think we can see a little upside to try to feel the gap with light volume (similar to Thanksgiving week) or we could just see continued sideways action. Though, as hard as this is to gut - there is still the concern and fear of the silly politicians opening their mouths this weekend and into next week that could sway the prices significantly like we saw today. I do believe that we are CLOSER to a deal and that they will likely come up with one but it will be more of a last minute thing (as always) but then again, what do I know? I am just a technician and the only thing I am basing that one is hearsay and theories - all could change come Monday.

The fact that we closed off the lows and trader higher (open vs. close) and we trader higher with massive volume tells me there are still buyer stepping in and buying the dip and thus us closing off the lows like we did - is a win for the bulls in my eyes.

--------

$AAPL - Onto Apple now. I do wonder when I will have to stop covering this stock every day, when will it not be the favorite anymore? When will the dynamics and the biology of this stock change so much that it is purely a trading vehicle in specific time periods (like $CSCO and $MSFT)? The answer to these questions.. I have no way of knowing. I will say it is still in a bearish pattern from a more macro/long term point of view. The bears have managed to push it all the way down to the 500ish level, from 700 with out much of a bounce. The trading and the price has become more and more choppy and less and less like a trend, this concerns me. I generally only focus on the stocks that are trending, one way or another and currently Apple is in a down trend but it so choppy and testy that i consider it more trendless. Currently there are a few signs of life from a more micro point of view (day to day) that I would like to highlight.

- Closed at the highs

- Traded with expanding volume today (compared to the prior two days)

- Formed a higher low today

- Somewhat LED the market today

Saying these TINY positive things is not much though. It still has a lot to prove and these small things are not enough for me to want to buy it right now. Time will tell and I will be patient with Apple. Forget about the name Apple, trade the price.

$GOOG - I still think Google is pretty strong and should be watched but currently I do not think I see a trade in it. It has been a little choppy with a lot of doji closes. I would stay long if you are a long but I will wait for a more clear signal before I want to buy in.

$AMZN - Decent channel action today after gapping down to the 8 EMA. It is at some support but then again, it is similar to Google -- there is not a real clear buyable trade here. It did have some selling volume today and it closed red (unlike Apple) which is not a great sign if you are looking to buy. Therefore, I would say give it some time and wait for a more potent reversal day or a more actionable signal.

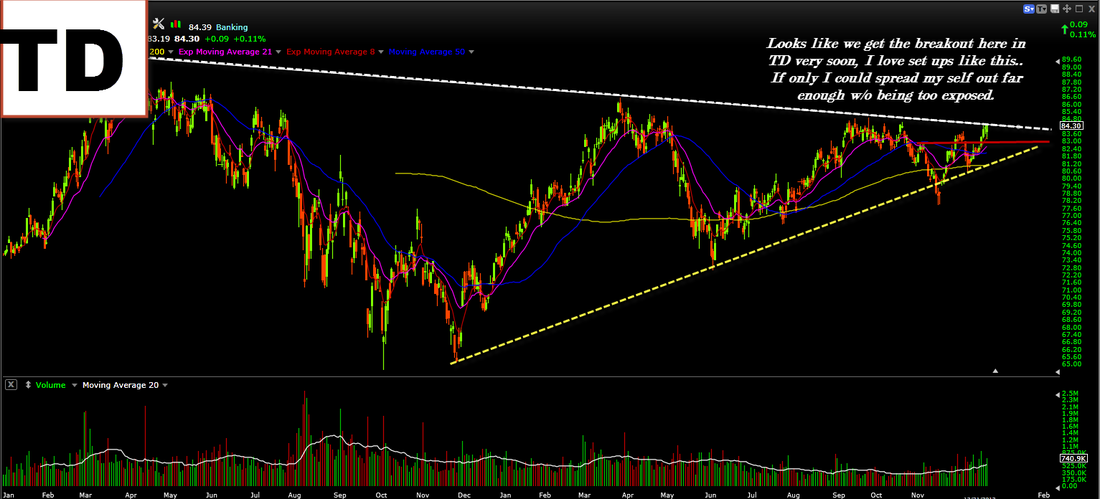

The banks held up really well today and should definitely still be watched. Most of them filled the entire gap down and then traded even higher. There could still be some sideways action in the future because of how extended they still are but for the most part, if you are in the banks.. you should feel very comfortable and be very happy. Keep with it and for people that want in on the banks, you could buy now verse the low of the day or wait for a couple more days of basing as a lot of them are still extended to the upside.

The hombuilders are still seeing some strength and buying and I like to see money going back into them. $KBH is the weakest out of the group and should be avoided. $PHM and $XHB look good though and the stop should be at the low of day (Friday) if you own it or want to own it. They saw some nice volume today and will likely continue higher. It is however difficult to chase price in $XHB, be careful.

Those are the main names and thinks you should be watching, I am currently long $DE and $MON. Both look pretty good breakout candidates and both showed relative strength today.

Have a nice holiday and be sure to check back here for charts/analysis over the weekend.

If you would like to contact me for questions/comment please visit the Contact page for details.

Click to enlarge the images --