First off, Happy Halloween to anyone who is "celebrating" that tonight.

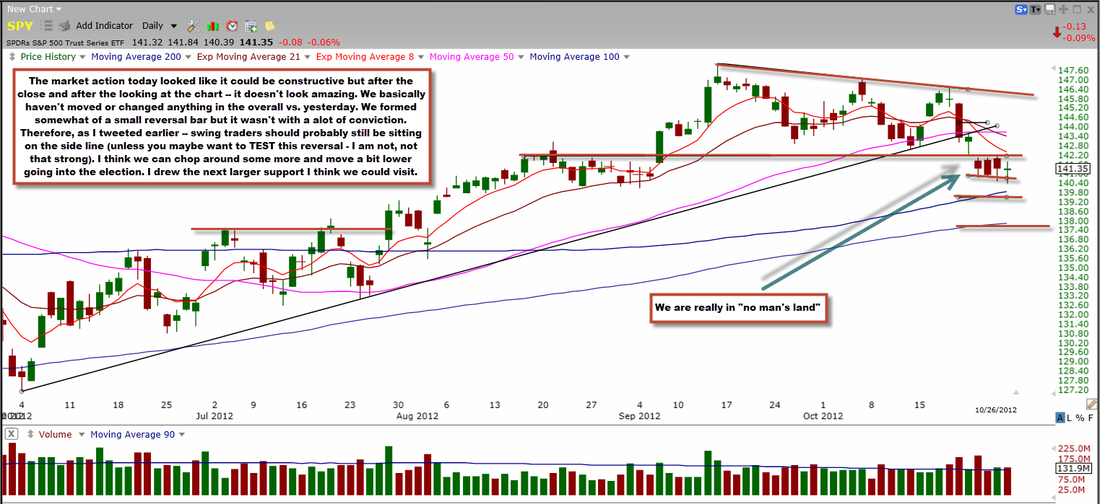

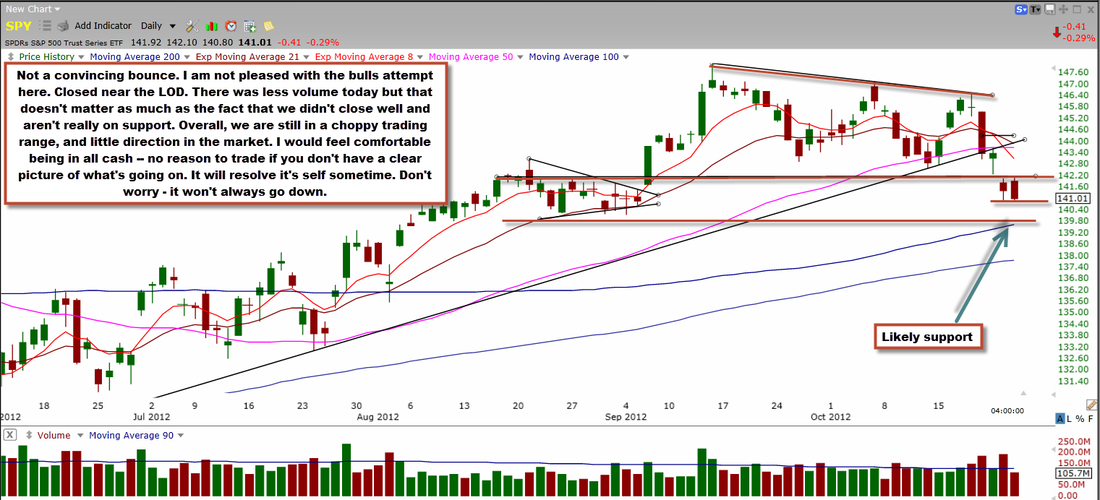

The market today continued to do what we have seen for the past 4 days (today being the 5th). We have been trading in a tight right for a quite a while. We have yet to see much conviction either way though. The battle going on between the bulls and the bears is fierce. Both bulls and bears are trying to prove themselves. Personally, I think we are going to be in the range till the election. Maybe not, but if we do not stay in this channel until then then we could see a more drastic price movement before or right after the election (depending on who is elected, and what the market would like to see). One notable occurrence is that we have "wicked" off the lows the past three days, and closed in the top half of this channel. This is the case for bulls. For the bears... They would argue that since we have closed some many times in the lower range of the overall move that we should continue lower. So, in summary - The price movement is not giving us much clarity and we need to wait for more confirmation. Swing traders should probably stay on the sidelines until this channel is resolved.

As for the banks. They showed a little more weakness today, therefore did not warrant (for me) as swing long or a buy at all. Compared to the overall market however, the banks are still holding up well and as long as they continue to do so, we will still continue to have a chance to go higher.

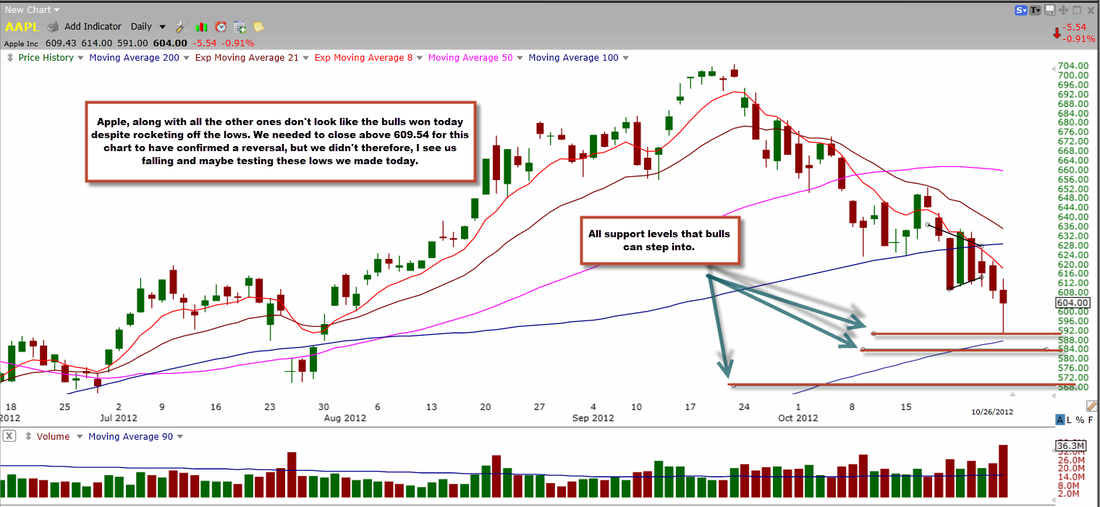

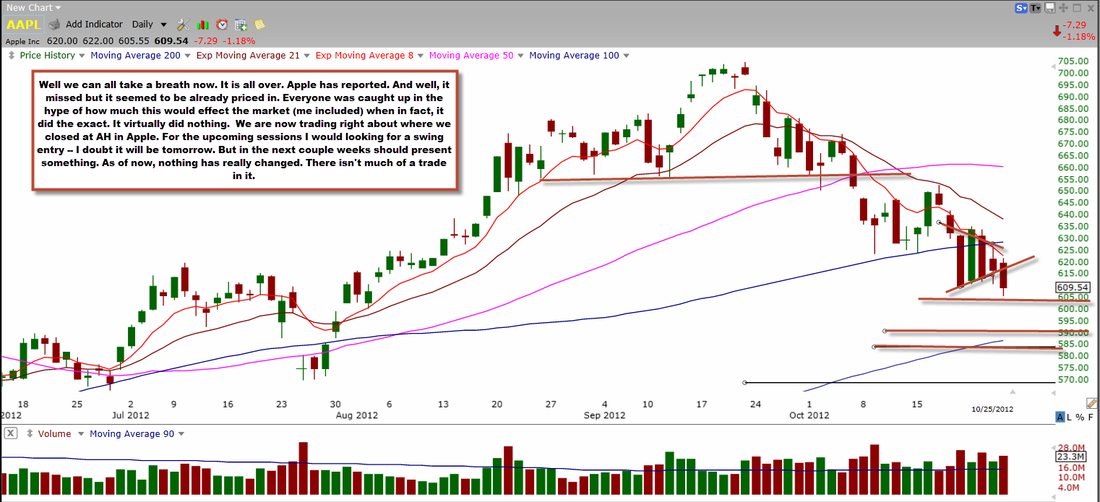

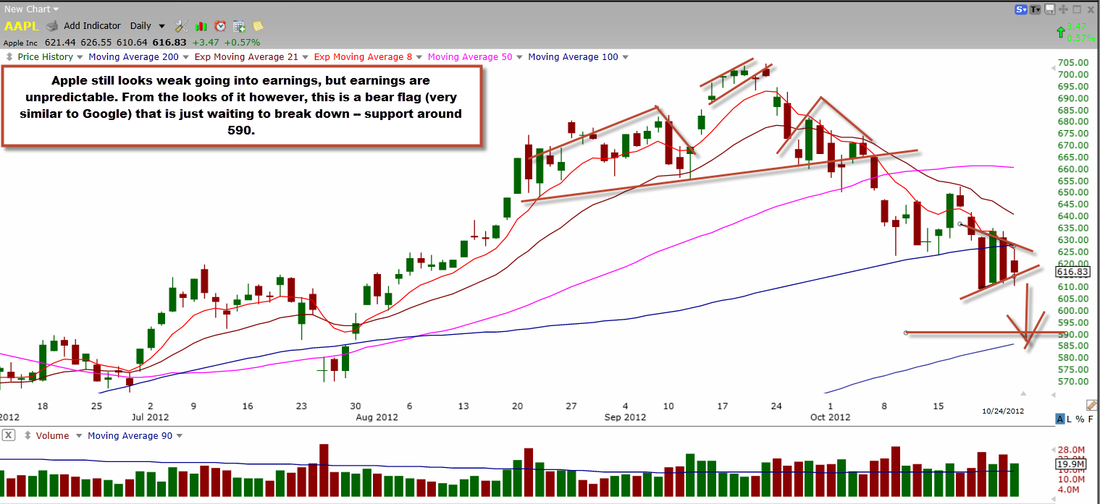

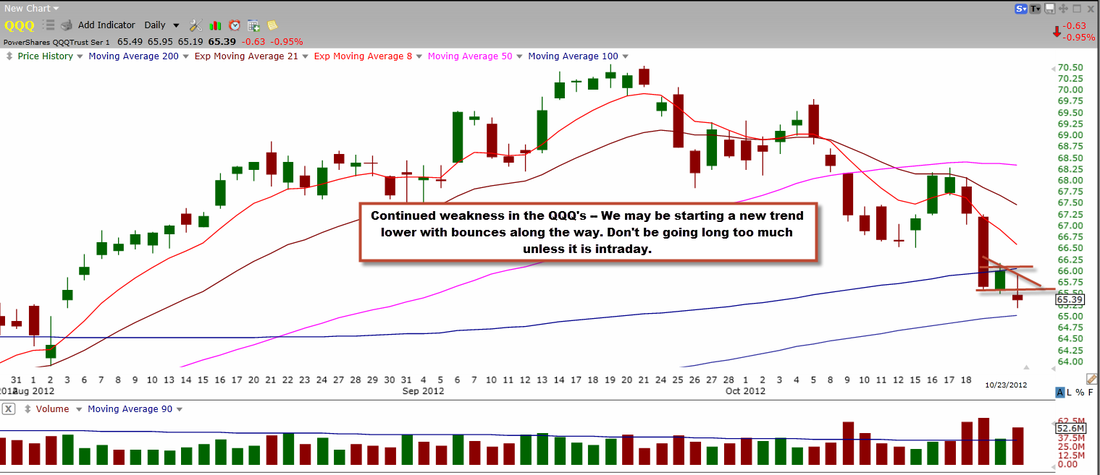

The tech sector has showed more weakness but did close with an inside day today ($qqq). I would expect some more consolidation (as we expect in the overall market) before deciding which way we are more likely to go. Google showed some strength today, and is maybe trying form a descending channel.

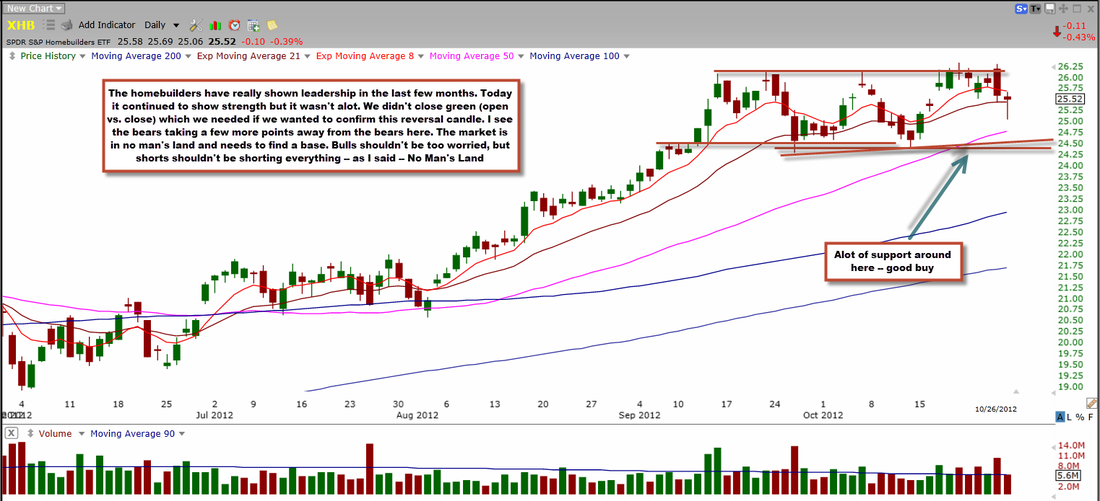

IF the banks, homebuilders, and the techs all start to show some more strength then we head higher. I will be waiting to see if this happens. Until this happens I think we could continue to chop, and whipsaw a little.

Check my Twitter (@BenCBanks) for more charts for today. They will be posted later on.

The market today continued to do what we have seen for the past 4 days (today being the 5th). We have been trading in a tight right for a quite a while. We have yet to see much conviction either way though. The battle going on between the bulls and the bears is fierce. Both bulls and bears are trying to prove themselves. Personally, I think we are going to be in the range till the election. Maybe not, but if we do not stay in this channel until then then we could see a more drastic price movement before or right after the election (depending on who is elected, and what the market would like to see). One notable occurrence is that we have "wicked" off the lows the past three days, and closed in the top half of this channel. This is the case for bulls. For the bears... They would argue that since we have closed some many times in the lower range of the overall move that we should continue lower. So, in summary - The price movement is not giving us much clarity and we need to wait for more confirmation. Swing traders should probably stay on the sidelines until this channel is resolved.

As for the banks. They showed a little more weakness today, therefore did not warrant (for me) as swing long or a buy at all. Compared to the overall market however, the banks are still holding up well and as long as they continue to do so, we will still continue to have a chance to go higher.

The tech sector has showed more weakness but did close with an inside day today ($qqq). I would expect some more consolidation (as we expect in the overall market) before deciding which way we are more likely to go. Google showed some strength today, and is maybe trying form a descending channel.

IF the banks, homebuilders, and the techs all start to show some more strength then we head higher. I will be waiting to see if this happens. Until this happens I think we could continue to chop, and whipsaw a little.

Check my Twitter (@BenCBanks) for more charts for today. They will be posted later on.