This will be the final post on this website. As of 1/22/13 Ben C Banks is now posting on www.BenCBanks.comYou are always welcome to come back to this website to review any of my past posts/analysis but any posts in the future will be posted on the new site. www.BenCBanks.com

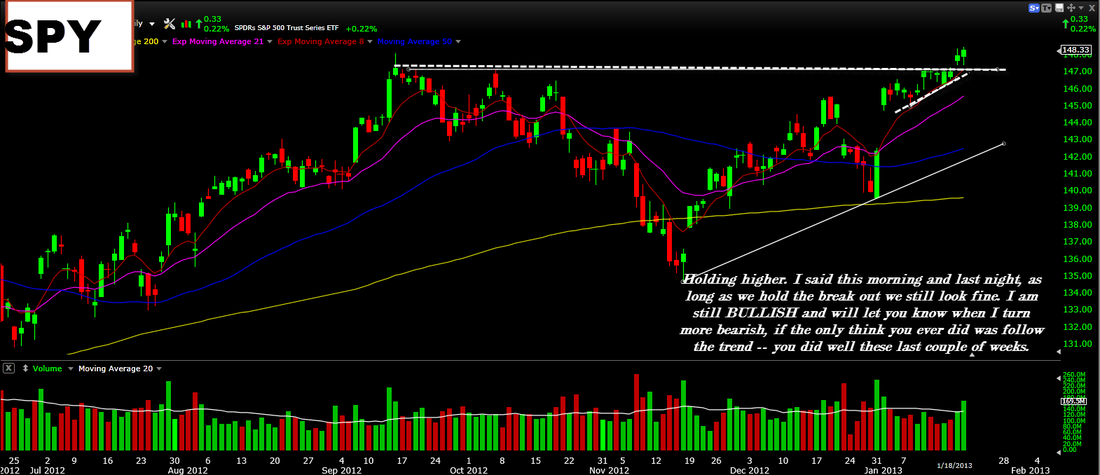

Well here I sit in VERY cold NYC. It has been a pretty fun day, and now it is really late but I said I would do the daily analysis... so I'm doing it. The market held the break out zone I talked about this morning and last night. This is a good thing and as long as we hold above that level it is safe to assume we continue higher. Basically all we are doing is stair stepping higher, which is the best way to do it. I remain bullish, and I will let you know when I become bearish. Keep in mind that when I become bearish it will be because of the charts telling me so (a reversal, engulfing, etc), I do not base my market sentiment on anything other than charts. That being said it is key for you to use stop losses right now. I am NOT bearish right now but that could very well change if something wild happens on Tuesday. Because of this unforeseen risk you need to have the stops placed and not solely really on the bullish-ness of the market.

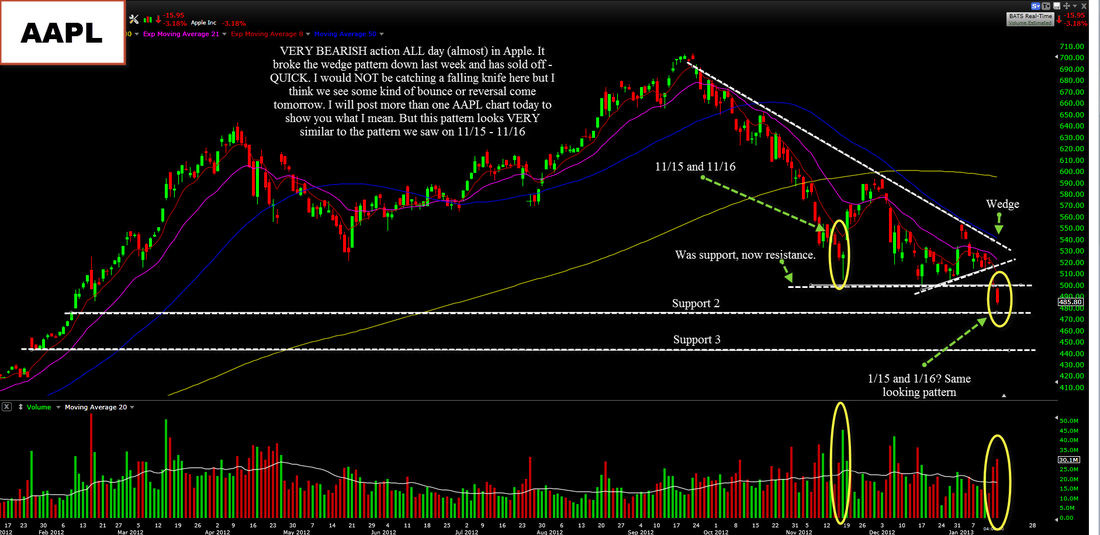

Apple.. NOTHING has changed. I am still bearish on Apple. The post a couple days ago I said "this could be a time for posistion traders to buy Apple" - This very well may still turn out to be true but right now it is VERY faulty from the short term point of view. Maybe in the next couple of years it can really get going and go back to being the old Apple we know but currently... it is bearish.

Google still needs time. It hit around my $700 level today but it did not reverse or show anything compelling to want to buy this stock - yet. Earnings soon.

Amazon still looks pretty good at all time highs. I would not buy it here as the earnings are coming up and it wicked down today but overall, the pattern looks bullish from a long term perspective.

That is it for now. I will post some more charts over the weekend.

If you would like to contact me, please visit the

Alright this daily analysis has been an interesting one. If you follow me on Twitter (@BenCBanks) then you know my power has been out since around 4:45 PM EST and therefore I have not had the ability do the daily. But, now we have the generator on to get some power to pack for NYC tomorrow! Anyways, let's get into it -

SPYs and the market broke out today which is a good thing. I think that this is obviously bullish. We consolidated for a few days and I have said, follow the trend UP and I will tell you when I become bearish. This has not happened yet, I continue to monitor the situation though. I do think we see a pullback sometime in the near future but I think it is silly to short an uptrend without a proper calculated entry. I have known people that keep on adding to their losing positions until they are right (which they may not ever be) and before they know it they are all in on a counter trend move that they should have not been taking in the first place. I have been guilty of this too, don't worry - I am not the the perfect human.

Apple is nothing new at all - the gap was sold and some probably took it home short, there was no problem with that. Right now I would continue to monitor Apple and right now it does not look too bullish.

Google NEEDS time. I like it a lot more closer to 700 with a proper signal there. Earnings are coming up, keep that in mind.

Amazon still is holding in there. Looks pretty good. I do not think it is long though right now. Especially with earnings coming up.

I said USO wanted higher, and It did, nice trade if you took it. I did not. I think it needs more time now. It gapped up and faded down...

INTC also wanted higher. It was a nice trade but now we need to see how the earnings play out in it.

GLD nice engulfing pattern today, stops need to be at the low of the day for swings. Looks pretty good for higher prices though not the A++ trade.

TBT/TLT - if TBT hold this gap up tomorrow - I think it is a safe long. TLT is stil VERY weak, major support coming soon.

That's it for now. I will be in NYC this time tomorrow. Let me know if you will be in the financial distract any time from 1-4 tomorrow.

Visit the contact page if you have any questions/comments -

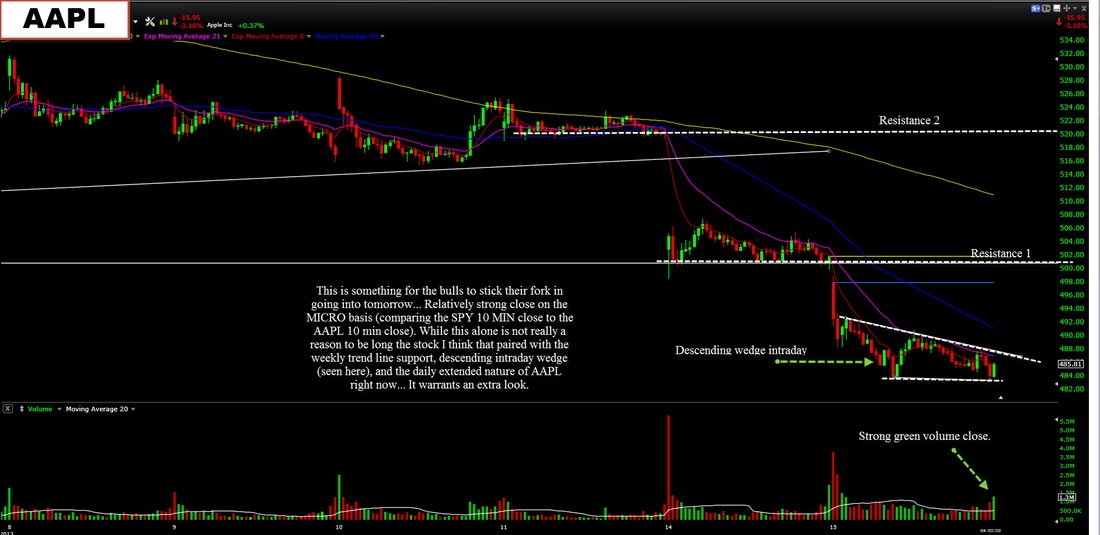

This is the first time in a long time I am wee bit bullish on Apple and let me explain why…

1. We sold off A LOT in the past couple of days and are now getting a tad extended

2. We are at support on the weekly/daily as well as a VERY long term support trendline

3. The intraday chart on the micro basis (last 10 min) closed pretty bullish with some volume coming in.

4. We look awfully similar to 11/15 (would like today) and 11/16 (would be MAYBE like tomorrow)

Time will tell but right now I think the R:R is in the favor of the bulls on Apple right, especially since the earnings are coming up… This could send the stock flying back up. This is purely based on the recent couple month action… The expectations are not high now and beat could mean some want to “BUY” the news instead of what we saw in $LEN And $FB today.

Trade accordingly. Take a look at the charts below (click to enlarge), there are many notes on them.

Alright well the website is still a work in process. Maybe by the end of the week it will be up! I can't wait!

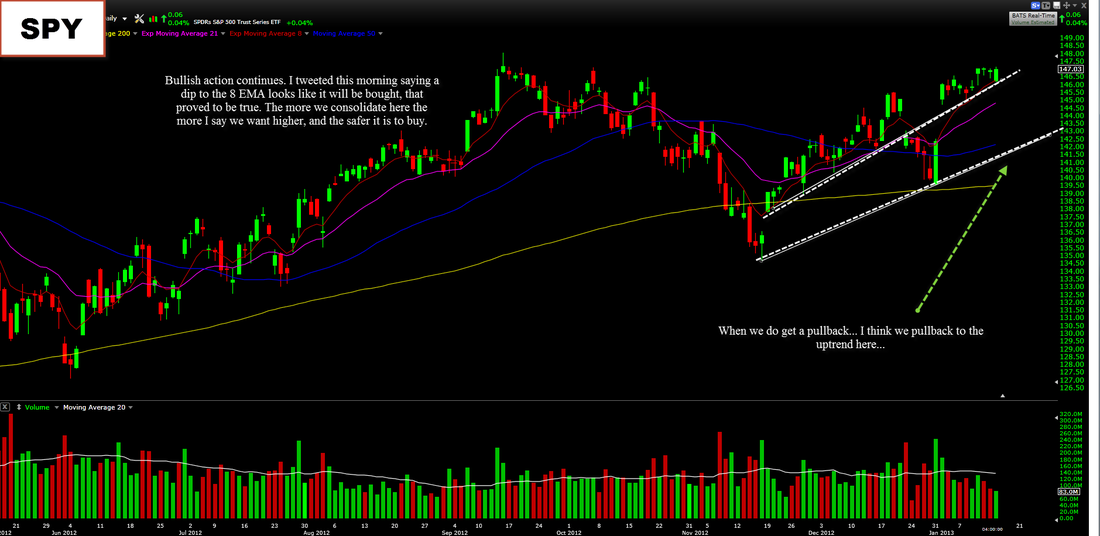

Anyways, the market today held up very well. As I had tweeted early this morning and probably on the daily analysis yesterday.. I thought the 8 EMA would be bought and we could go higher from there. That is exactly what happened. Going forward I still remain cautiously bullish - we look good technically but to truly ensure higher prices we need to consolidate a couple more days. If we have another leg higher right now it could easily considered extended, and unbuyable - bulls do not want this. As long we continue this trend of holding higher and staying above the 8 EMA the more I think we can go higher. I am in the camp though that we could see another push higher and then a sell off to the trend line (see chart).

I plan on doing a full post on Apple with MANY charts but I do think that the position traders may want to consider buying some back now. It is on a long term support level/trend line and could see at least a bounce. Will post more on a individual post. Stay tuned. All the charts will be on this post too.

Google had a wild day but closed more in the bullish camp. I still think google is in for higher prices though I would wait for the pattern to develop a little more first.

Amazon is hanging tough, not a conviction buy right now for me though. I still think we can go higher but would like a more bullish candles to take place and better set up - keep it on the watchlist.

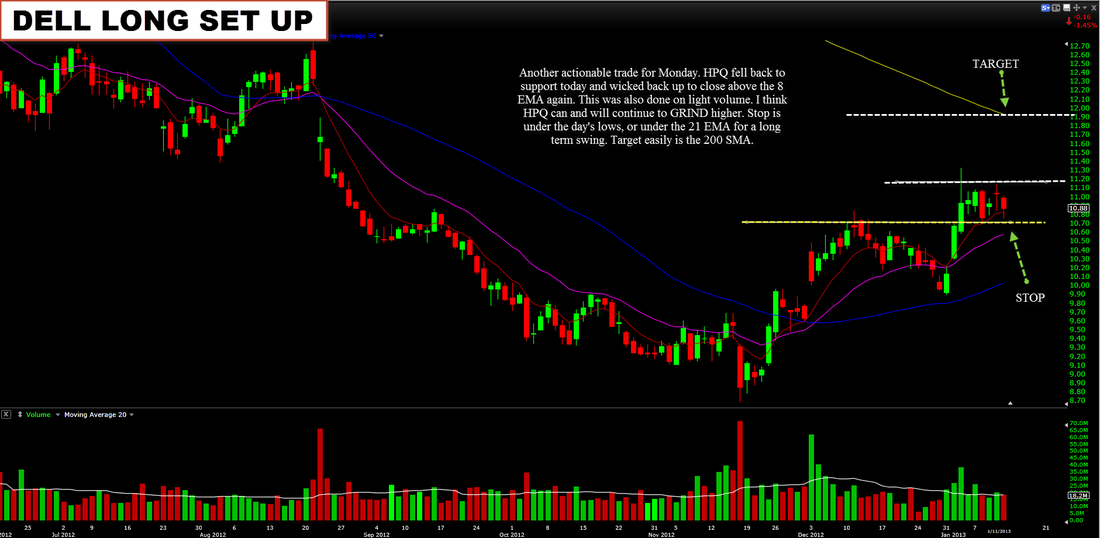

Dell continued today after I mentioned it this past weekend that it looked good. Now I think that it needs time but I still think that 14.60 is a reasonable target.

$GG did well today after I mentioned it this past weekend. I would not look to buy now because it did not have any real volume behind the move but if you took the trade - congrats.

New website up soon. Overall the market is holding in there. Will be on the look out for a sell signal but still looks like it wants higher.. At least for the short term.

Before we really get started I would like to inform all of my readers about something VERY exciting.... I am getting a REAL website with a REAL URL. I have been working on it all weekend, and it is ALOT of work but I think I have almost completed it. It should be live here in a couple days, I will be sure to let you know. When that day comes, this site will know longer be in use.

------------------------

the market is holding steady which is a VERY good thing (for bulls). I think we still look and feel like we are going higher and quite frankly the more people load on the shorts right now without any definite top... the stronger the squeeze will be. I will let you know when I turn bearish on the market and feel like we are faulty but so far all we a are doing is consolidating at highs. Keep it light though, you do not ant to chase right now.. A couple more days of sideways action and you could see another leg higher.

Apple is so weak right now. I would not want to be long this stock whats so ever. It still has the head and shoulders pattern (visible on the weekly), and on the daily it still looks extremely weak. We close with a doji today so maybe we try to fill the gap (some) tomorrow but overall.. I do not see a strong trade here. I would also be careful being short because of doji close with volume, and the extendedness, and the earnings coming up.

Google became a little more faulty today as it sold off and broke the 8 EMA on volume. I would have been stopped out if I owned it. It sill has the 21 EMA that it can bounce off of so that is good and then trendline support around 717. Uptrend is still intact though it did close on the lows so I would be careful.

Amazon is the strongest out of the high beta land.. I mentioned multiple times last week that I liked Amazon for higher price and right now it is sitting at all time highs...PRICE PAYS. I would wait for another entry now but overall, it still looks good and looks like it wants to grind higher.

Dell had a wild day today.. I mentioned I liked it long this afternoon before the massive rally started. This is a good example of how you do not have to know what was going on behind the scenes to still participate, the chart tells the story.

Have a nice evening, I can't wait for the new website!

If you would like to contact me please visit the contact page.

Well to say the least, it has been a rough two weeks for trading for me. Lost a good bit, some of y'all may even have some of my money (haha). Anyways, I am writing this to help me more than to help you, sorry. I need to be able to look back and review what I did wrong in these two weeks and be able to specifically point out how to do better. So let's get started.

Bought - $LEN 39.98 (1/3/13) Sold 40.98 (1/7/13)

Very good trade. This was my ONLY good trade of the past two weeks and for good reason. I did well. Basically what I saw was a solid basing formation with break out of the base then consolidation that look like it wanted higher. It did, and it did go higher. Where I went wrong here though, there is almost always something, I did not let the swing "swing". I sold it too soon (again). However, I did sell it for good reason. At the time I bought it I did not look at the weekly chart (my mistake), and on the weekly chart it was obvious there was significant resistance upcoming. I knew this so I got out ASAP with some OK profits.

Bought - $DE 88.69 (1/7/13) Sold - 87.59 (1/8/13) -

YUCK! Here is where it gets ugly for me. I bought $DE for the second time in the past month because I really like the chart and I think it is going higher. The first time it look like it wanted higher, and it fell dramatically before I got out with minimal profit (I was scared out, to be honest). The second time, more recently I bought it because it was consolidating nicely and it looked like it wanted higher, it did... But I was out before it did go higher (happens a lot to me). My reasoning was that it was hovering right at resistance closed relatively strong for the day. What I did NOT consider (which I should have), was the fact that it was extended, and at resistance (I was anticipating the breakout). Therefore, since it was extended I should have realized that and paired that with the fact that it was at resistance and NOT taken the trade and waiting for it to pullback... Which it did the next day, and I was stopped out. I had obviously had my stop WAY too close for the move I was anticipating. Recently it has formed a topping tail and look like it wants to come in some, back to the breakout zone - so it can be back on y'alls radar (this was typed on 1/11/13.

Bought - $FAZ 13.47 (1/7/13) Sold - 13.57 (1/8/13) -

This trade had the potential to be a good trade but I had some careless physiological errors that inhibited that from happening. If you remember the last trade, the $DE one... Well, basically I thought that I needed to "cover my losses" from the past trade (the $DE one) in this trade so I would break even. This was purely a case of greed. I knew I should have sold when I had the chance, I even tweeted it. But.. I chose not too, and I basically broke even. Going forward, I need to be able to disconnect trades and look at each one of them the same, that would have saved me a lot more money this time around. Also, shorting the market leaders is also a tricky idea I learned this week -- Unless you have a VERY potent signal, I would not recommend it -- That is why rule now.

Bought - $SDS 51.64 (1/9/13) Sold - 50.86 (1/10/13) -

Obviously you always know what in hindsight what was wrong with a trade and it stick out like a sore thumb to you after you loose but a lot times you do not see that obvious signal or do not think about that one last scenario when you are hitting the BUY button. This is what happened to me this time. I believe I forced a trade. I have been trying to short this rally THREE times, and only break even ONCE. That should tell me something, and that something is that I need to follow the trend more. I am trying to pick tops when in fact I would be much better off if I just followed the trend up, and followed it down. Yes, every so often I would be following the trend and the trend will have changed directions, but most of the time I would make money. Or, if I did want to short counter trend (like I said in the my last journal), I need to have a POTENT reversal signal or something very definable to trade against No more of this "guessing the top" junk. I need to FOLLOW THE TREND. Also, the other thing I need to be more careful about is NOT following others on Twitter, StockTwits, etc calls for fact. I know how to read a chart very well and therefore when I am reading other's posts on Twitter etc I need to be more careful of that NOT influencing my trade decisions. By doing these things I can minimize distractions, and stay with the TREND more. It is all about following where the market wants to go, not trying to be the "smart guy" who tries to pick a top blindly (me, this week - bu ONLY this week).

At this time, if you read all of this... Congratulations. I am very impressed. If you learned something, even better, if you would like to ask me questions or leave me any comments please comment on this or email me (visit Contact page for EMAIL address). I would welcome your thoughts on these trades, and technique changes but as I said in the last journal - I can read the chart well, and I just need to disconnect from the people on Twitter more, therefore do not think you will be influencing my charting abilities/techniques. (I did NOT proofread this, it is almost 11:00 PM and I am very tired so I am sorry if you find spelling errors - I am no English teacher).

Not a whole lot of movement today as the VIX is really low right now, and we ave already moved a lot so the volatility is expected to be less. We closed green, but barely. I would NOT look to be buying right now... I think you can buy on a pullback but buying at these levels is not a good idea. A gap down on Monday will likely lead to some buying though because the bullish trend does continue. If we get down to the 8 EMA I think it will be bought and we can go higher but until then I remain bullish, but not buying. Until we really form a topping tail or break some key trend lines or MAs I think you have to remain bullish on the market. I have learned this week that is a bad idea to try to pick tops. I was hurt more than once doing so. Therefore, going forward, I would recommend everyone, including me to follow the trend and not try to short something that is strong.

So bullish, yes. Cautious, oh yes.

Apple is a NON event. I honestly do not know why I cover everyday. Would yall mind if I did not? I will if everyone wants me to; leave a comment with your preference. We are still in the daily wedge pattern with 500 support. To really get anywhere we need to break the down trend line.

Google seems ok, and the bullish bias remains but I do not see an actionable set up or a strong buy right now. It still looks good though.

Amazon I really like, and I said that recently. I think it goes HIGHER. Nice bull flag, and a OK volume pattern. Overall, bullish. Stop should be in the gap.

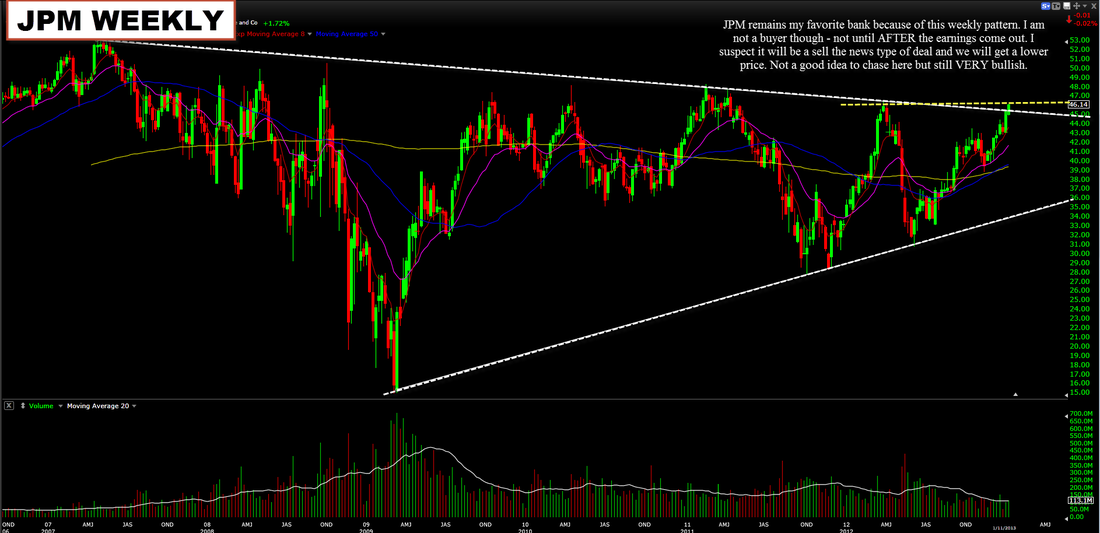

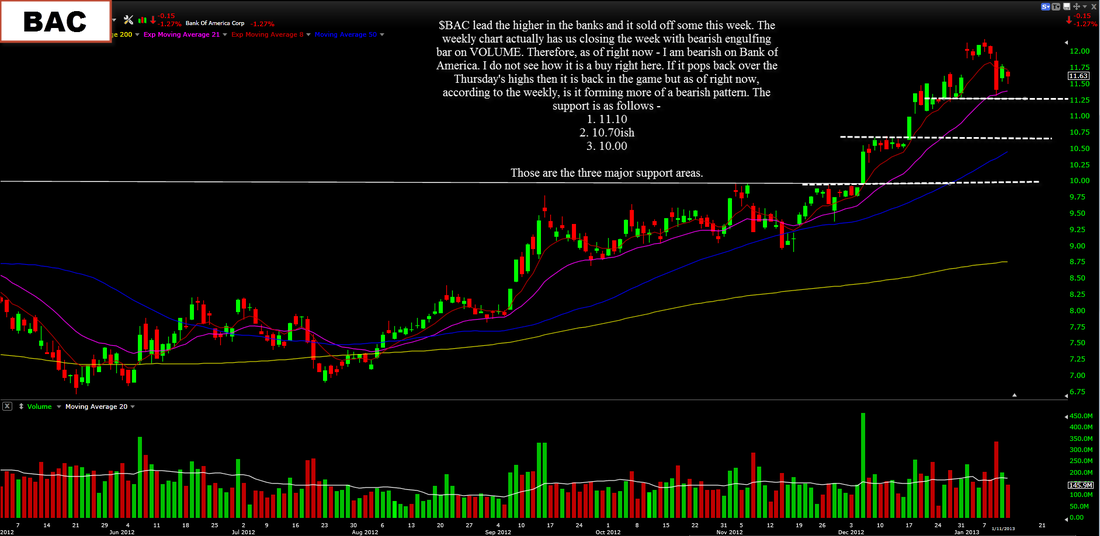

Wells Fargo reported today pre-market open. Sold off some and then rallied back. I think we can and should expect some selling from the banks coming up. With the amount of distance they have traveled.. I would not be surprised to see it a "sell the news" type of play.

I am long TWO things right, same as yesterday and for my benefit let me tell you why:

$X - sold off hard today which I did not like at all but I am still in it. It sold off on lighter volume and is still inside the consolidation box/bull flag. I have a loose stop on it because the weekly looks good and it is more of a swing trade. I have patience.

$FWLT - I am long with one because of the volume yesterday. I am down in this one as well but then again. it still is looking strong. Overall, the trend is UP and I think it can continue. Stop is also loose on this one as I want to follow the trend, and not the day to day action.

If you have any comments regarding my positions or just want to ask a question please visit the contact page (for email), or leave a comment below.

Have a nice weekend. Click to enlarge these charts -

Well today we finally broke out of the consolidation period which had everyone upset (mostly). I posted on my Daily Analysis last night that I thought we could see lower, and I gave reasons, and I was positioned for it. Well, I was flat out wrong. But that all said, I knew why I was short and that was really what matters. I was wrong, so I can move on and change my outlook - which I am - in some ways.

Well after we broke higher and traded higher on increased volume I can't help but alter my thesis a little; if I don't ever change what I believe will happen, I will lose a lot more money.

Today we broke out and closed above a key trendline I had been watching and we had increased volume, AND we came out of a base (giving the move a little more juice). Right now we are still a little extended but I cannot help but to say a more bullish than bearish at this point. There is resistance near but so far we have not had a potent/legitimate sell signal. I have tried to "call the top" (my mistake) for a couple days and in hindsight I should have been focusing on better longs. So going forward, I would look for a little bit more continuation upwards but do not chase if you are not already in (unless we cross the days highs). In summary - stick with what is working.

Apple has been a laggard, and a extreme what at that. It sold off at the start of the day, filling the pre market gap up. This is bearish in itself. Then we found support later in the day and traded higher, coming way off the lows - with good volume. I still do not consider Apple a buy right now. I think it still has a lot to prove but is a trading vehicle (day trading).

Google I said yesterday looked really good for higher prices. It did well today and still looks pretty good, despite closing red (open vs close). Overall the chart is bullish and I would raise my stops to the low of today.

Amazon is not really performing like you would like to see after a break to all time highs. It is not continuing it's strength (which is concerning). I will continue to monitor this one and tell you when I think it is ready to go again or fail here. Stay tuned. It is a no trade for right now.

DELL ($DELL) looks good for higher prices as it has a good volume pattern and is consolidating nicely. I would look to add/buy on a break out of this consolidation.

Sprint ($S) is looking REALLY nice and it remains one of my favorite picks for 2013 and in the near term future. I am looking for a entry soon but overall, I would call this a BUY right now. The weekly chart shows a beautiful cup and handle pattern that is breaking out.

The homebuilders did not really go anywhere today but they are still holding in there. Some are at some support so they could bounce off there tomorrow. I would continue to monitor them, and look for entries. They still look good.

|