Click to enlarge --

Welcome back! It is finally Christmas break for me, I am excited to have a few days off of school to purely focus on bringing you some charts. This morning I posted a chart on the level we need to hold to keep momentum in the market. the chart I posted around 5:50 AM this morning is below ---

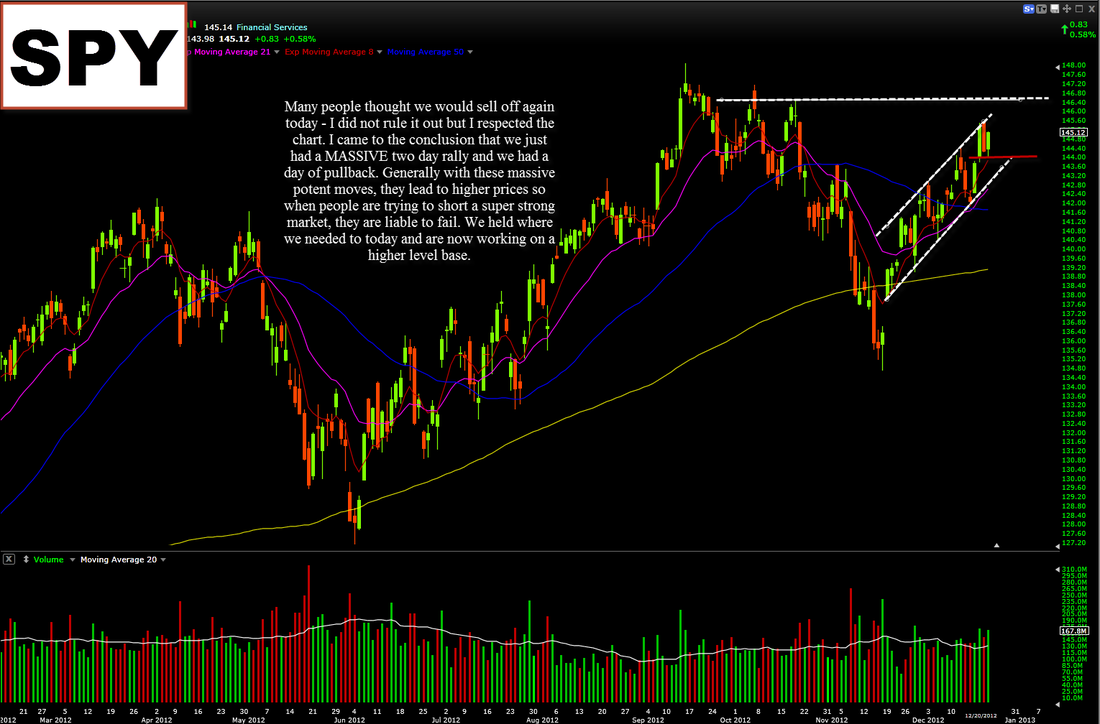

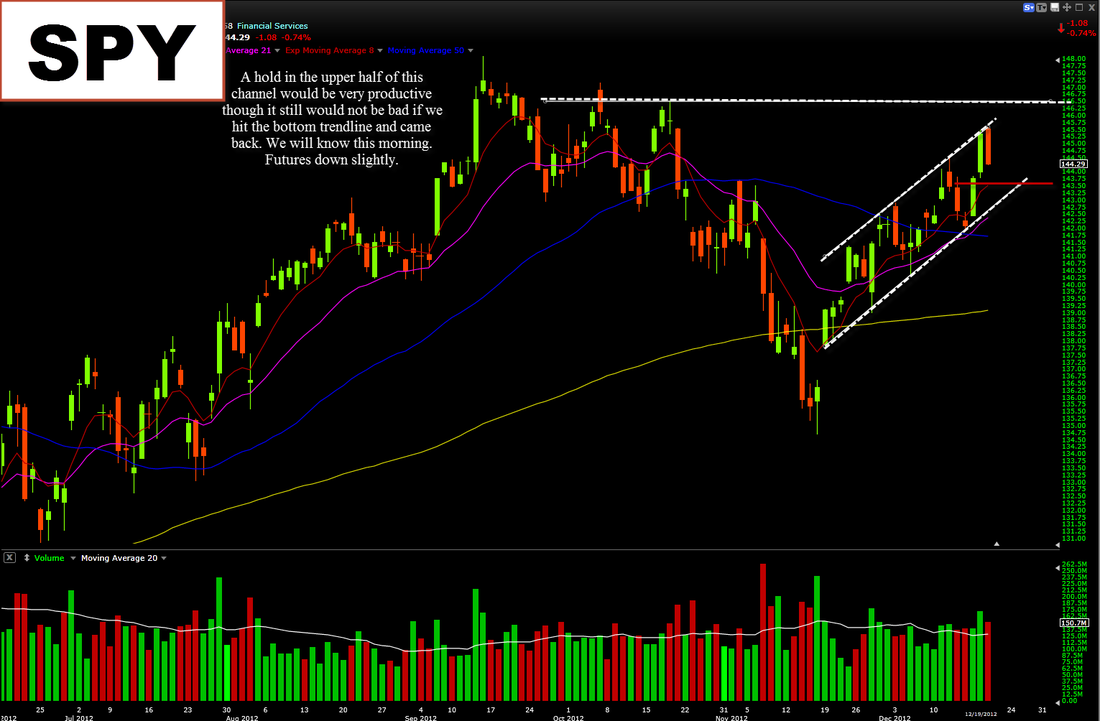

Well, we basically came back an barely nicked that area. This tells me there is still momentum in this market. Shorts were trying to short a potent move and calling a move back down to the 143 area - I determined that because of how potent the move was the past two days, we should not come back that much, this evidently was true. Going forward it looks like we are forming a higher level base to potentially break higher out of this upward channel. We are still slightly extended though today helped alot with that. You could trade against today's lows as your stop for a swing long, thought I will not buy the $SPYs right now (just not yet) because of the fact we still seem a tad extended (this does NOT mean we go down though).

------------------------

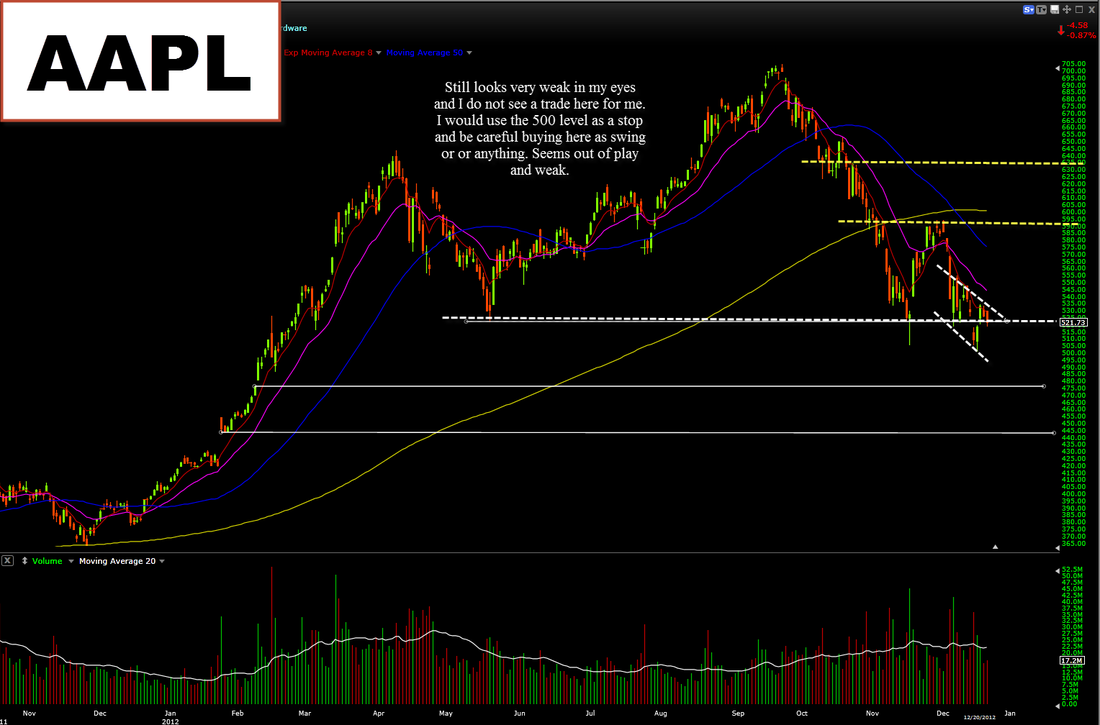

Apple has been out of play for a long time now and continues to be so, I would not be putting more money into Apple (I would have been taking it out after the first sell signal around 685). Going forward I still think there is a high probability of it breaking the 500 mark. A close below 500 could send this one down much further. There seems to be somewhat of a fight going on to keep it above this mark but the chart tells me the bulls are currently losing the battle. It's a trade, and most likely not even a swing trade.

Google has been acting very well lately and I have mentioned it a lot saying it is the strongest or "best in breed" stocks that you can own right now. Definitely the best in the high beta land (behind Amazon of course). Going forward, I still think it looks good. The MAs are catching up and the theory of the bull flag is still in play. The one thing I do not like too much about is the close today -- the market closed green (open vs close) while Google close red. Therefore, I will be buying before a breakout, I will wait for a more clear signal.

Amazon is the best high beta name right now and it looks very good for new highs. Trade against the days lows and then just hold onto to it. I would not day trade a stock like this, it is more a swing trade candidate.

Facebook has been a little slower recently, I am not a buyer right now as it is not showing me much of a set up, in time in may very well again but right now it is no trade for me.

IBM is similar to Facebook as it is just a no trade right now for me, not a clean set up and not really trending with authority.

DD looks good for higher prices, showed for strength today has room above, the day's low as your stop.

Visa and Mastercard have both made countless all time highs this year and I would stick with them if I were you. Although, every new high and every rally is one more closer to their last. They are going to get tired and pullback a little more than you may like. (Similar to HD and LOW right now). Trade accordingly.

Please visit the contact page for details on how to email/message me for comments and questions.

------------------------

Apple has been out of play for a long time now and continues to be so, I would not be putting more money into Apple (I would have been taking it out after the first sell signal around 685). Going forward I still think there is a high probability of it breaking the 500 mark. A close below 500 could send this one down much further. There seems to be somewhat of a fight going on to keep it above this mark but the chart tells me the bulls are currently losing the battle. It's a trade, and most likely not even a swing trade.

Google has been acting very well lately and I have mentioned it a lot saying it is the strongest or "best in breed" stocks that you can own right now. Definitely the best in the high beta land (behind Amazon of course). Going forward, I still think it looks good. The MAs are catching up and the theory of the bull flag is still in play. The one thing I do not like too much about is the close today -- the market closed green (open vs close) while Google close red. Therefore, I will be buying before a breakout, I will wait for a more clear signal.

Amazon is the best high beta name right now and it looks very good for new highs. Trade against the days lows and then just hold onto to it. I would not day trade a stock like this, it is more a swing trade candidate.

Facebook has been a little slower recently, I am not a buyer right now as it is not showing me much of a set up, in time in may very well again but right now it is no trade for me.

IBM is similar to Facebook as it is just a no trade right now for me, not a clean set up and not really trending with authority.

DD looks good for higher prices, showed for strength today has room above, the day's low as your stop.

Visa and Mastercard have both made countless all time highs this year and I would stick with them if I were you. Although, every new high and every rally is one more closer to their last. They are going to get tired and pullback a little more than you may like. (Similar to HD and LOW right now). Trade accordingly.

Please visit the contact page for details on how to email/message me for comments and questions.

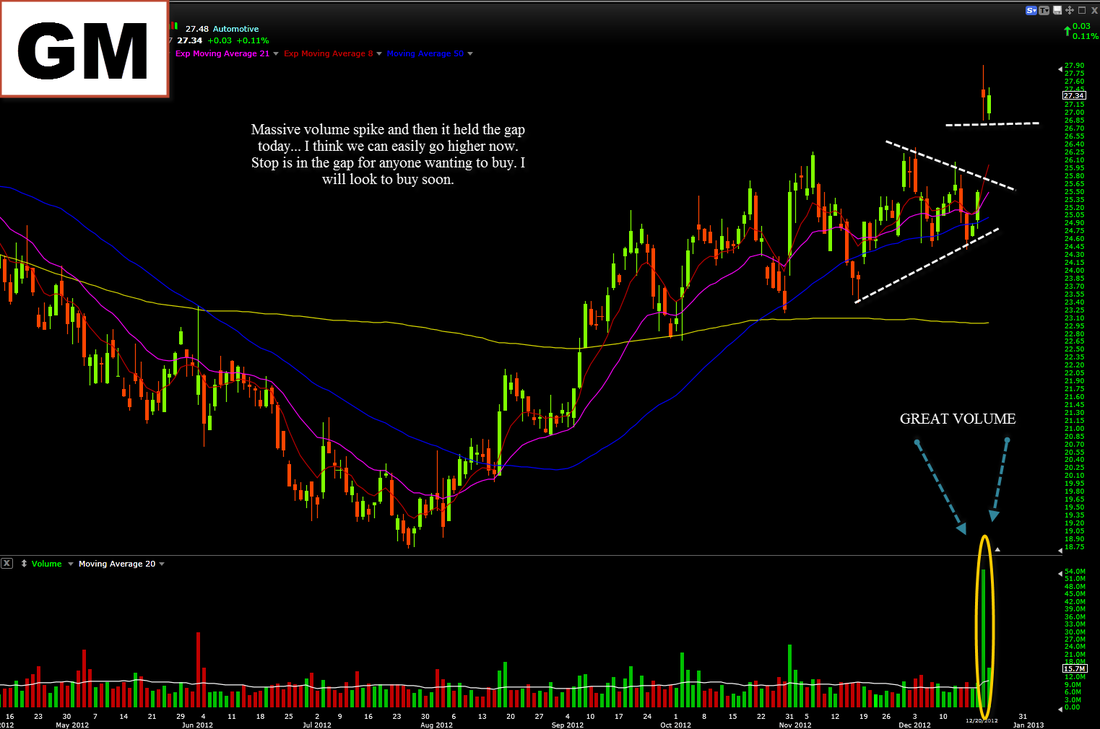

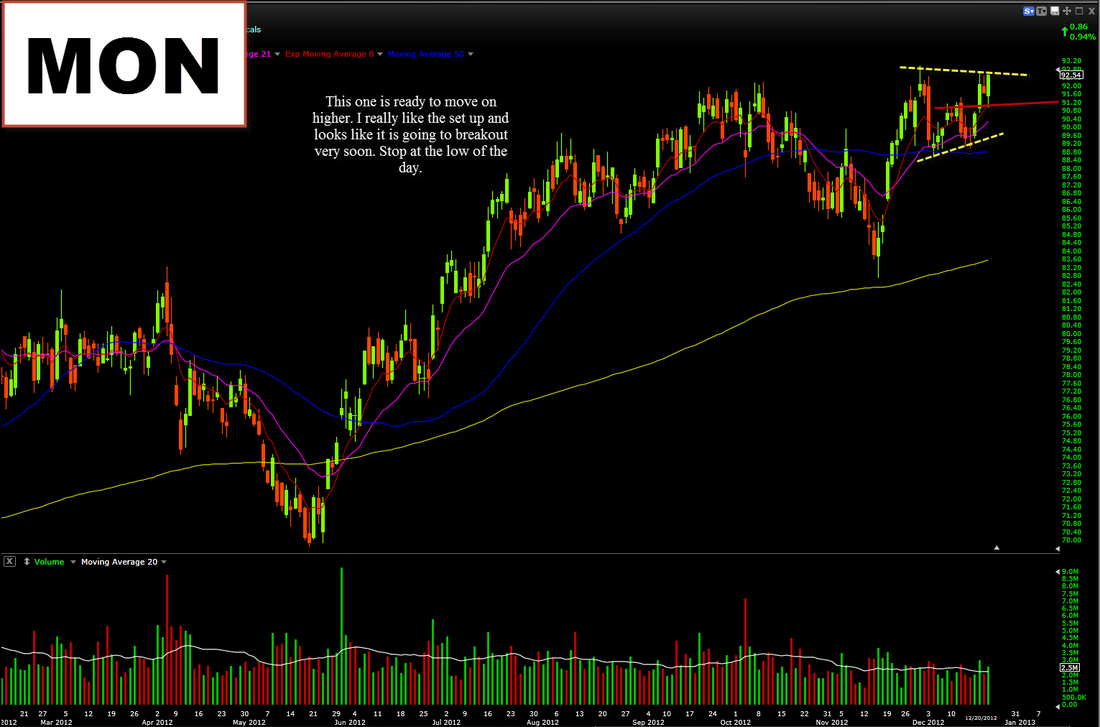

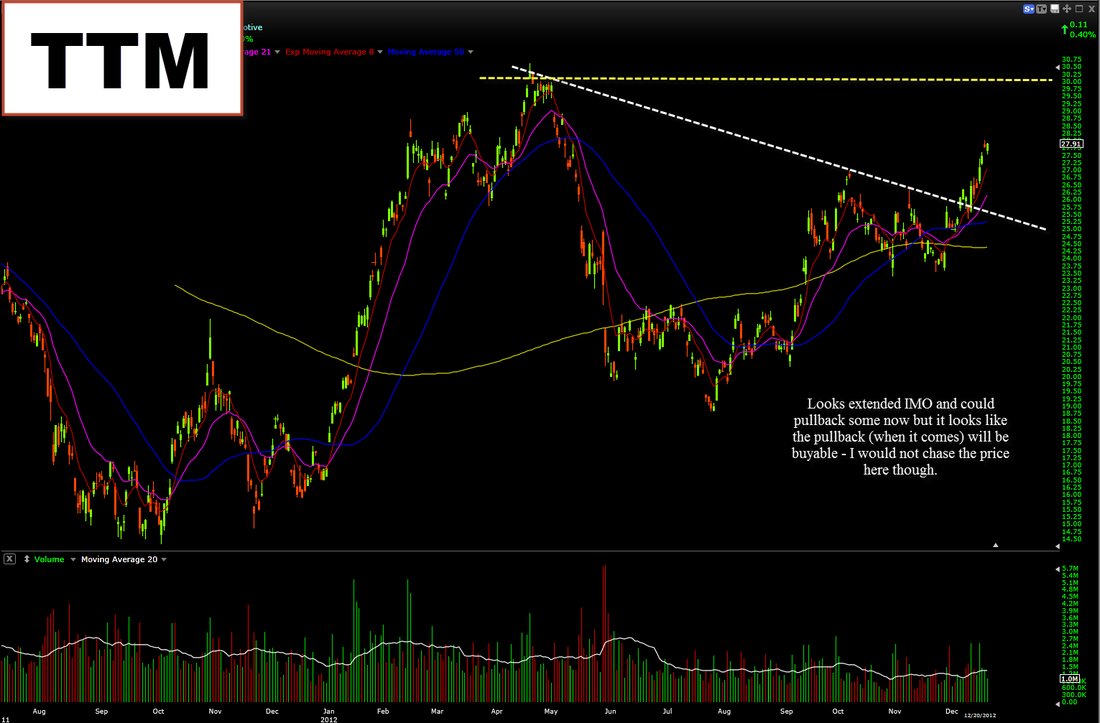

Here are some of the main charts with my notes, enjoy!

Now some chart y'all requested --