Click to enlarge images --

First off let me tell you, it IS possible to time the markets. See a set up, execute, and you have timed the markets. I got short two days ago and sold today, a little premature but either way -- still money.

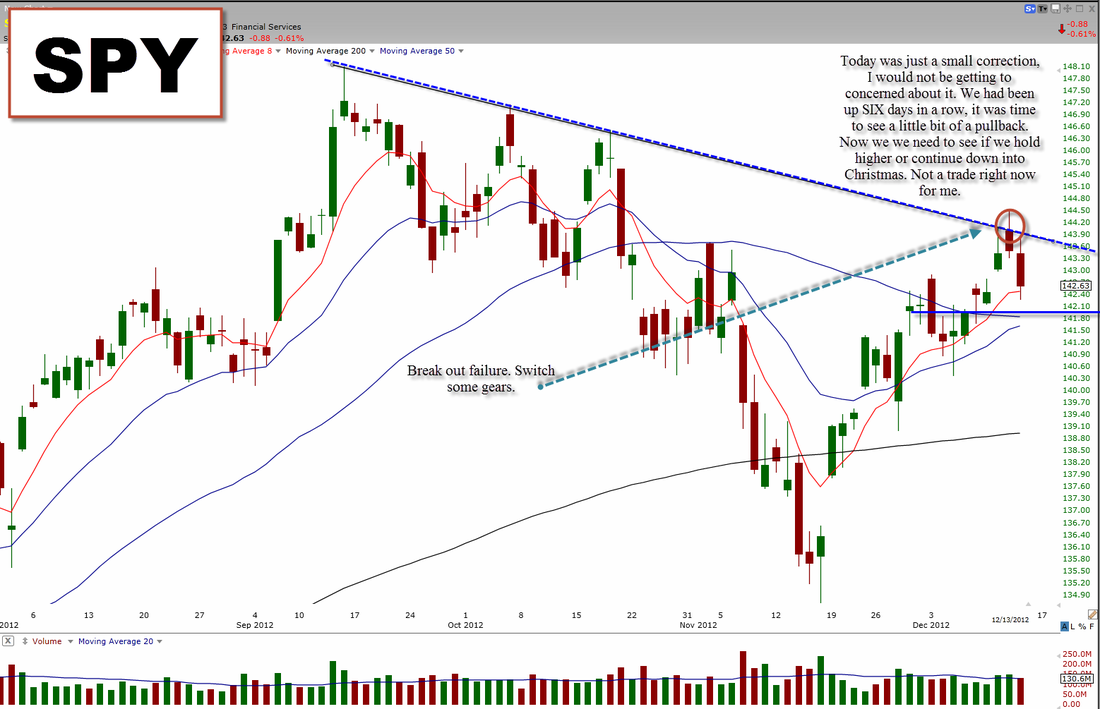

I believe today was just consolidation or a small pullback day. I think pullbacks will be buyable but I would like to see a another day or two of consolidation and tight price action. I would bid into this market long right now but I do not like how the volume ended today, if it were well below average, I would have probably bought some of the banks long because those are the strongest sector right now. I will wait for a clean, and better set up. This is just me though, trade your own way if that is what your gameplan calls you to do.

Apple is still weak, nothing has changed. I will say however that the longer it stays below the 555 mark, the more likely the chance it will trade through the support at 500 and trade deep into the 400s... Just a warning. I would not want to own Apple long unless it is for a day trade only!

Google is not near as good looking as it did yesterday. It formed a reversal candle today on OK volume and could see a little further downside. The pop in the pre market (that I still do not know what it was from) and the opening was a point to sell some.

Amazon is still strong, but has formed topping tails in a row, I would not long this stock or short this stock right now. It can go either way. It is a little extended but then again, it is a strong name right now. I do not like a whole lot of mixed messages. I will stay away.

Netfilx is still trading higher and is TRYING to fill the gap though the volume is not that strong. I do not like how it broke out a little prematurely (IMO) yesterday, I would have liked to have seen it coil up some more near the 90 level first.

Facebook I highlighted yesterday in the DAILY ANALYSIS and I said I think it will move again very soon, it did today. I was not in it, I wanted to see if go one more day sideways before bidding but oh well, that's the market.

Now for some names y'all requested --

GTAT - I do not see a buyable trade here, yes it is holding higher a MAYBE forming a bull flag but the sell of and minor engulfing bar does not give me a reason to buy it right here. Also it has been beaten down A LOT meaning it is a very weak stock and a lager play.

BAC - yes, it could be considered a buy here but I, my self, am not going to. I think we need to form a tighter range to trade with, right now it is just rounding off and kinda choppy. I do think it is still strong though, and should be watched.

RIMM - It is probably a short squeeze rally and should not be chased, you have missed the move if you are not in it now. There will be another.

BSBR - very similar to GTAT I mentioned earlier. Not really a trade here. Here are my reasons: The volume is not shaping up like I would like, it is WEAK and beaten down name, there was a reversal/topping tail today, and sitting as some resistance. I will not say it will not go up, I am just saying -- there are probably better set ups with stronger patterns.

LVS - LVS has been range bound for a while now, I like trending stocks more the channel range bound. I will say though, it does look strong. Wish there was bit more volume coming in but not bad. I wouldn't chase though after so many green days.

HAL - HAL has been downtrending for quite a while it looks to be making a lower high right now. I do not see it as a buy right now as slashed through some key MA's.

Make sure to visit the chart page to see some of your favorite set ups/names with analysis --

CLICK HERE to go to Charts Page

And that is it! Thanks for reading! My contact info is below for questions/comments --

Twitter - https://twitter.com/BenCBanks

StockTwits - http://stocktwits.com/BenCBanks

Email - [email protected]

I believe today was just consolidation or a small pullback day. I think pullbacks will be buyable but I would like to see a another day or two of consolidation and tight price action. I would bid into this market long right now but I do not like how the volume ended today, if it were well below average, I would have probably bought some of the banks long because those are the strongest sector right now. I will wait for a clean, and better set up. This is just me though, trade your own way if that is what your gameplan calls you to do.

Apple is still weak, nothing has changed. I will say however that the longer it stays below the 555 mark, the more likely the chance it will trade through the support at 500 and trade deep into the 400s... Just a warning. I would not want to own Apple long unless it is for a day trade only!

Google is not near as good looking as it did yesterday. It formed a reversal candle today on OK volume and could see a little further downside. The pop in the pre market (that I still do not know what it was from) and the opening was a point to sell some.

Amazon is still strong, but has formed topping tails in a row, I would not long this stock or short this stock right now. It can go either way. It is a little extended but then again, it is a strong name right now. I do not like a whole lot of mixed messages. I will stay away.

Netfilx is still trading higher and is TRYING to fill the gap though the volume is not that strong. I do not like how it broke out a little prematurely (IMO) yesterday, I would have liked to have seen it coil up some more near the 90 level first.

Facebook I highlighted yesterday in the DAILY ANALYSIS and I said I think it will move again very soon, it did today. I was not in it, I wanted to see if go one more day sideways before bidding but oh well, that's the market.

Now for some names y'all requested --

GTAT - I do not see a buyable trade here, yes it is holding higher a MAYBE forming a bull flag but the sell of and minor engulfing bar does not give me a reason to buy it right here. Also it has been beaten down A LOT meaning it is a very weak stock and a lager play.

BAC - yes, it could be considered a buy here but I, my self, am not going to. I think we need to form a tighter range to trade with, right now it is just rounding off and kinda choppy. I do think it is still strong though, and should be watched.

RIMM - It is probably a short squeeze rally and should not be chased, you have missed the move if you are not in it now. There will be another.

BSBR - very similar to GTAT I mentioned earlier. Not really a trade here. Here are my reasons: The volume is not shaping up like I would like, it is WEAK and beaten down name, there was a reversal/topping tail today, and sitting as some resistance. I will not say it will not go up, I am just saying -- there are probably better set ups with stronger patterns.

LVS - LVS has been range bound for a while now, I like trending stocks more the channel range bound. I will say though, it does look strong. Wish there was bit more volume coming in but not bad. I wouldn't chase though after so many green days.

HAL - HAL has been downtrending for quite a while it looks to be making a lower high right now. I do not see it as a buy right now as slashed through some key MA's.

Make sure to visit the chart page to see some of your favorite set ups/names with analysis --

CLICK HERE to go to Charts Page

And that is it! Thanks for reading! My contact info is below for questions/comments --

Twitter - https://twitter.com/BenCBanks

StockTwits - http://stocktwits.com/BenCBanks

Email - [email protected]