Click to enlarge the images -

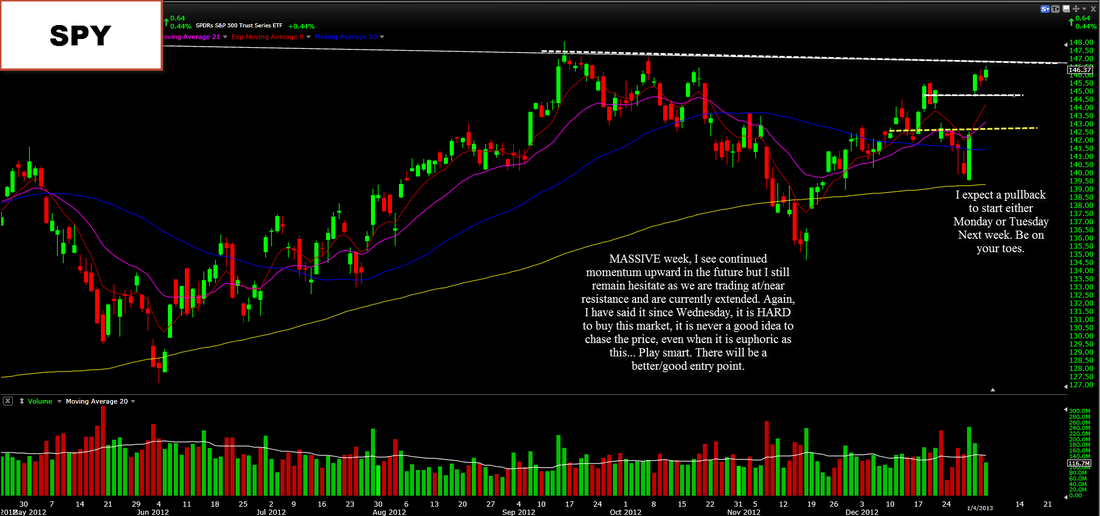

Another green day, this is wild in my eyes, and did not expect this (not that that matters, I trade price). I have been saying all day that we still are extended to the upside and that is difficult to buy this kind of euphoric market without being concerned with the probability of some short term selling/pullback to digest the move. I believe this still remains true. It is not a good idea to be buying this market right now, the risk to reward is not really in your favor. I would much rather be a buyer on a pullback to support. You do not want to be the one stuck at the top. Euphoric markets, where everyone is "happy" is usually a point to be concerned. When all you see on Twitter, StockTwits, CNBC, etc is "Another gap up coming" or "BUY BUY BUY" it usually close to an inflection point. I feel like we are very close to that point here. I expect to start to see the signs of a pullback if not a pullback itself either Monday or Tuesday next week. Now, there is always the chance we do not pullback very much at all and just continue to trade somewhat flat with a down day in there every so often. This theory would have the same result; the extendedness will be gone, and the market will likely be buyable again.

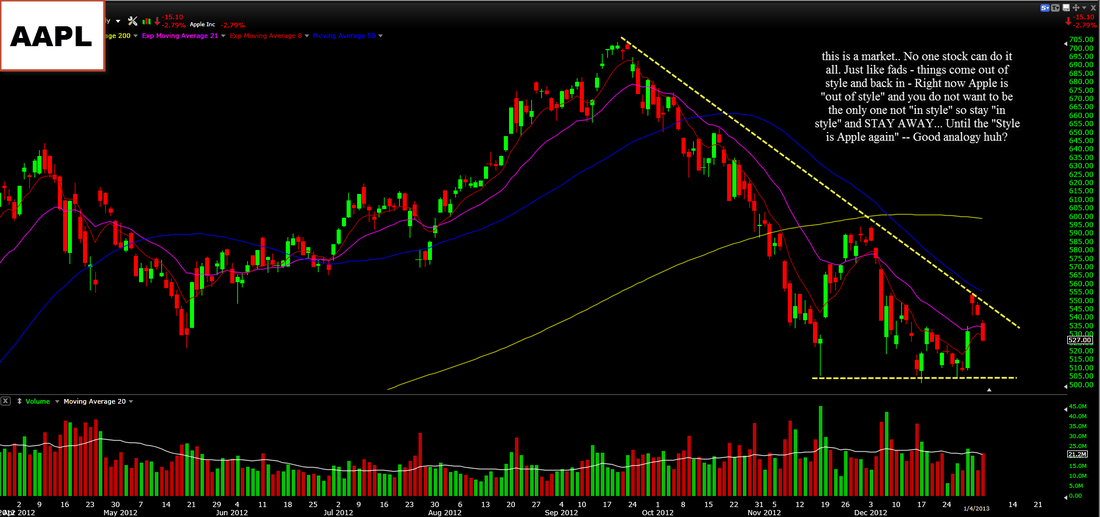

Apple has proven time and time again it is not where the money is, and not where yours should be (unless your short). Here is my little analogy -

"this is a market.. No one stock can do it all. Just like fads - things come out of style and back in - Right now Apple is "out of style" and you do not want to be the only one not "in style" so stay "in style" and STAY AWAY... Until the "Style is Apple again"

I do hope that made sense and if it did, then that is exactly what Apple is dealing with right now, it is out of fashion.

----------------

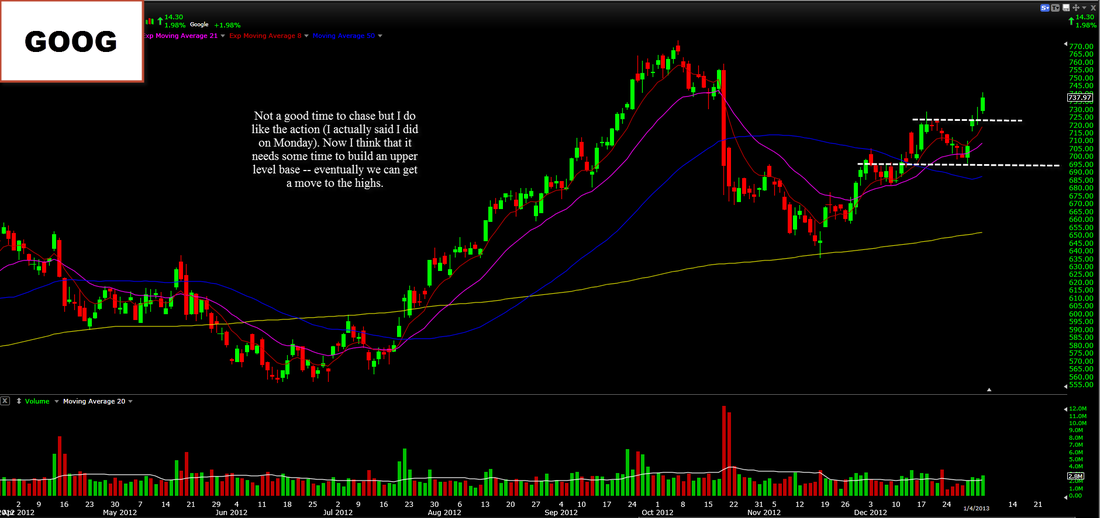

Google I did say on Monday that I liked the action in Google and it looked like it wanted to go higher, it did go higher this week and performed well. I currently think that it is not a conviction buy right now because it is "wee" bit extended now and at some resistance zones. Let's wait to bid some support.

---------------

Amazon is probably one of my favorite set ups. Amazon is very close the all time highs, it is consolidating well, and not too extended from the MAs. I personally think amazon sees higher. The only point of concern I have with it is that the volume pattern is not that amazing. You do not see the volume increasing like it should be, but none the less, it still looks good and I like the fact it has defined support and defined resistance.

---------------

Bank of America has been very good over the past month and is has not shown any signs of slowing down (for the most part). I would however say, it is not a buy at these levels unless with very little size. I do not like how far it is extended, and I do not like that there is not more/increased volume coming in. I am more likely to be a buyer down closer to support. I choose not to be the "chaser".

---------------

Lennar homes/homebuilders are holding the breakout gap pretty well and look like they do want to go higher. I am in long on $LEN right now. Currently I think the hombuilder ETF ($XHB) is a little tired and extended but not $LEN or $PHM, those both look fine and not too extended at all, that is why I chose them. I like the fact that the homebuilders broke out of the channels/bases with defined support/resistance.

---------------

Please visit the contact page if you have any questions/comments -

Below are some charts I have looked at with my notes on them, please click them to enlarge.

Apple has proven time and time again it is not where the money is, and not where yours should be (unless your short). Here is my little analogy -

"this is a market.. No one stock can do it all. Just like fads - things come out of style and back in - Right now Apple is "out of style" and you do not want to be the only one not "in style" so stay "in style" and STAY AWAY... Until the "Style is Apple again"

I do hope that made sense and if it did, then that is exactly what Apple is dealing with right now, it is out of fashion.

----------------

Google I did say on Monday that I liked the action in Google and it looked like it wanted to go higher, it did go higher this week and performed well. I currently think that it is not a conviction buy right now because it is "wee" bit extended now and at some resistance zones. Let's wait to bid some support.

---------------

Amazon is probably one of my favorite set ups. Amazon is very close the all time highs, it is consolidating well, and not too extended from the MAs. I personally think amazon sees higher. The only point of concern I have with it is that the volume pattern is not that amazing. You do not see the volume increasing like it should be, but none the less, it still looks good and I like the fact it has defined support and defined resistance.

---------------

Bank of America has been very good over the past month and is has not shown any signs of slowing down (for the most part). I would however say, it is not a buy at these levels unless with very little size. I do not like how far it is extended, and I do not like that there is not more/increased volume coming in. I am more likely to be a buyer down closer to support. I choose not to be the "chaser".

---------------

Lennar homes/homebuilders are holding the breakout gap pretty well and look like they do want to go higher. I am in long on $LEN right now. Currently I think the hombuilder ETF ($XHB) is a little tired and extended but not $LEN or $PHM, those both look fine and not too extended at all, that is why I chose them. I like the fact that the homebuilders broke out of the channels/bases with defined support/resistance.

---------------

Please visit the contact page if you have any questions/comments -

Below are some charts I have looked at with my notes on them, please click them to enlarge.