Well here I sit in VERY cold NYC. It has been a pretty fun day, and now it is really late but I said I would do the daily analysis... so I'm doing it.

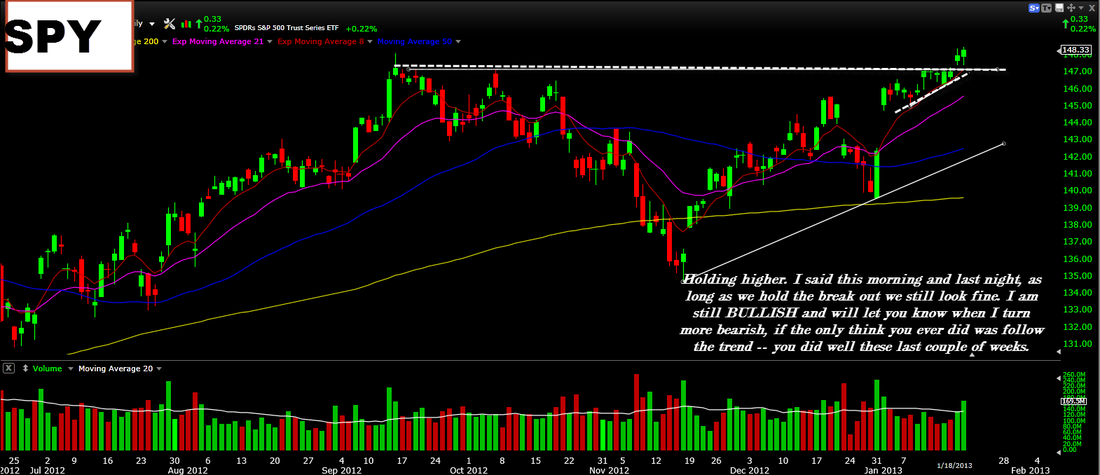

The market held the break out zone I talked about this morning and last night. This is a good thing and as long as we hold above that level it is safe to assume we continue higher. Basically all we are doing is stair stepping higher, which is the best way to do it. I remain bullish, and I will let you know when I become bearish. Keep in mind that when I become bearish it will be because of the charts telling me so (a reversal, engulfing, etc), I do not base my market sentiment on anything other than charts. That being said it is key for you to use stop losses right now. I am NOT bearish right now but that could very well change if something wild happens on Tuesday. Because of this unforeseen risk you need to have the stops placed and not solely really on the bullish-ness of the market.

The market held the break out zone I talked about this morning and last night. This is a good thing and as long as we hold above that level it is safe to assume we continue higher. Basically all we are doing is stair stepping higher, which is the best way to do it. I remain bullish, and I will let you know when I become bearish. Keep in mind that when I become bearish it will be because of the charts telling me so (a reversal, engulfing, etc), I do not base my market sentiment on anything other than charts. That being said it is key for you to use stop losses right now. I am NOT bearish right now but that could very well change if something wild happens on Tuesday. Because of this unforeseen risk you need to have the stops placed and not solely really on the bullish-ness of the market.

Apple.. NOTHING has changed. I am still bearish on Apple. The post a couple days ago I said

"this could be a time for posistion traders to buy Apple" - This very well may still turn out to be true but right now it is VERY faulty from the short term point of view. Maybe in the next couple of years it can really get going and go back to being the old Apple we know but currently... it is bearish.

Google still needs time. It hit around my $700 level today but it did not reverse or show anything compelling to want to buy this stock - yet. Earnings soon.

Amazon still looks pretty good at all time highs. I would not buy it here as the earnings are coming up and it wicked down today but overall, the pattern looks bullish from a long term perspective.

That is it for now. I will post some more charts over the weekend.

If you would like to contact me, please visit the