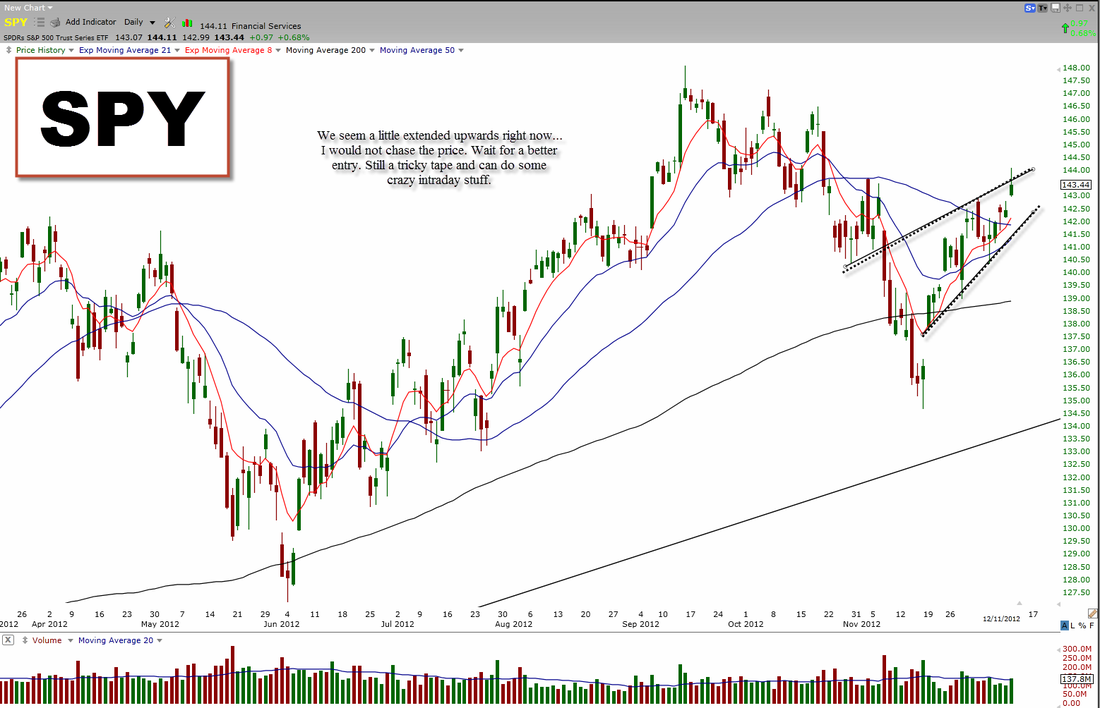

We seem a little extended again on the daily chart of the indexes (specifically DIA and IWN). This does not mean we are in a big pullback phase at all but it does mean you should take off some risk. We have came a long way. We have continued to grind higher and my biased has been bullish and will remain bullish. The trend is up, and nothing says otherwise in the intermediate term. Apple still is weak, it is going to need to form a potent move with VOLUME for me to consider it not a weak stock any more. I do not know when this will happen but until it does, I would remain cautious. This is only a trading vehicle now, I would not be swinging this one right now. Google is hanging tough. Closed pretty well today and is still in the cards for higher prices. I like cleaner entries though. I still consider it to be consolidating, it needs to get over the 50 SMA with some power for it really to move. Amazon just doesn't seem to ever want to go down. I wouldn't short it right now, it just seems to basing. A fall under the lows tomorrow could mean a larger pullback though. Do not chase the price also though. LULU had a nice day and ALMOST if not broke the descending wedge. I think this one can go higher into years end. Looks a little shorter today, I'm sorry. I am off to dinner tonight. Have a nice evening. Contact info - Twitter - https://twitter.com/BenCBanksStockTwits - http://stocktwits.com/BenCBanksEmail - [email protected]

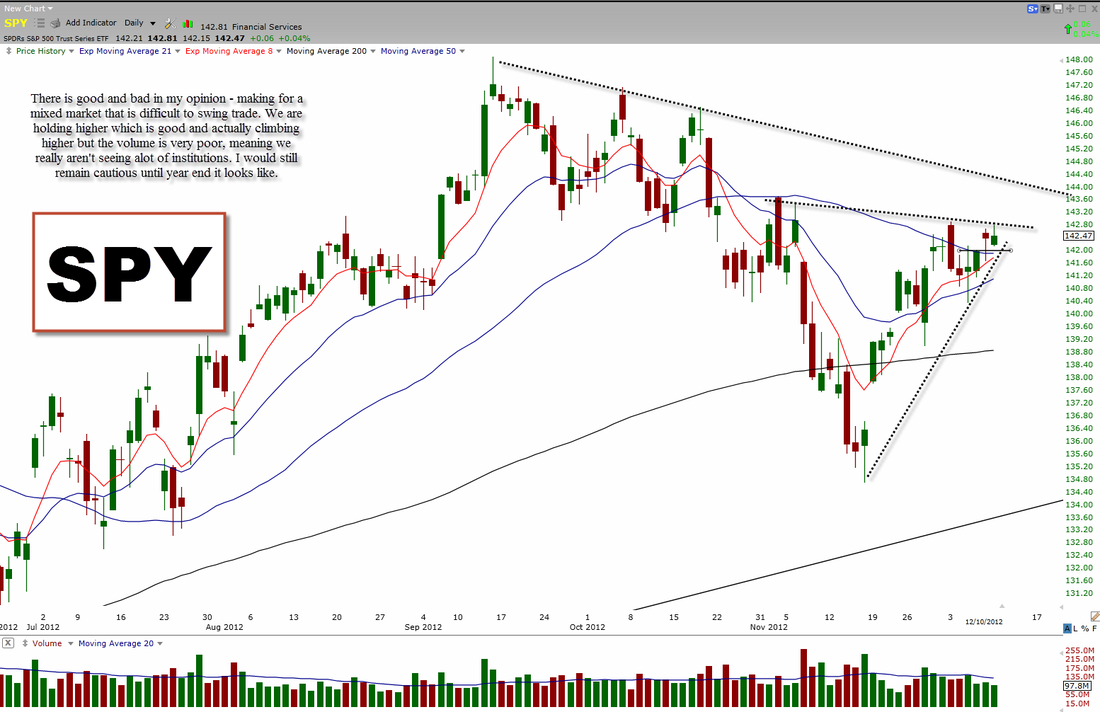

Click to enlarge the image. First off, I hope you all had a nice weekend. Now onto the market! Today I feel very similar to the way I felt last week. We have been grinding higher but really haven't shown much power. We need power behind this move higher. We have gone up on VERY weak volume, telling me the institutions really aren't taking a stake right now, this could be due because of the year end of the fiscal cliff - I do not know. Currently I have a bullish biased on the market because it has been grinding higher but I would remain cautious as the higher we go on lighter volume... The greater the chance we see a bigger down move. Overall, stay small, and be specific - I wouldn't long anything right now because more than likely, you will lose. STRONG is the key right now. Apple has continued it's weakness and I hate to say it (and will probably be hated by some) but Apple has a chance to see 485 then the 440 area. It has been weak and a break of the recent support or a powerful close below the 505-518 could really bring in some sellers. All powers must come to the end - I am not saying it is the end for Apple, it's just there are stronger names out there now. Google held in there today above the recent support line. I feel confident with Google, wouldn't buy it but it does not look that bad. Nice upper consolidation. Amazon FINALLY pulled in a little, a well needed break in my opinion. I think you will be able to re buy this stock soon but I like to see reversals form. Facebook has been very strong and will likely continue higher, to really confirm this theory I want to see 1-2 more days of riding the 8 EMA up and then another move higher. HPQ, MCP, INTC, DELL -- All of these names have been beaten down stocks that are now showing signs of life. I would look for entries in these as that has worked, and will continue to work until it doesn't. Have a nice evening everyone, and remember to check out the charts page! Contact info -- (for questions, comments, etc) Twitter - https://twitter.com/BenCBanksStockTwits - http://stocktwits.com/BenCBanksEmail - [email protected]

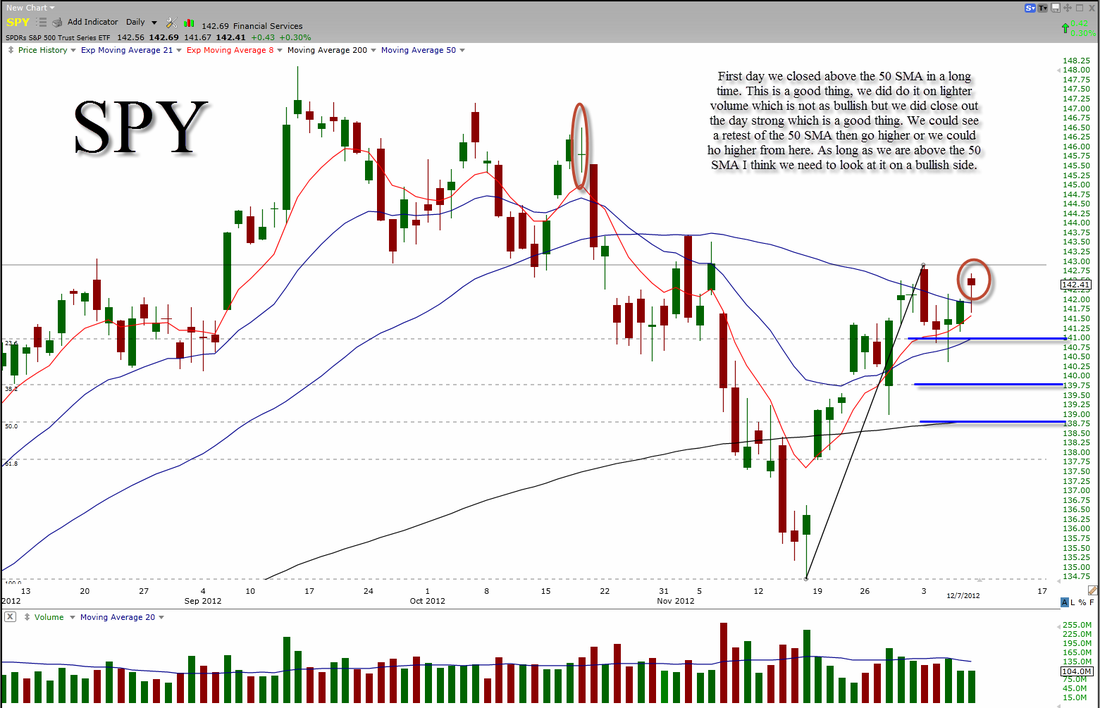

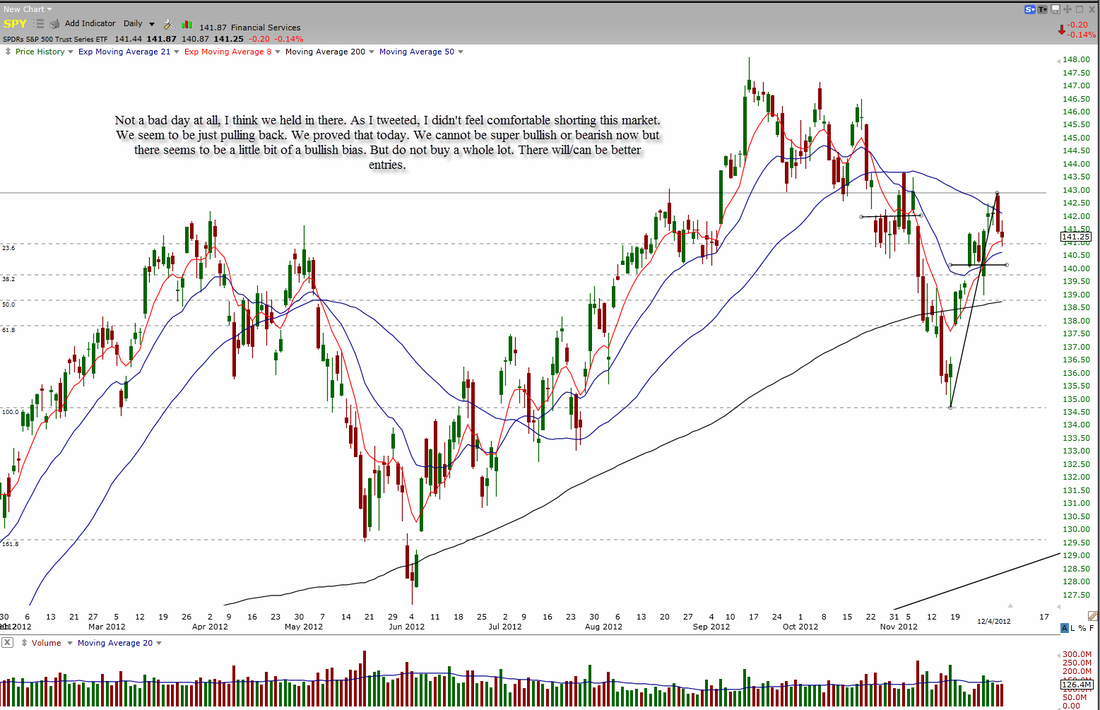

Ok this may be a little quick today because I have to go to a progressive dinner tonight. So right onto it, the SPY closed above the 50 SMA for the first time in a long time which is a very good thing. It lacked the potent volume I would have liked to have seen but that is alright, it did close close to it's highs. As of right now, I think you need to look at things from a more bullish perspective, for as long as we are above the 50 SMA. We need Apple to bounce. We saw a slightly bearish candle today again which is not a good sign but we did hold above the 530 level, which is key. We also had lighter volume today, which is another better sign. I am not saying go ahead and trade it long... It is just there is still a minor bullish hope in it as long as it holds above the 530 level. Google hung in there and is still consolidating and it is one that I think can see higher prices (if/when we rally). Amazon is a monster, as I have said. It still looks extended and could pull in a little but it is not bad. I like the chart and it is one of the stronger ones out there. It needs to continue to hold higher or come in a little though before many other people will be buying. I think. HPQ is now on my radar. I would like to see it hold 13.60 - it is defintiely in the cards for higher prices. I like it. LULU just consolidated today which is a good thing. Another day or two of this and we could see another up move. Facebook is forming a bull flag up here, I wouldn't buy after today though because I do not think it is ready break out again. That's it for now. Throughout the weekend I will upload more charts to the "Charts" page so be sure to come back and check on that. Have a good weekend. Contact -- Twitter - https://twitter.com/BenCBanksStockTwits - http://stocktwits.com/BenCBanksEmail - [email protected]

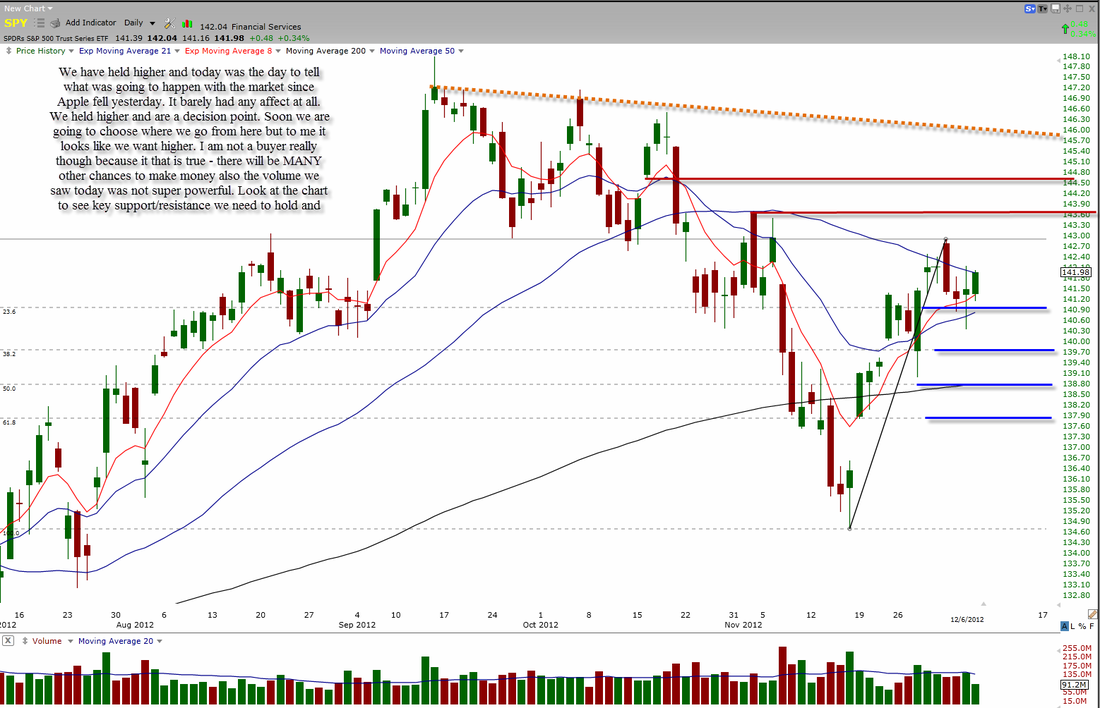

Let me start out by saying, thank you for your cooperation with dealing with the TWO ads on website (Trading Journal and Charts page). I would also like to give an extra thanks to the people who gave up two seconds and clicked on one or both of them for me (I only earned 1.25 yesterday, but hey it isn't about the money). --------------- Today we held higher again and we look to making another run at the 50 SMA. I think with this is a key level we need to pass through. I do think we can move through this level though, my bias is to the long side. My reasoning for this is as follows - - Held higher despite the APPLE fall - Gave a nice move today, closing at highs (first time in a while). - the MA's continue to rise There is one point of concern I watching though... The volume, I would like to have seen a little more volume come into play today and a decent up day. This isn't to say we go super lower and not higher, but it is part of the reason why I am not buying so much right now. Another reason why I am not buying much here is that IF we do break higher, we can continue, and there is ALOT more money to made after the first day. No reason to gamble more on the first day if you can wait and confirm the action. Now onto Apple. Apple had a NICE reversal today. Wow. On good volume. I think this can open the door higher prices, but that does not mean it is that tradebale on the long side YET. I think it still has alot to prove to us. It has been weak and we would all like to see it get back to being a market leader. That could really help the market get going. We have formed a potent reversal on volume and higher low AND a slight double bottom.... Those things combined shifts my biased to the long side on Apple but I am not buying, not yet - do what you do though, there are trades. Google seems to holding support. I said yesterday that it NEEDED to have a green day soon to confirm that it is still in the game to see higher prices. It gave us that today, thankfully. The volume on Google though was not great, but not alot of volume was today (where did everyone go?). We could see higher prices in Google but it is not worth the risk of my money yet. Amazon still is STRONG. This one never seems to quit. Always seems to amaze me. It did see some volume today and closed with a doji so there could be a little more downward action left in this one and I would not chase, horrible idea. LULU had a NICE day today. It traded really low (66.60) and closed UP 7.26%. This was all done on volume, which is a huge indicator for me. We will probably see more upside in LULU but as of right now I am buying, not yet. Still in a channel/triangle and needs to prove it's way through that. Starbucks finally had a move that everyone was looking for. Huge day up on volume above resistance. Congrats if you were long this one. Right now it would be nice to see a bull flag with consolidation then a move higher. A potential place I would look as a target is 55.40. The homebuilders have been kinda out of play recently. I continue to monitor them because they have been leaders in the past but as of right now I am not a buyer, just seems to be weak. The banks have woken up though. - Goldman Sachs seems to be trying to make a base to trade againist but there are better bank plays out there.

- BAC for one, holding higher. For me to bid, I want to see at least one more day of consolidation because we did see a SLIGHT outside day today and I would like to negate that.

- Another strong bank now is CitiGroup (C), almost as strong as BAC right now and same goes for it. Needs to base out and bull flag a bit more for me right now.

Now for IBM, continues to be weak. Bounce today but on light volume I would like to see this one really wake up to really start to confirm a market rally but as for now... Nothing. Facebook could pull in a bit more from here.. just a pullback though. It had a light volume sell off which is a good thing but it has came a long way and the R:R (risk to reward) is better at lower levels. Wow. This was a huge Daily Analysis, I did not think I would end up typing this much. IF you learned something or thought it was worth time in reading would you please spread the word but Tweeiting/Emailing/texting or doing whatever to all your other trading friends. That would mean alot. Contact info -- Twitter - https://twitter.com/BenCBanksStockTwits (to see charts I post there) - http://stocktwits.com/BenCBanksEmail - [email protected]Disclaimer: I am long $K right but do not like the action too much. We will see. Just holding it.

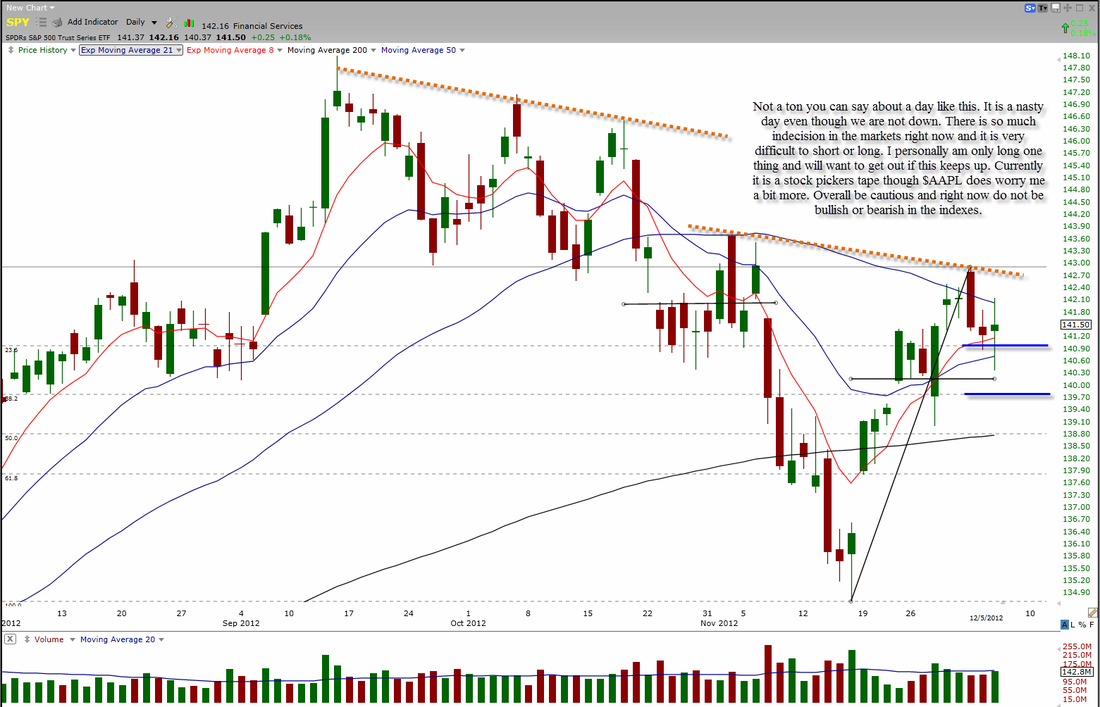

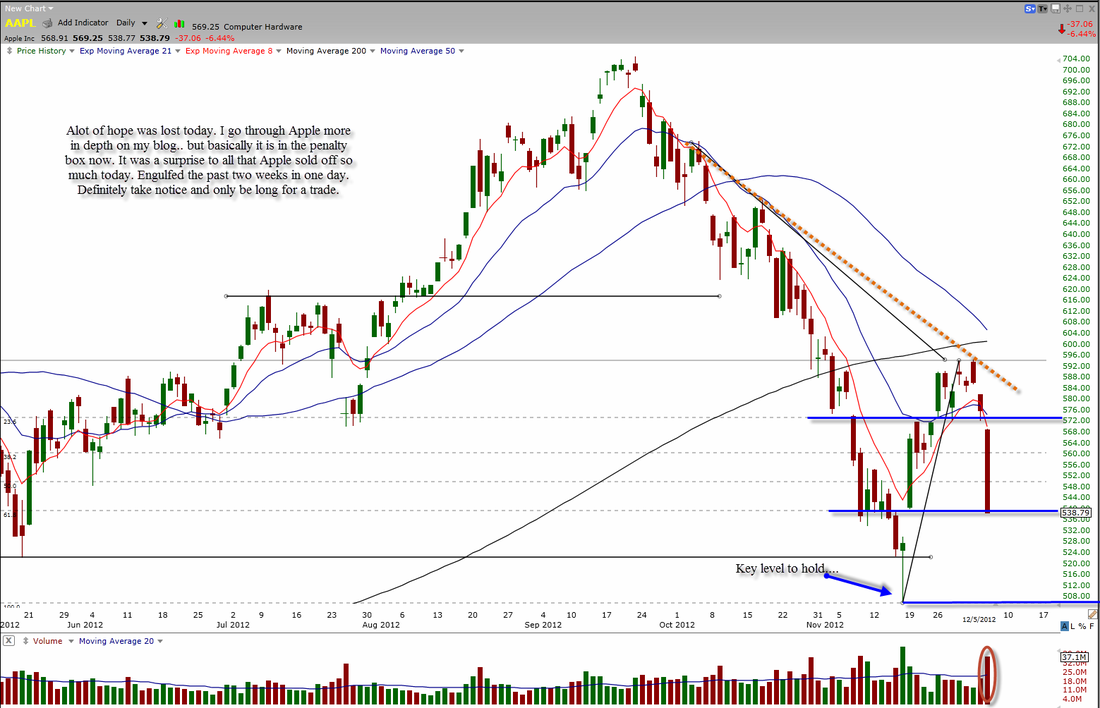

Notice: I put two ads on my site, one on the Trading Journal page, and one on the charts page. I chose not to put them on this page because it is my most popular page and I do not want to bother you too much. I do earn money off these ads but it is not much at all and I only get paid when people click on them. The reason why I put them on was that I spend a couple hours doing this every night so it is just a little way to help justify that without going to a subscription based site. I hope you understand. Thanks for commitment and participation in my site. -------------------------- On to the Daily Analysis. Today we rallied and sold and rallied and sold. Today was a choppy day and did not provide much for swings, I do not plan on participating in this current market condition from a swing perspective, it is way to indecisive. We have formed two dojis in a row now and that tells me we really do not have much conviction to either side. I am glad we close green but then again, it does not mean much when you look at the scheme of things, we have two dojis and virtually UNCH compared to yesterday. We will most likely move on any significant news, good or bad and that will be a direction to trade with. I cannot say with great certainty at all which way we will go from here. With Apple selling off hard but the banks and the Dow doing well, I really do not have a clue (which is alright, you do not have to know everything, you can't). Now to Apple, everyone's favorite? Well I doubt so after today. What a disgusting day. We sold off a ton and engulfed the past two weeks. I do not think anyone was expecting this much of a downside. We were weak yesterday and all last week but holding in there. Now we are not at all. Of course we could get a bounce here and there (and maybe a slight one tomorrow) but overall, until proven otherwise - this one is in the penalty box and should not traded long for a swing or investment. Personally a fall below the 500 level with a close there will more than likely send some investors off the "cliff". Do not play Apple, unless for a trade. Google sold off a little again today, we do not want to see too much more of this going on in Google. We need to see a green day soon to confirm a still bullish sentiment. We have been selling on lighter volume which is good sign but still, selling is selling. We need a green day soon. Amazon is holding tough. It is really amazing how this one is doing. I do not want to buy up here on Amazon because of the rest of tech land selling but it is still holding in there. I feel the same way about Facebook as I do Amazon. Needs to consolidate more and prove itself longer in this tape than it would have if Apple hadn't done what it did. I am not a buyer. Up day with lighter volume. Netflix sold off a little more than I thought it should today and is not resting at support. In a strong strong tape it could be a bounce buy but this tape is far from that. So me personally, I am not a buyer. Needs to prove itself by consolidating. IBM today showed us it is still weak, but that is not a huge surprise. It has been weak for quite some time now. It would need to hold 185 at this point. I would not trade this long. Another tech that is weak.... The good news about today is that the more Apple sells off, the less an effect it has on the market. Which is a good thing at this point. Less is more in Apple right now, literally. I hope everyone had a nice day and I will see you all tomorrow. As always here is my contact info and Twitter/StockTwits handle (where I often post charts). Also, remember to check out the charts page on here, wink wink, nudge nudge ;). Twitter - https://twitter.com/BenCBanksStockTwits - http://stocktwits.com/BenCBanksEmail - [email protected]

Alright today was not bad at all. Do not let a red bar scare you too much. This is what I see (Do not take anything I say for guarantee) - Doji signals some indecision - Low volume again today, continues to prove my buy able pullback theory - After a potent move like yesterday, we should have seen some follow though, we did not see much. - Apple held the key 574 level, while down today it still held in there. I am not bearish quite yet on it. Not grea though, it seems like the market wants to lead Apple now. Not Apple lead the market. - VIX nearing some resistance - OIL ($OIH) held higher and actually closed green with decent volume This helps me confirm and substantiate the bullish bias, but there are few things that need to be considered that favor the bears too - - The banks are slowing drifting lower, $GS led the way today (just cause $BAC is strong doesn't mean they can hold everyone up) - Gold and Silver sold off today, but as my friend pointed out to me, they have been as correlated recently with equities. Still something to CONSIDER. - We did close down not strong and we closed red again, this isn't super bearish but it does not held the bulls case. In summary, our path is not clear cut yet. As you can see, there are many mixed signals out there. You can always wait to trade, I believe there will be a time to make a ton of money - choppy markets that aren't quite sure where they want to go is not the time/area. As I have already mentioned Apple I will not cover too much. Apple still is showing us it is not ready and a little weak but it did hold the key support of 574. Bulls are still fighting. Google took another break today which is not bad, I would look to buy a pullback after somewhat of a reversal sign or pattern. Amazon will not die, that is amazing. Either way though, I would not chase these levels. Could easily come back some more. Netflix had a massive move today and could easily head higher. The volume was huge and it was a massive engulfing pattern. You would have to risk ALOT if you want to buy these levels and it is at minor resistance so it would be nice to see a small bull flag (like we saw in $FSLR and $GMCR recently) Well that is it for now. Here is my contact info/Twitter; I often post charts on Twitter/StockTwits w/ notes -- Twitter - https://twitter.com/BenCBanksStockTwits - http://stocktwits.com/BenCBanksEmail - [email protected]

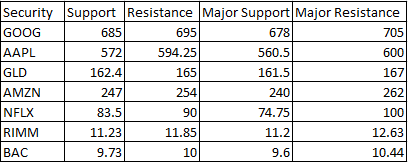

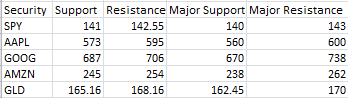

The above picture is a gift you from me. I think the spreadsheets can really help out in the lining up of trades and I sometimes use them. ------------------------------------------------------------------------------------------------------------------------------------------ Today we had the pullback we have been talking about for some time now. I tweeted this morning and sad by opening up that high, we could easily see a pullback the rest of the day. We did that exact thing. I do not think this is a time to switch gears completely, but it may be wise to take some profits off the table now. We are not full blown bears right now, we are still holding higher and potentially consolidating. I think this is going to a buyable pullback. We have not reached a buy signal yet though so do not buy just yet. What tells me this is that that we saw a light volume day today on a down day. Moe often than not, bigger reversals happen on heavier volume (remember a few Friday's ago). What I am looking for now is a another couple datys of consolidation and then eventually taking out the 50 SMA. Apple today was still a little weaker today. You must look at the bigger picture though, it is still holding higher and potentially forming just a bull flag. I do not think that it is done forever, and it will just taper off. I think it is holding up well and showing a little strength. Maybe in a couple days we can tell more. Google finally hit our target after a decent trade. Today was a day to switch some gears in that one as it formed an outside day. I do not think that is bad though. We would like so see some tight consolidation before heading higher. Amazon finally hit a resistance and is taking a well deserved break. I think this one can pullback back a little bit more than some of the other ones just because of how far it has come in so little of a time. Facebook also hit some resistance today and is taking a well deserved break. I think we need to hold the $26 area and then look at it again from there. We can buy after a reversal sign or some muscle "flexing" again. Overall, we have came a long way and could pullback some. Do not get super bearish though, some of the leaders still have been holding up and we pulled back on LIGHT VOLUME. As always here is my twitter/stocktwits (I post many charts there) - Twitter - https://twitter.com/BenCBanksStockTwits - http://stocktwits.com/BenCBanksEmail - [email protected]

|