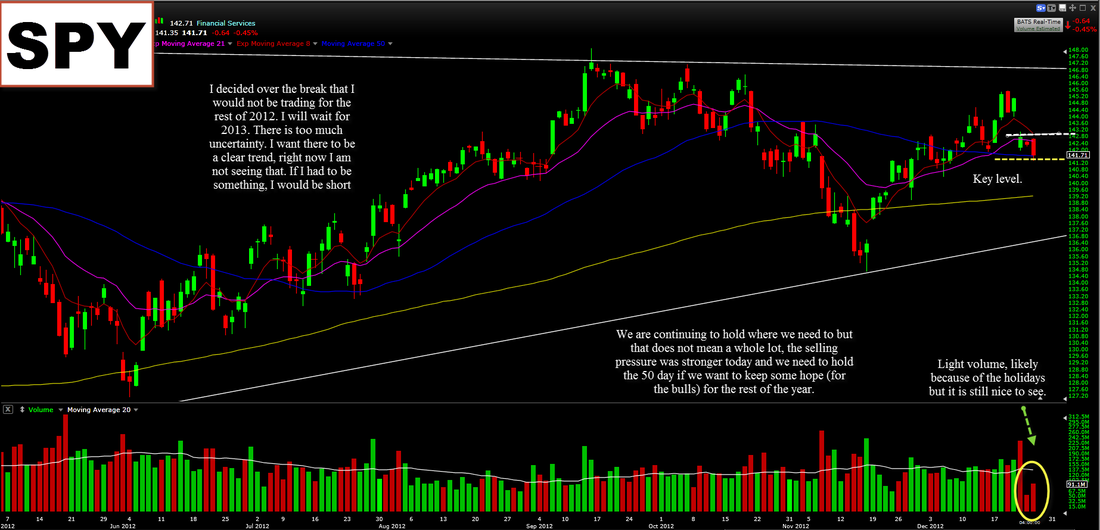

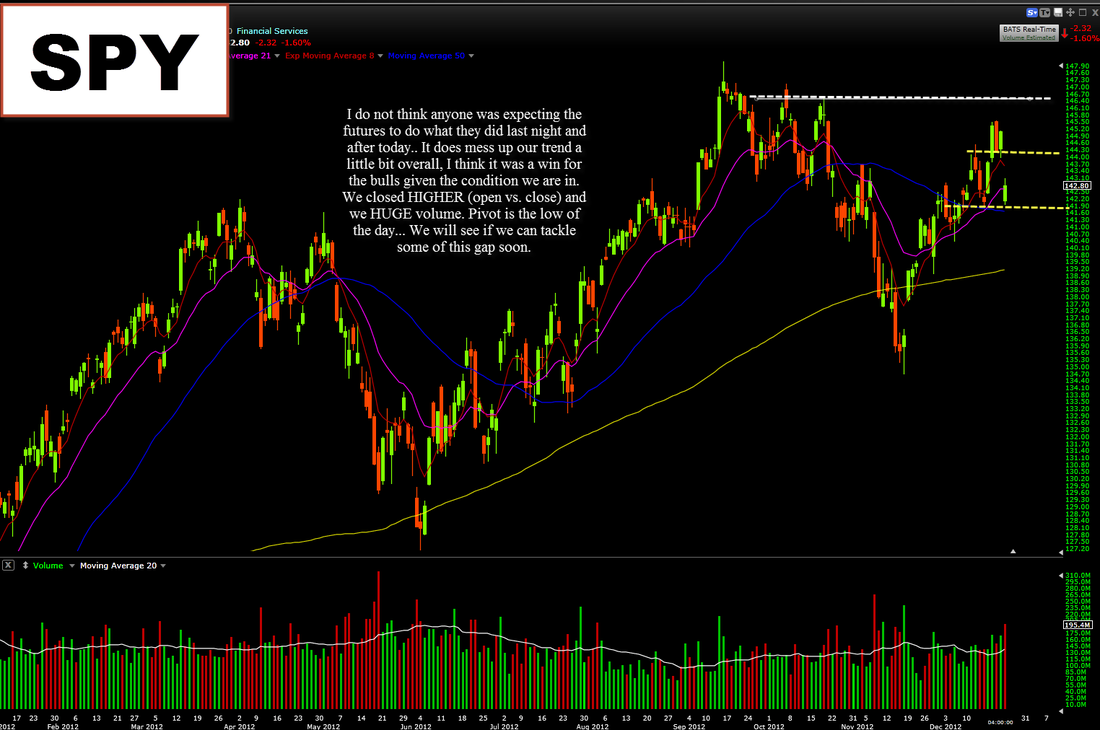

To say the least; today was wild. We were down so much (over 1%) intraday and then closed down only .13%. You could have made money day trading in this market if you were quick, I do not usually day trade and I said to my self that I would not trade anymore in 2012 because of the fact the fiscal cliff news in dominating the market and I really, really do not like headline driven markets. Going forward, I will continue to be remain cautious. The market did not seem to form that potent of a reversal, we did not see it close green, and we have not seen a massive sell off like we had coming into November 16th. Right now you can trade against the low of the day. Maybe we can see some kinda follow through tomorrow, at least in the morning, but I do not think that we are at a massive support. There will be better times to make a lot more money and therefore, there is no reason to fully invested in this type of choppy market.

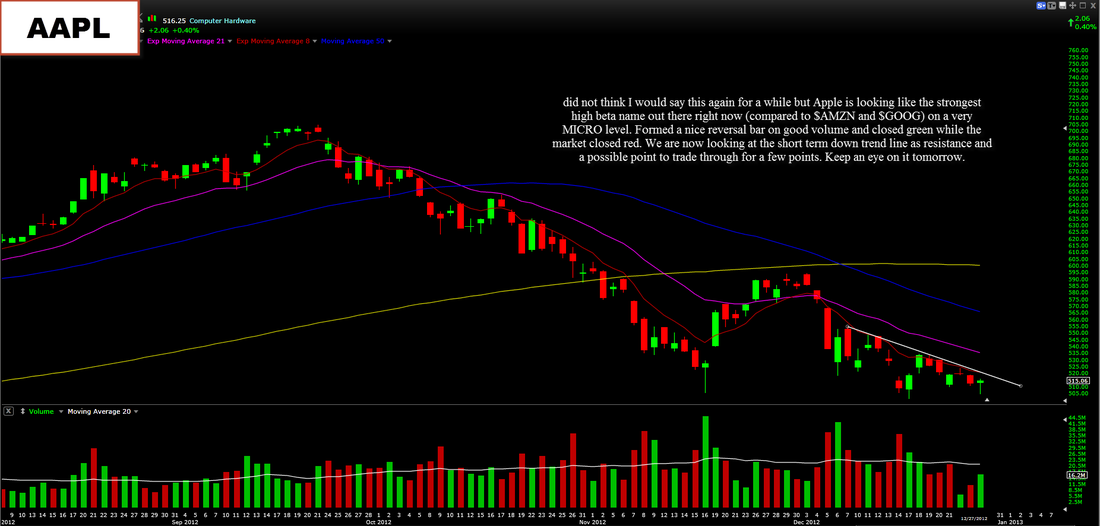

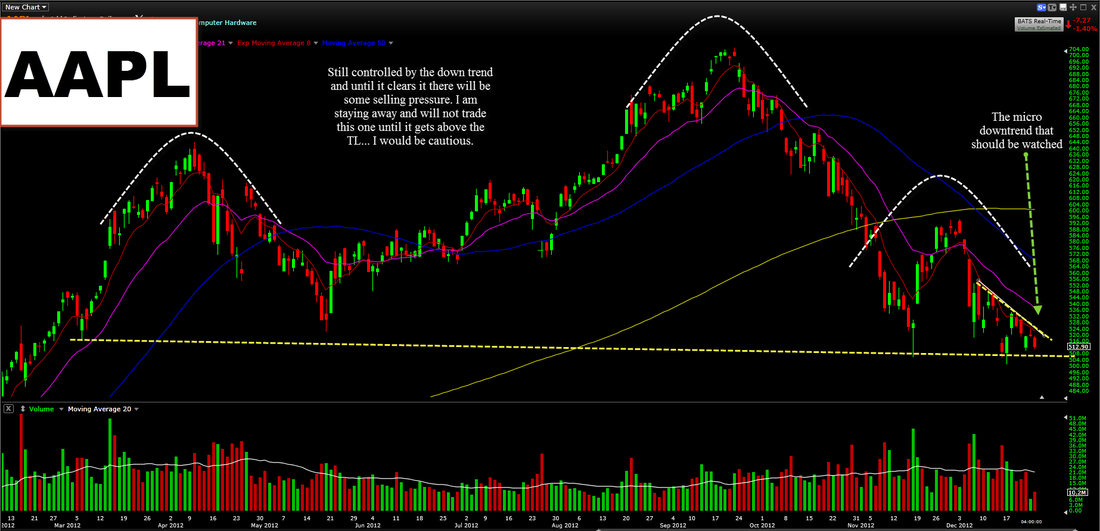

Apple helped lead the market off the lows today though it does remain EXTREMELY weak and there is still the "elephant in the room", the huge head and shoulders pattern. If you would like a long TRADE then this could be a time to get in with tight stop at the low of the day because of how broken this stock really is. It still has a lot of resistance over head but is showing SOME signs of a possible short term bottom right now. Remain light.

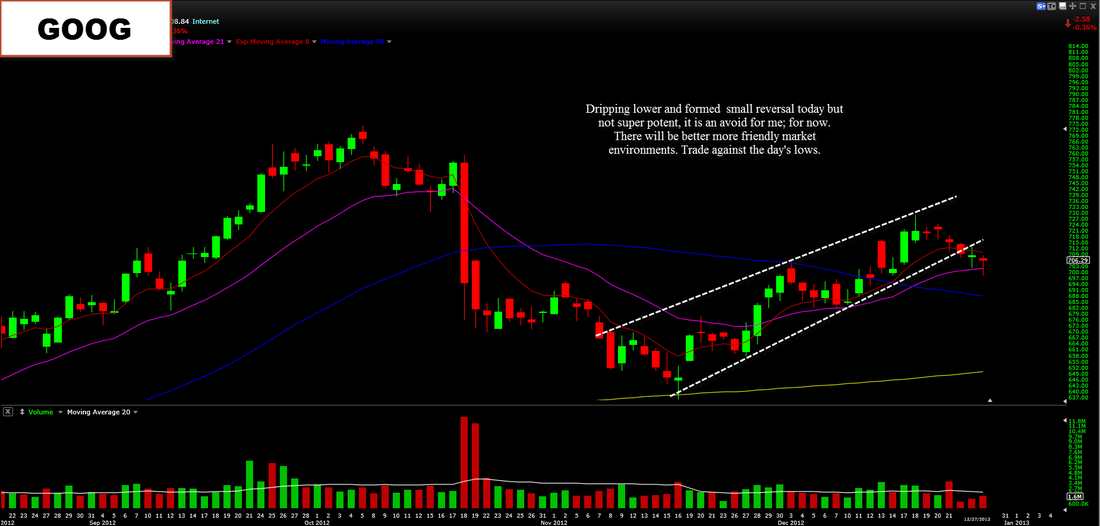

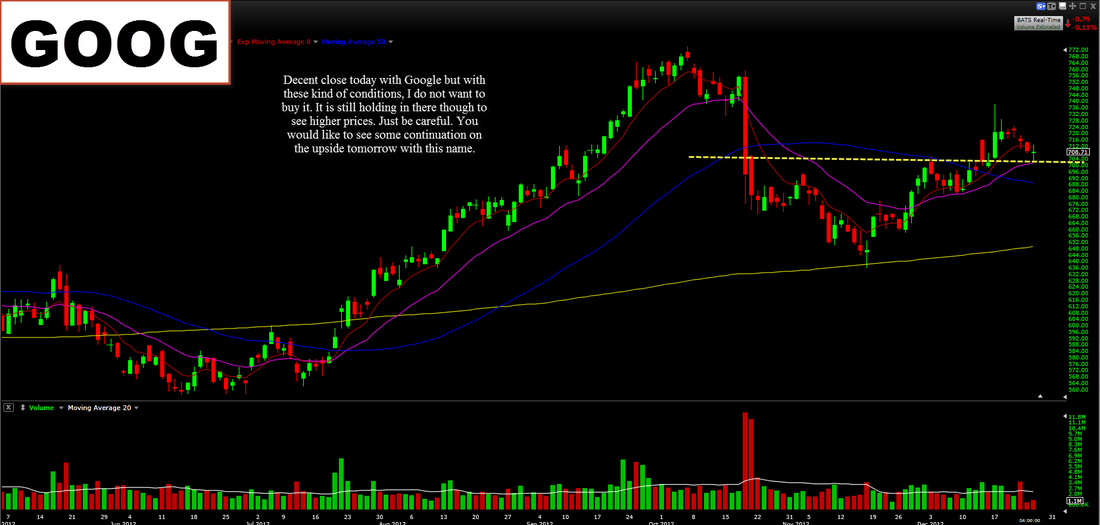

Google has been a choppy mess and not a trade in there for me, I like a trending tight market and when there is a cluster of dojis with is dripping lower I generally stay away. It is nice to see it hold the 21 EMA and maybe we can build off today as we have came back down to some support. You could just as easily stay away though and not miss a lot.

Amazon fell below some key support yesterday (should have been stopped out) and now traded lower and held the 50 SMA but it is still broken and I do not expect a whole lot out of this name until we start to get back up to the those highs we just saw.

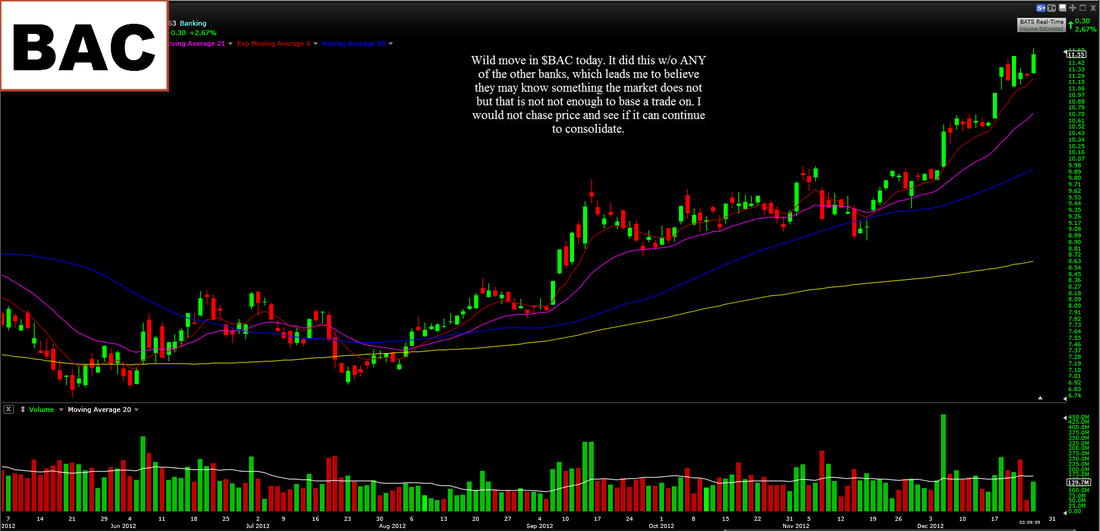

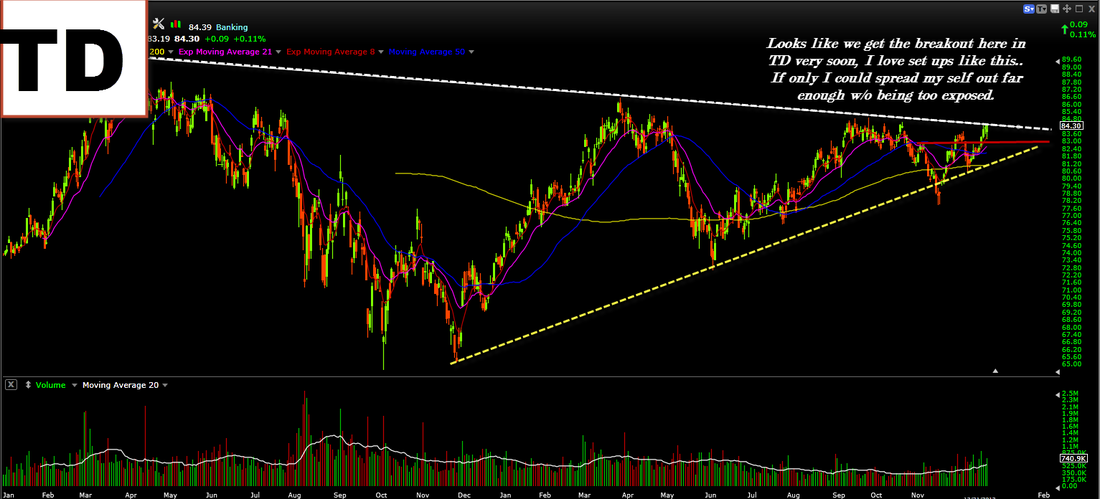

The banks held some key support today and you would like to see it build off the low of today but I remain cautious until we do see some follow through. The banks still look good for at least the first part of 2013.

Overall, stay light or just watch - the new year will hopefully bring more direction to this choppy tape.

Some names I am watching; $CMG $YELP, $FCX $DD $GMCR

-------

If you would like to contact me for questions/comments please visit the contact page at the top of the page.

--------

My 2013 predictions with analysis and targets all come out on the 2nd of January -- BE SURE to come back here to check them out and let your friends know about it also.

-------

Below these charts there are a few more I am looking at as a well as the big name stocks I always follow; enjoy!

-------

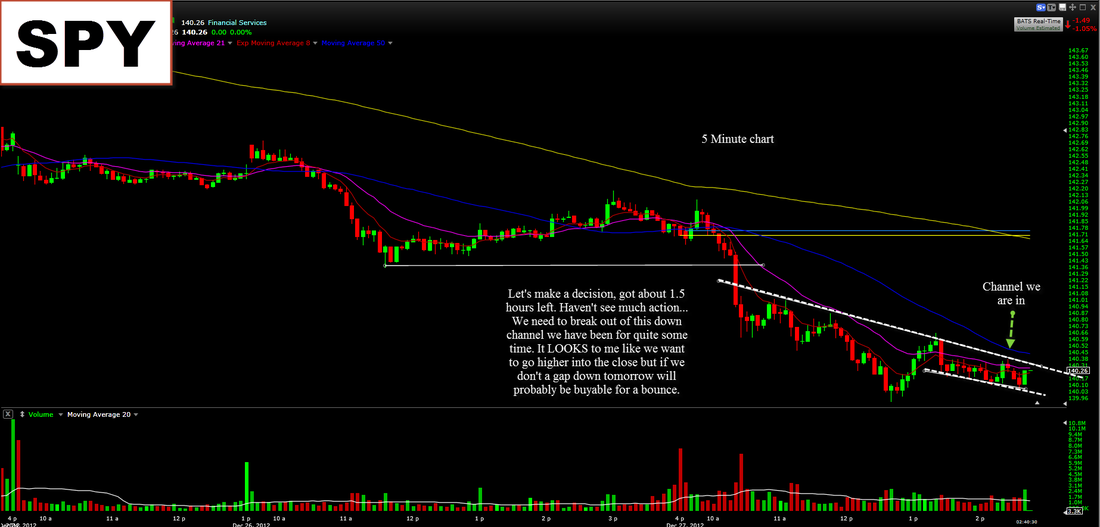

I would like to give you an example of how I time the market and look at the charts; below are a couple charts I tweeted throughout the day. No, I did not create the charts after the rally we saw. My charts w/ notes for tomorrow --

Well to give you guys a little mid day update...

Yesterday I said that we have held where we needed to so far but I remain hesitate and cautious. The VIX is now over 20 (first time since July), the indexes are down about 1%, and the leaders (banks) are leading us down. Yesterday or this morning was a good time to take off some risk for swing trades or day trades and we continue to see uncertainty in this marker. I believe we will see a rally in 2013 but until the chart tells me that I will remain cash (for the most part) and monitor the situation I said a day or two ago I will more than likely not trade any more this year because of Washington and the lack of volume in this market, this is still true.

I do think it is probably too late to short this market today, maybe you could get in short on a bounce to the 50 SMA but we have seen multiple down days in a row and it dangerous to chase after such a move. Another thing to remember is that we have seen a trend in the afternoon hours of where we trade higher and recover some of losses from the morning so you would hate to be caught in that if your were short.

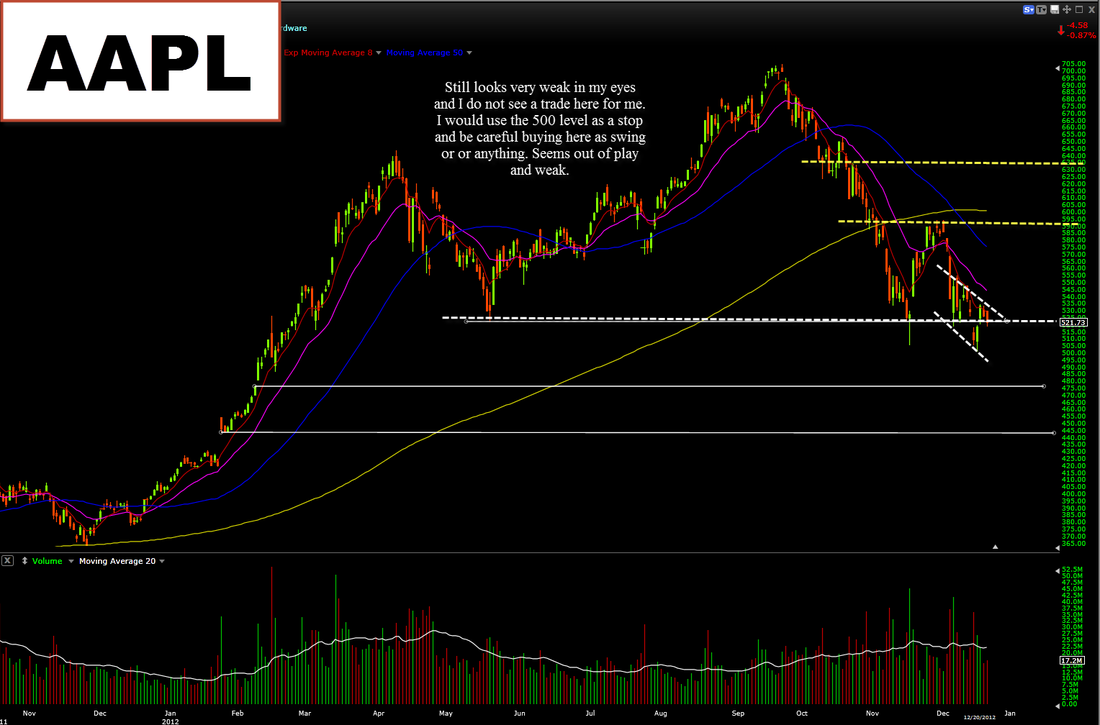

Apple is still very weak and looks like it wants lower, below 500 is very bad for this stock.

Facebook continues lower and looks like it wants to go lower too.

Google is OK, not a buy but not sell if you are a position trader.

SPY is broken. I am looking for a bounce around the 139.24 area if not before but remember it is not a good idea to chase a

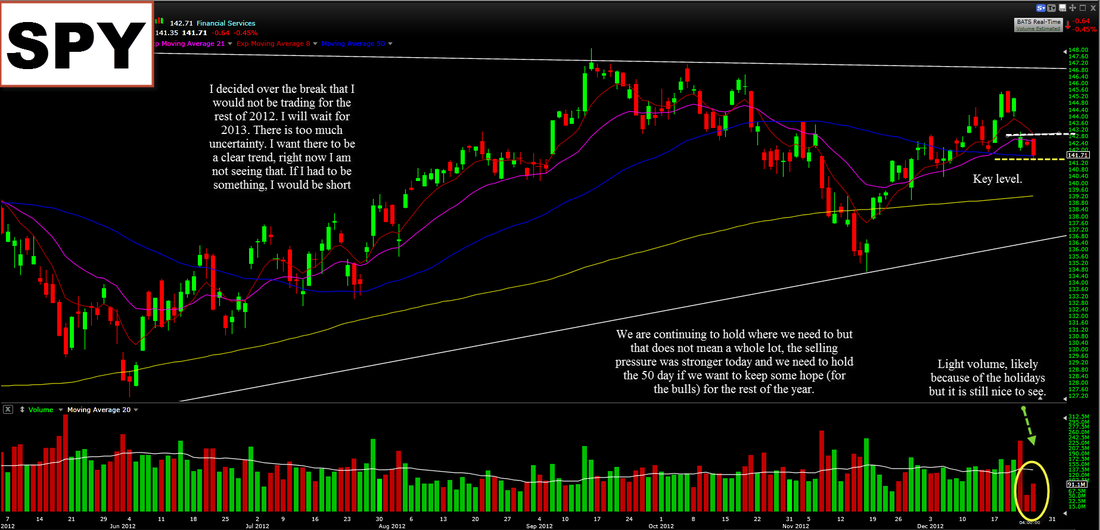

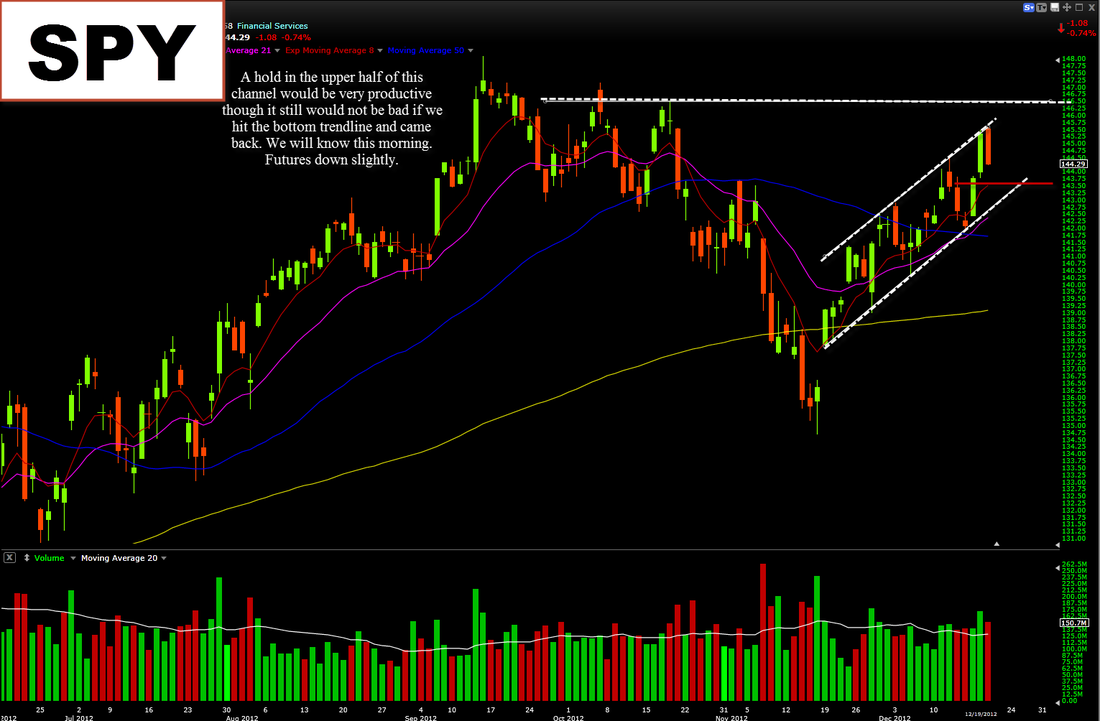

Click to enlarge - Today we saw the market sell off some more with a little bit more power. I would be remaining cautious through year end, personally, I do not want to trade anymore until 2013; the news dominates the market and quite frankly - We are seeing a weaker market now. The $SPY held where it had to today (the 50 SMA) but the action today did not give me enough conviction to bid into this choppy, mixed tape. If you do choose to trade however, please choose the strongest names out, with the cleanest, strongest charts (this is NOT apple).

Apple saw continued pressure today and I remain bearish. It needs to get back over the micro down trend line (see chart below) to go anywhere. It remains a no trade for me. It has yet to confirm the head and shoulders pattern but it has also yet to confirm any bullish action either. It is trading vehicle, not a investment/swing trade at this point.

Google is holding in there though I remain cautious. It closed relatively strong, compared to the market. What has me hesitating though is the fact that it's fellow high betas are not acting well at all... $AMZN sold off hard today and $AAPL is showing no signs of strength.

Speaking of Amazon, we saw a huge sell off today and it should have stopped out any uncommitted longs. You can always revisit this name but it is better to get out while you can before it goes way south for you. I would watch the 246 level, you should watch out if it falls below that level as that is the level of support from the most recent bull flag.

$BAC saw some crazy action today. It was up a lot with pretty good volume without ANY of the banks following. This could (MAYBE) mean they know something that the public does not. Though by me saying that it does not mean I am a buyer, I focus on the charts and if the charts tell me to buy, I will (currently they do not).

The banks as a whole though continue to be the place to be and therefore when 2013 rolls around and I start to trade again I will most likely be focusing on them. Focus on the leaders, it's as simple as that.

---------------------------------------

On JANUARY 2nd my 2013 predictions/investments come out, please help me spread the word by clicking tweet on the bottom of this page and come back to see them on that date, thanks!

If you would like to contact me for questions/comments, please visit the contact page for details.

Finally, below are the charts with notes I have done so far. Click on them to make them larger, more are likely to added later --

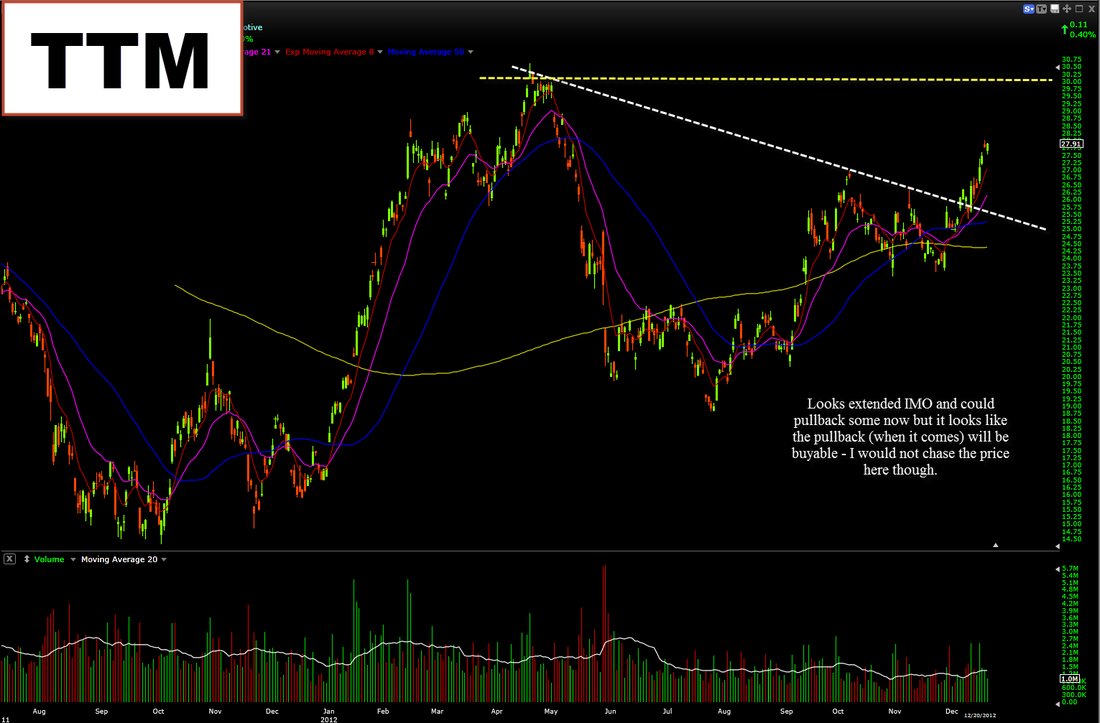

There is not much I can say about this one, I played it all right and it turned out to be good and true now but I was stopped out a day before the move. I should have had my stop a little looser than it was.. I did not give it enough room for the move I was anticipating It was Christmas eve and the first wick of the day wiped me out. The only thing I can do now is too move on and look to the next one. I wish it hadn't worked out like that but oh well. It did.

Ben

If anyone follows charts they would know that this trade could have been a lot better. I did make money and a decent amount but still is not that good. I saw all the banks breaking out and $GS forming a higher low with a tight pattern so I got in; this was all good. I think sold the same day because it fell too much intraday for me to like. It went on to close at the highs of the day and rocketing 8 more points after that in the coming days. I lost out of a potential HUGE winner, but that is ok. Here is what I learned --

Did well -

1. Pattern recognizing.

Could improve on -

1. My swing trading mentality I was using a day trading mentality (from my iPhone, again) on a swing trade. This should have not happened. It is a swing trade and there is no reason to have super tight stops intraday.

Overall, good trade and I am glad I participated.

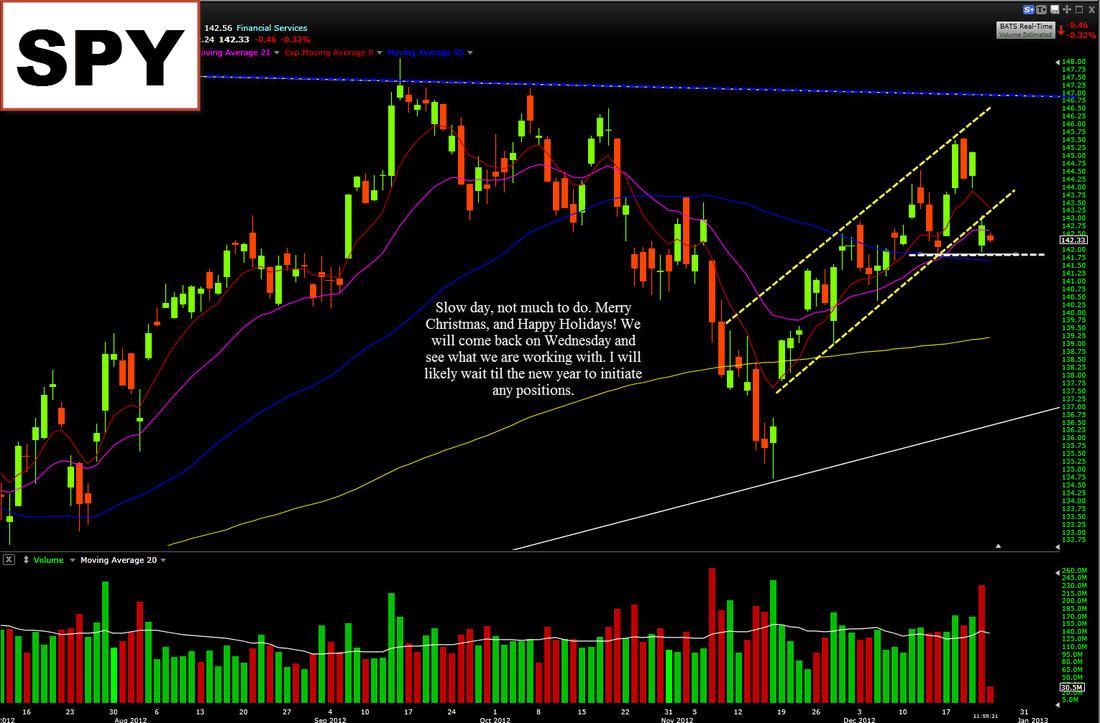

Merry Christmas or Happy Holidays. Hope you are are having a wonderful time. I doing the Daily Analysis an hour before the market closes today because I am going to a family Christmas party very soon.

The market (as of right now, 12:03) has been a non event. Very tight trading range and not really much today. Non really a win for the bulls or the bears. The QQQ's were a tad stronger today, likely because of Apple being green. I wouldn't think to much of today.. Could have never happened and it wouldn't effect anything. Currently I do think I will be initiating any new positions before 2013 just because there is the risk of the fiscal cliff and we seem to just be stalling and moving sideways. New money comes in in January and then we will likely continue up - I do not think you will miss very much this week. The banks are still you friend and more than likely I will be buying (like $BAC) some of them early January. I do not think it is wise to chase the price the last week of the year. Let the trade come to you. Even if the market does move this week it will be on light volume and will likely move event more once the new year comes around.

Overall, keep your eyes on the banks. They will continue to be your friend in at least the first part of the new year. Keep an eye on Apple as it looks like it could be trying to build a lower base. Needs to get over 555 first though. Amazon continues to perform and will likely take out the all time highs. Facebook has been very well and I suspect it to continue to do well in January/2013.

Have a nice holiday. Remember to come back here on the 2nd of January to see my 2013 predictions with Price Targets! Spread the word!

If you would like to contact me visit the contact page.

I do not usually run into this problem but when I do it really confuses me. I do not know which chart to trust.. Since technical analysis depends so much on the price action and on the chart you need to make sure you have it right. Therefore I bring to you four different pictures of the same stock, but two completely different charts that could potentially alter your view on a trade drastically if you look at one over another. Please let me know your thoughts on why this happens and if I am missing something obvious, thank you. Maybe we need to contact these charting services and tell them what it is happening if it actually is a mistake.

Click to enlarge the images --

The first chart is from TC 2000 (the charting service I use, and I think this chart is correct) The next chart is from StockCharts.com, what happened to that extra leg up? Did price actually trade as high as 8.10ish? According to StockCharts it didn't -- Now here is CNBC's depiction of the stock and the chart, it looks the same as TC 2000, mhmmmm... Finally we have Trading View (which many people use) showing the same as StockCharts.com.... Now that we have seen all the different charts you can easily tell how looking at one over another can alter your opinion on the security greatly. The question is.. Which one is actually correct?

Thank you for your responses.

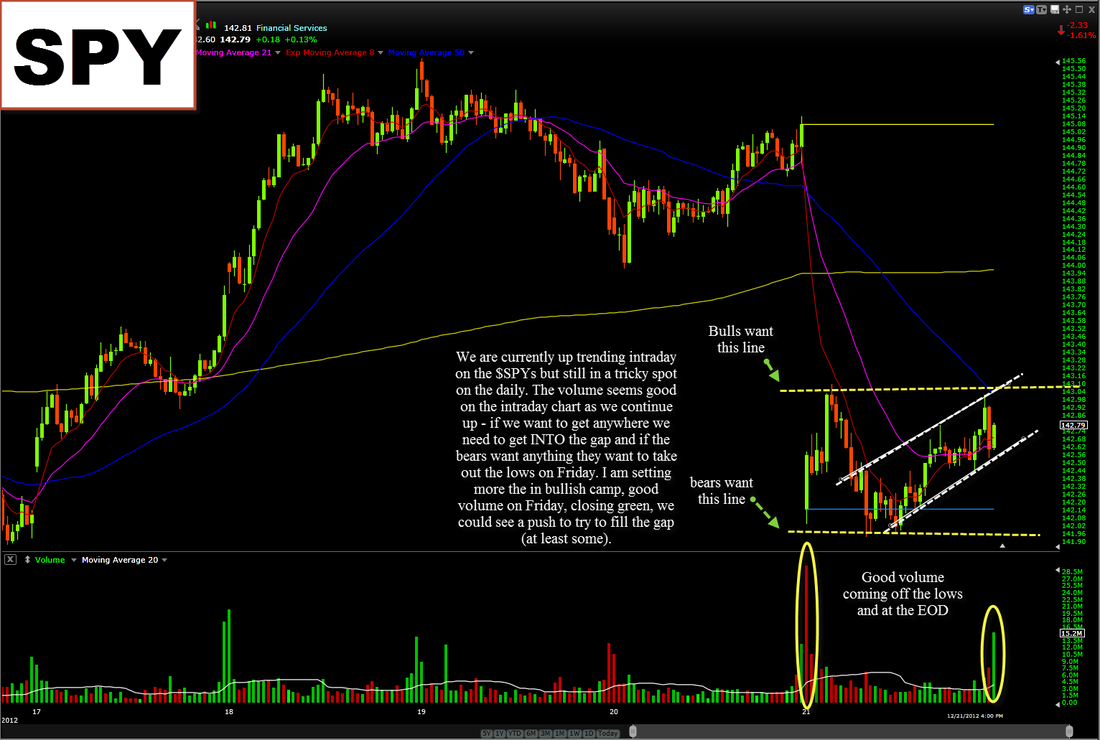

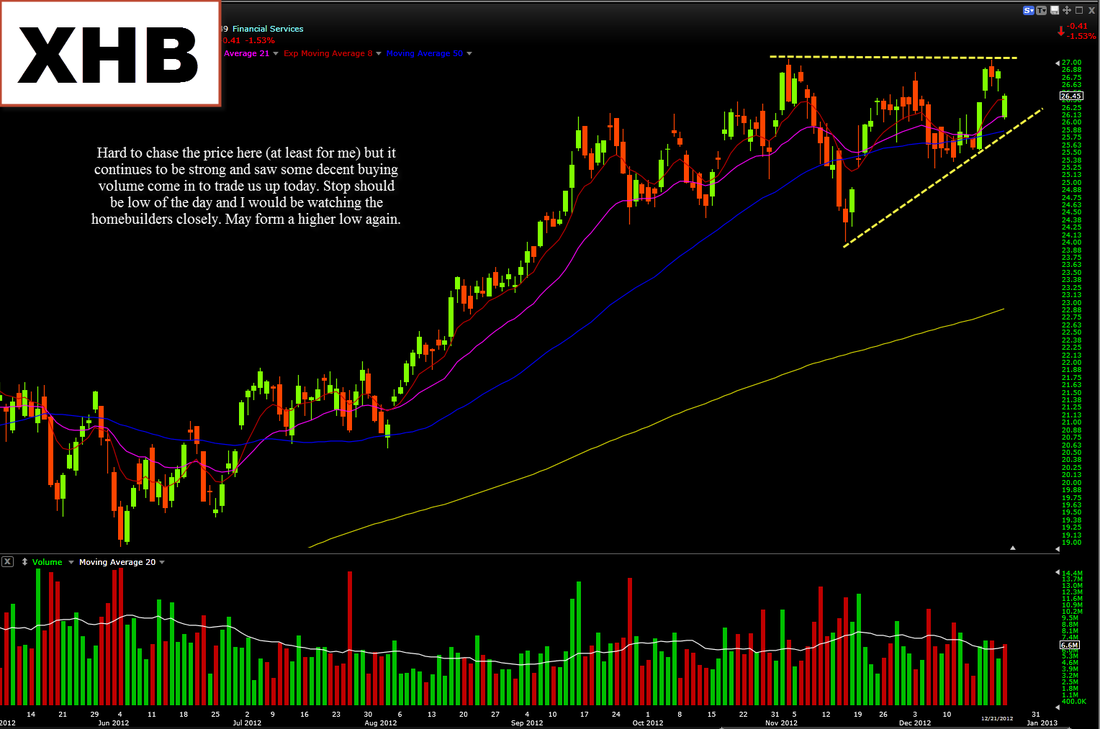

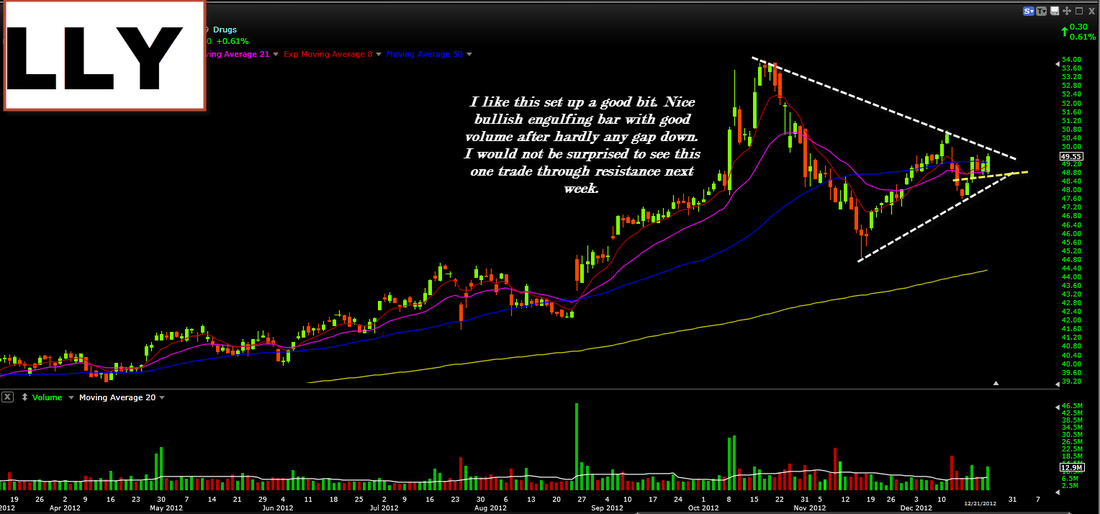

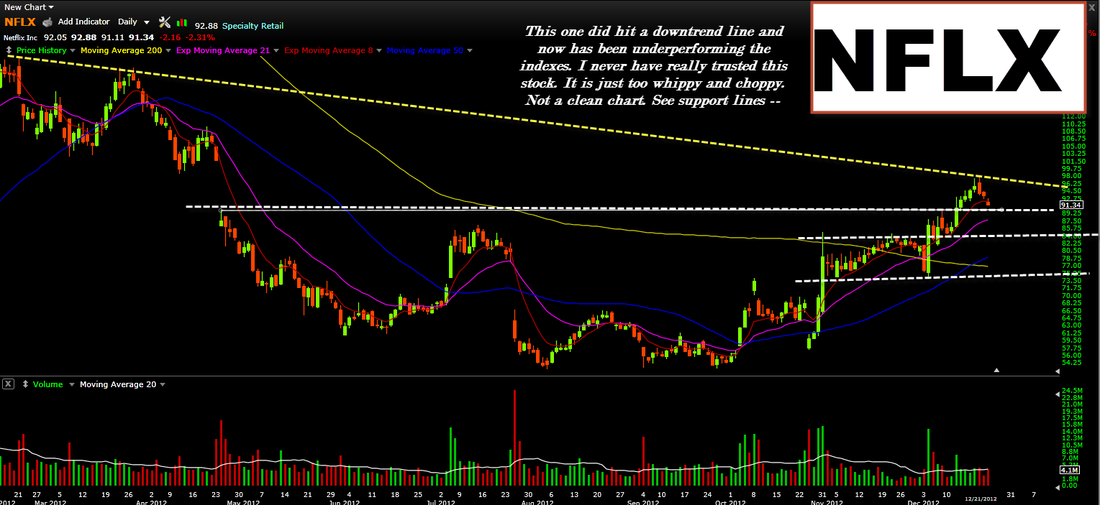

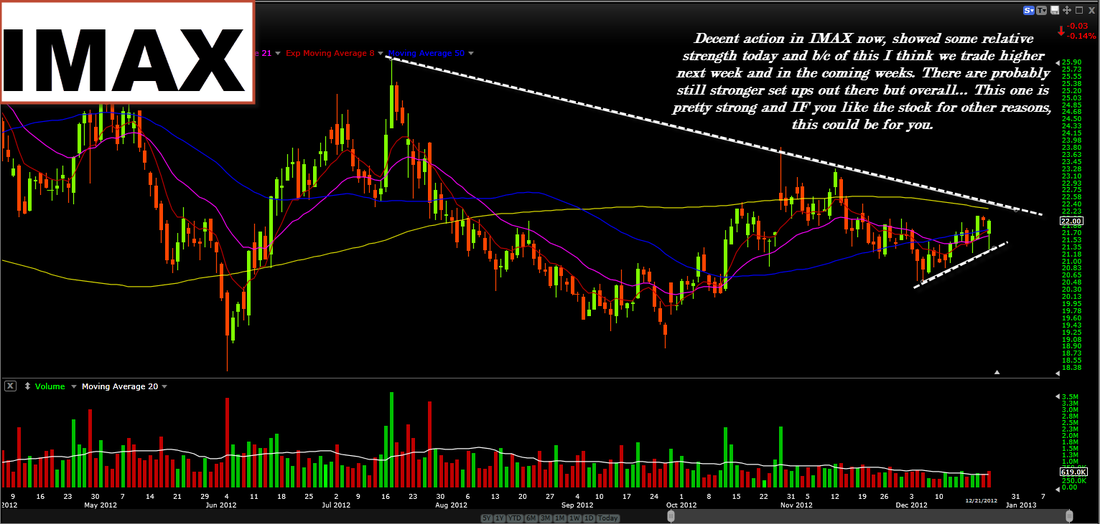

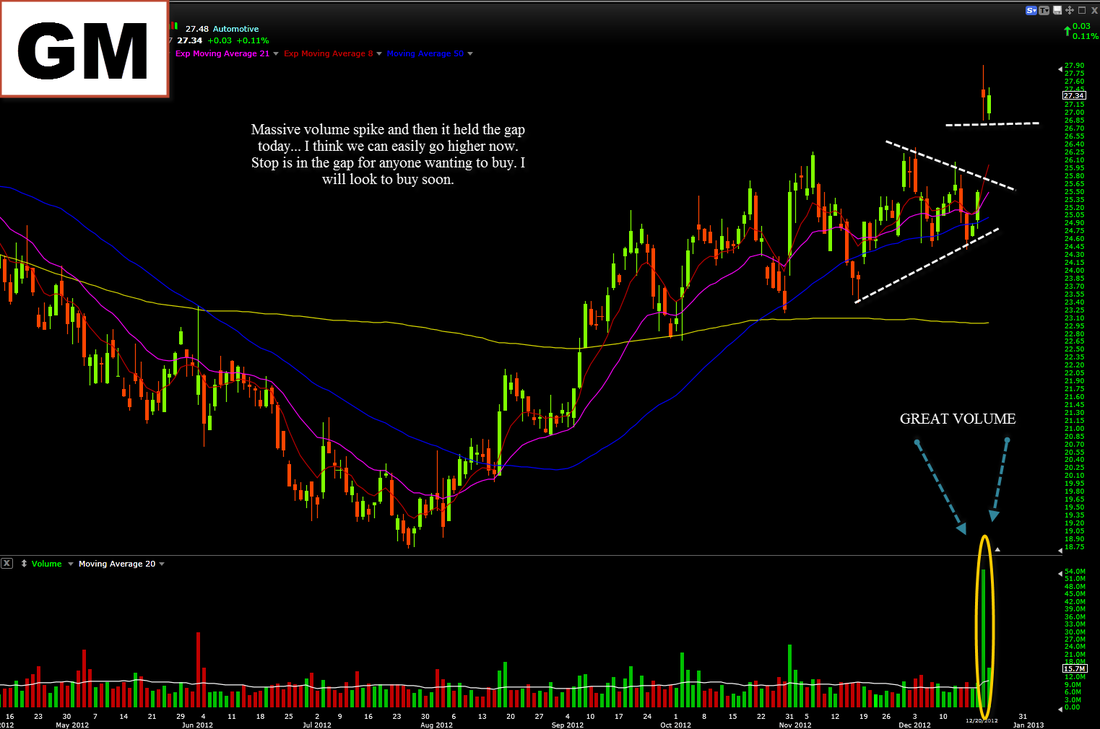

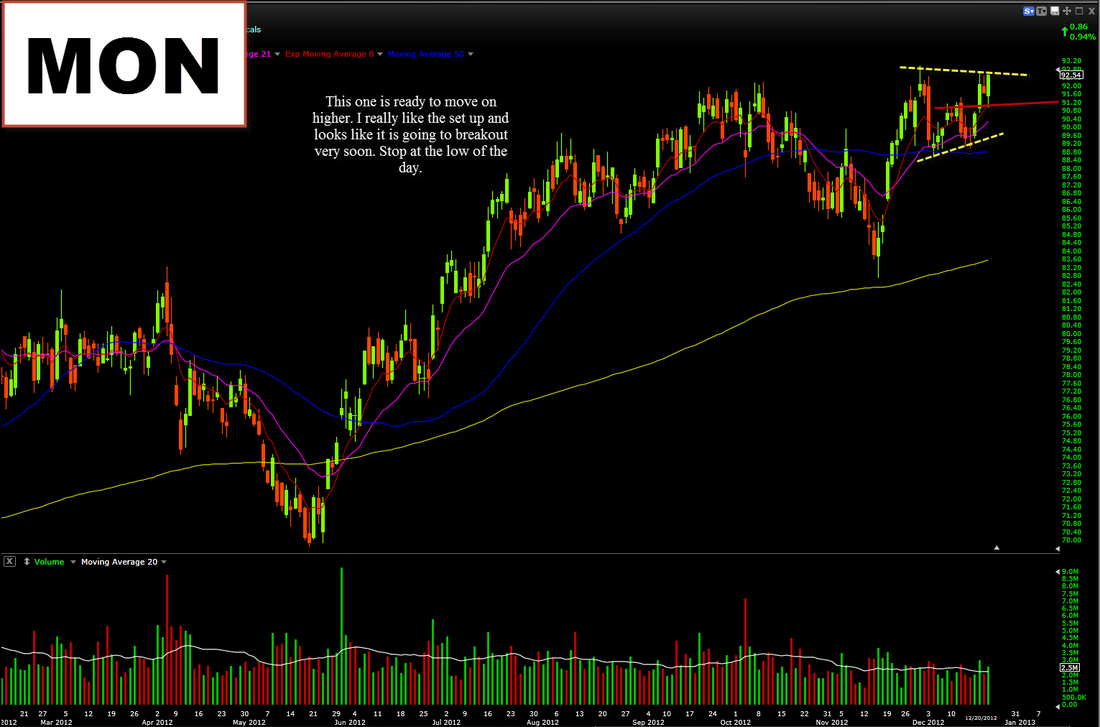

intraday price analysis, sitting more in the bullish camp. First of all, Merry Christmas (or Happy Holidays)! I wish you all a good time on your days off and hope you use this time to take a different perspective on your trading and try to regroup some. Analyze a few of your trades and determine how you did on them and what you could have done better. And, of course, spend some time with your family. The market last night fell a ton over the failed "Plan B" bill and we open significantly lower than we had closed. This was a huge problem for most traders and I am sure it was very nerve racking too. Personally I did not have a clue what this was going to lead to and therefore I posted a blog this morning going over three different scenarios that could play out. After witnessing the close today I feel confident in saying that it was the first scenario that I listed was/is true. Another scenario I listed talked about the gap down sell off theory, this would have been detrimental for the bull in my opinion. I feel like this is just creating a buying opportunity for the bulls to get some reasonable prices after the prices being so extended. Time will tell though. Going into next week I think we can see a little upside to try to feel the gap with light volume (similar to Thanksgiving week) or we could just see continued sideways action. Though, as hard as this is to gut - there is still the concern and fear of the silly politicians opening their mouths this weekend and into next week that could sway the prices significantly like we saw today. I do believe that we are CLOSER to a deal and that they will likely come up with one but it will be more of a last minute thing (as always) but then again, what do I know? I am just a technician and the only thing I am basing that one is hearsay and theories - all could change come Monday. The fact that we closed off the lows and trader higher (open vs. close) and we trader higher with massive volume tells me there are still buyer stepping in and buying the dip and thus us closing off the lows like we did - is a win for the bulls in my eyes. -------- $AAPL - Onto Apple now. I do wonder when I will have to stop covering this stock every day, when will it not be the favorite anymore? When will the dynamics and the biology of this stock change so much that it is purely a trading vehicle in specific time periods (like $CSCO and $MSFT)? The answer to these questions.. I have no way of knowing. I will say it is still in a bearish pattern from a more macro/long term point of view. The bears have managed to push it all the way down to the 500ish level, from 700 with out much of a bounce. The trading and the price has become more and more choppy and less and less like a trend, this concerns me. I generally only focus on the stocks that are trending, one way or another and currently Apple is in a down trend but it so choppy and testy that i consider it more trendless. Currently there are a few signs of life from a more micro point of view (day to day) that I would like to highlight. - Closed at the highs

- Traded with expanding volume today (compared to the prior two days)

- Formed a higher low today

- Somewhat LED the market today

Saying these TINY positive things is not much though. It still has a lot to prove and these small things are not enough for me to want to buy it right now. Time will tell and I will be patient with Apple. Forget about the name Apple, trade the price. $GOOG - I still think Google is pretty strong and should be watched but currently I do not think I see a trade in it. It has been a little choppy with a lot of doji closes. I would stay long if you are a long but I will wait for a more clear signal before I want to buy in. $AMZN - Decent channel action today after gapping down to the 8 EMA. It is at some support but then again, it is similar to Google -- there is not a real clear buyable trade here. It did have some selling volume today and it closed red (unlike Apple) which is not a great sign if you are looking to buy. Therefore, I would say give it some time and wait for a more potent reversal day or a more actionable signal. The banks held up really well today and should definitely still be watched. Most of them filled the entire gap down and then traded even higher. There could still be some sideways action in the future because of how extended they still are but for the most part, if you are in the banks.. you should feel very comfortable and be very happy. Keep with it and for people that want in on the banks, you could buy now verse the low of the day or wait for a couple more days of basing as a lot of them are still extended to the upside. The hombuilders are still seeing some strength and buying and I like to see money going back into them. $KBH is the weakest out of the group and should be avoided. $PHM and $XHB look good though and the stop should be at the low of day (Friday) if you own it or want to own it. They saw some nice volume today and will likely continue higher. It is however difficult to chase price in $XHB, be careful. Those are the main names and thinks you should be watching, I am currently long $DE and $MON. Both look pretty good breakout candidates and both showed relative strength today. Have a nice holiday and be sure to check back here for charts/analysis over the weekend. If you would like to contact me for questions/comment please visit the Contact page for details. Click to enlarge the images --

I do not know what today will lead to, the futures and the market are down huge pre market hours and I do not know what to make of it. There are a few theories but none of them could be true, here are some of the things I am thinking about -

1. The fiscal cliff is all baked in now and this is a buy opportunity

2. The fiscal cliff is huge deal in someone's eyes are we gap down and sell off more

3. We gap down and then stall and from just a doji

Any three of these theories could turn out to be true but I do not know which one. I will let the chart tell me. I will say though, a lot of longs were hurt overnight (me included). We were in an uptrend so the likely hood of this dip being bought is slightly higher. I will focus on the banks and the hombuilders today. Good luck to all.

Ben

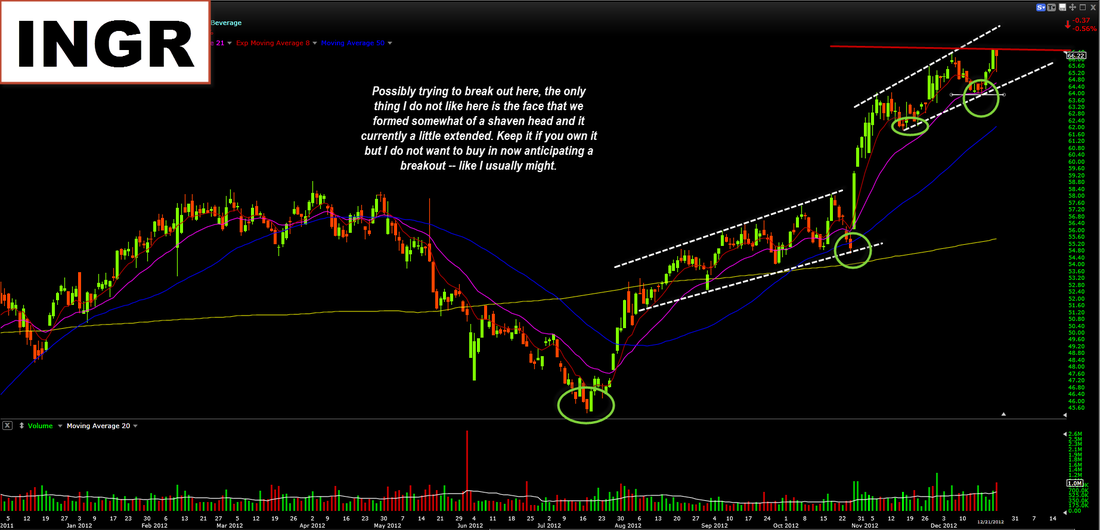

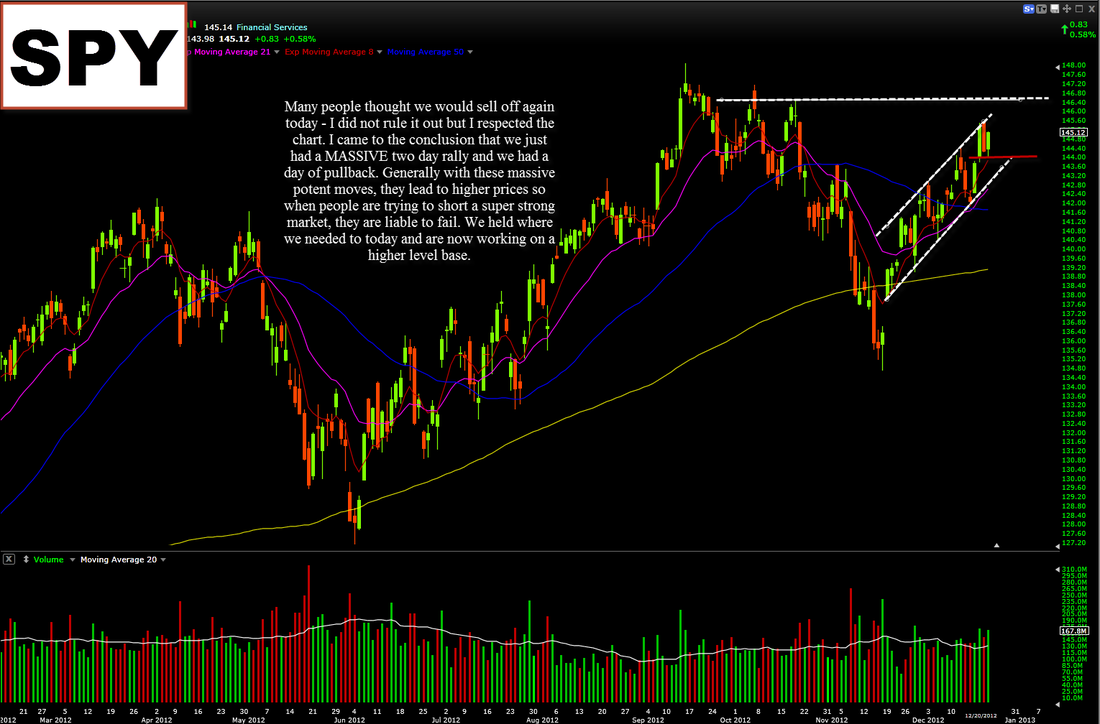

Click to enlarge -- Welcome back! It is finally Christmas break for me, I am excited to have a few days off of school to purely focus on bringing you some charts. This morning I posted a chart on the level we need to hold to keep momentum in the market. the chart I posted around 5:50 AM this morning is below --- Well, we basically came back an barely nicked that area. This tells me there is still momentum in this market. Shorts were trying to short a potent move and calling a move back down to the 143 area - I determined that because of how potent the move was the past two days, we should not come back that much, this evidently was true. Going forward it looks like we are forming a higher level base to potentially break higher out of this upward channel. We are still slightly extended though today helped alot with that. You could trade against today's lows as your stop for a swing long, thought I will not buy the $SPYs right now (just not yet) because of the fact we still seem a tad extended (this does NOT mean we go down though).

------------------------

Apple has been out of play for a long time now and continues to be so, I would not be putting more money into Apple (I would have been taking it out after the first sell signal around 685). Going forward I still think there is a high probability of it breaking the 500 mark. A close below 500 could send this one down much further. There seems to be somewhat of a fight going on to keep it above this mark but the chart tells me the bulls are currently losing the battle. It's a trade, and most likely not even a swing trade.

Google has been acting very well lately and I have mentioned it a lot saying it is the strongest or "best in breed" stocks that you can own right now. Definitely the best in the high beta land (behind Amazon of course). Going forward, I still think it looks good. The MAs are catching up and the theory of the bull flag is still in play. The one thing I do not like too much about is the close today -- the market closed green (open vs close) while Google close red. Therefore, I will be buying before a breakout, I will wait for a more clear signal.

Amazon is the best high beta name right now and it looks very good for new highs. Trade against the days lows and then just hold onto to it. I would not day trade a stock like this, it is more a swing trade candidate.

Facebook has been a little slower recently, I am not a buyer right now as it is not showing me much of a set up, in time in may very well again but right now it is no trade for me.

IBM is similar to Facebook as it is just a no trade right now for me, not a clean set up and not really trending with authority.

DD looks good for higher prices, showed for strength today has room above, the day's low as your stop.

Visa and Mastercard have both made countless all time highs this year and I would stick with them if I were you. Although, every new high and every rally is one more closer to their last. They are going to get tired and pullback a little more than you may like. (Similar to HD and LOW right now). Trade accordingly.

Please visit the contact page for details on how to email/message me for comments and questions.

Here are some of the main charts with my notes, enjoy! Now some chart y'all requested --

|